Digital Health Venture Funding Doubled in 2014

A similar version of this Health Alert appeared at Forbes.

If it hasn’t happened to you already, it will soon: Your doctor, employer, health insurer, friend, or colleague will recommend you try a new smartphone app to keep you healthy. Apps are just one example of the fast growing area of “digital health,” which refers to applying the digital technology that has changed so much of our lives to the health care industry.

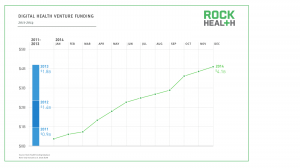

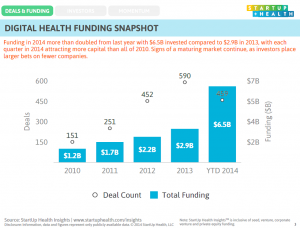

Two recent reports show how important digital health is becoming, and how fast. StartUp Health, a New York-based accelerator, and Rock Health, a San Francisco-based accelerator and seed fund, have independently reported that funding for new digital health ventures in the United States doubled in 2014.

Looking only at investments worth at least $2 million, Rock Health estimates that $4.1 billion of new capital was invested in digital health, up from less than $1 billion in 2011.

StartUp Health, which also captures smaller deals, estimates that $6.5 billion in new capital was invested in digital health in 2014, up from $1.2 billion in 2010.

What types of new businesses are these? Both sources agree that analytics and big data were the largest sector, accounting for $1.46 billion (over one-fifth) of StartUp Health’s estimate and $393 million (just under 10 percent) of Rock Health’s estimate. After that, the categories get fuzzier.

| Funding of Top Categories of Digital Health, 2014 | |||

| StartUp Health | Rock Health | ||

| Analytics/Big Data | $1.46 billion | Analytics/Big Data | $393 million |

| Population health | $1.14 billion | Healthcare consumer engagement | $323 million |

| Navigating the Care System | $974 million | Digital medical devices | $312 million |

| Diagnostics | $962 million | Telemedicine | $285 million |

| Consumer health | $880 million | Personalized medicine | $268 million |

| Practice management | $783 million | Population health management | $225 million |

| Payor/insurance | $699 million | ||

| Workflows | $681 million | ||

| Genomics | $632 million | ||

| Clinical research | $624 million | ||

For advocates of free-market health reform with less government control, the most interesting is StartUp Health’s “Navigating the Care System.”

That category includes telehealth (which Rock Health gives its own category), including Teladoc (which raised $50 million of new capital). The jump in telehealth investing is especially good to see. Because insurers control most health care dollars in the United States, it has been hard for services that improve care but cannot be audited by insurers to get paid. This is slowly changing in the employer-based market and Medicare, while physicians are succeeding in figuring out licensing requirements.

“Navigating the Care System” also includes Oscar, a small New York insurer that was founded explicitly to participate in that state’s Obamacare health insurance exchange.

Oscar more than doubled its capital in 2014 with an $80 million investment, valuing the new insurer at $800 million, more than 10 times the premiums earned in 2014. (Insurers like UnitedHealth Group and Anthem trade at one-tenth that multiple.) Plus, it entered New Jersey’s Obamacare exchange for 2015 and plans to enter California and Texas soon.

Oscar is clearly designed to attract the healthy. This is critical to succeeding under Obamacare, which gives insurers incentives to shun the sick. One way Oscar achieves this is by giving enrollees a free MisFit Flash fitness tracker and paying each member up to $240 per year to meet his or her fitness goals.

Oscar is also consumer friendly. In New York, you still have to apply through the state’s Obamacare exchange, which is a soul-destroying experience. If you call Oscar directly, one of their customer service reps will hold your hand as you go through the process.

Another winner in “Navigating the Health Care System” is Zenefits, which Forbes named 2014’s “hottest startup.” Zenefits raised a total of $78 million of new capital to provide small firms with HR-management software for free in exchange for buying health benefits through Zenefits. It’s disrupting what Forbes describes as a “stodgy” market. It’s also a market that many believe is shrinking, as small employers shed benefits to dump their employees on to Obamacare’s exchanges.

Finally, many new ventures in digital diagnostics, genomics, medical devices and clinical research will likely be regulated by the Food and Drug Administration (FDA). The rush of capital into these categories emphasizes how important it is that Congress clarifies the FDA’s authority over these emerging technologies. Bipartisan solutions, such as the SOFTWARE Act and the MEDTECH Act, have been proposed in the previous Congress. The current Congress should prioritize them to ensure that digital entrepreneurs can get their new inventions to market without undue regulatory interference.