And it isn’t easy:

Detroit’s emergency manager, Kevyn Orr, has announced that to return the city to solvency, effective Jan. 1, he will stop providing coverage to 8,000 retirees under age 65. Instead, they will receive a $125 monthly stipend to use toward private plans from the exchange. (Spouses and dependents don’t get anything.) The hope was that the Affordable Care Act’s subsidies would kick in for unmarried retirees making from $11,490 to $45,960 and married retirees making from $15,000 and $62,040 annually, the cutoffs for eligibility.

The stipend combined with the subsidies would allow the city to slash its unfunded health-care liabilities — which are about a third of its total debt — and most retirees to obtain coverage with minimal out-of-pocket expenses. It would be a win-win for all, except maybe for federal taxpayers, who would be on the hook for the ObamaCare subsidies.

The hitch is that the Michigan exchange, like many of the 35 others run by the federal government after the states refused to build their own, has been beset by glitches. Enrolling has been a nightmare, although some reports suggest that “navigators” — trained professionals who help consumers navigate the website — have been having some luck in the last few days. Even if consumers manage to enroll, however, it’s unclear they will actually get coverage given that the exchange reportedly isn’t providing accurate enrollment information to underwriters. (Shikha Dalmia)

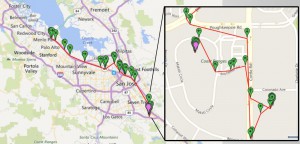

I was perusing a health news website and ran across an advertisement for SmartSole, a GPS insole tracking device. It’s developed for Alzheimer’s patients and those with cognitive impairment who make be at risk of wondering away from their caregivers.

I was perusing a health news website and ran across an advertisement for SmartSole, a GPS insole tracking device. It’s developed for Alzheimer’s patients and those with cognitive impairment who make be at risk of wondering away from their caregivers.