Free of Obamacare Taxes, the Future of Health is Digital

A version of this Health Alert appeared at Forbes.

A handful of recent reports indicate that capital, overall, is seeking to exit the health care industries burdened by Obamacare’s excise taxes and annual fees. With one outstanding exception — digital health — much of health care is seeing consolidation through mergers and acquisitions (M&A). As for fresh capital, venture funding has shriveled from its 2007 high.

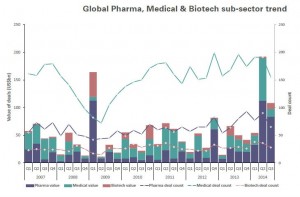

Mergermarket has published its analysis of Q3 global mergers and acquisitions in pharma, biotech and medical devices. Mergermarket reports $354.3 billion in deals so far in 2014, more than two-thirds over last year’s value and the highest annual level since 2001. These sectors also have the highest share of all global M&A (14.2 percent), the biggest share of M&A since 2001.

Unfortunately, Mergermarket’s analysis is already somewhat out of date, because it includes deals announced but not yet closed. So, the failed merger of Shire and AbbVie is included in the total. This deal appears to have been primarily motivated by the tax benefits of inversion to a foreign domicile, and AbbVie will pay Shire a $1.65 billion break-up fee for jilting the Irish-domiciled firm. AbbVie is not going to grow its own business instead. Rather, it announced a $5 billion stock buyback program.

Nevertheless, most deals are going through, despite the U.S. Treasury’s attempts to stop these inversions. Despite all the political hand-wringing about companies moving their tax domicile to avoid U.S. taxes, inversions were not the primary cause of most deals. Rather, corporate strategy drives the consolidation, according to Mergermarket.

The exhibit shows that 2014 Q2 M&A in pharma, biotech, and medical devices was even bigger than it was in 2009 Q1, at the tail end of the Great Recession. However, 2009 Q2 saw deals slow to a trickle. 2014 Q3 shows deals continuing at a rapid pace, suggesting that this round of consolidation represents a longer term, secular decline in interest in investing in these industries.

Also, Mergermarket observes that “high valuations has generated a raft of deals between strategic players, leaving private equity players waiting on the sidelines.” Despite strong stock markets, private equity sponsors will face headwinds cashing out of their current investments, as “the IPO market is predicted to be bleak.” PitchBook’s 4Q 2014 PE Breakdown corroborates the conclusion that strategic buyers are outbidding private equity in health care. This might be a sign that general partners are being more careful with their limited partners’ money than boards of publicly listed companies are. The latter have inflated currency for acquisitions, thanks to the bull market.

Nor is the lifeblood of life science investment being rejuvenated by new companies. The latest MoneyTree™ report from PricewaterhouseCoopers LLP (PwC) and the National Venture Capital Association (NVCA), based on data provided by Thomson Reuters, reports that:

Overall, investments in Q3 in the Life Sciences sector (Biotechnology and Medical Devices combined) fell 35 percent in dollars and 6 percent in deals when compared to Q2 2014. The Biotechnology industry captured the third largest total during the quarter with $1.1 billion going into 110 deals, down 43 percent in dollars invested and 10 percent in deals from the prior quarter. The Medical Devices and Equipment industry also experienced a decrease in dollars compared to the second quarter, falling 13 percent in dollars to $586 million invested into 78 deals in Q3 — the same number of deals as the prior quarter.

The high-water mark for VC investments in these sectors was 2007 Q1, just before the recession hit in December 2007, before Barack Obama was elected President in November 2008, and before the Patient Protection and Affordable Care Act (Obamacare) was signed into law in March 2010. MoneyTree™ reports that 2007 Q1 VC investment was $1.58 billion in biotech and $1.12 billion in medical-devices. However, these understate the drop off, because they are reported in nominal dollars. If we inflate them to 2014 Q2 dollars using the GDP deflator, VC investment was $1.77 billion in biotech and $1.25 billion in medical devices.

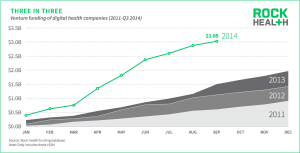

Of course, there are some great deals being done in all these sectors. However, the overall picture is pretty bad. The one exception is digital health. According to Rock Health’s Q3 report, VC investment in digital health is accelerating faster than any year since 2011, when Rock Health began tracking deals. This year’s total so far is $3 billion, averaging $1 billion per quarter.

I was not able to reconcile Rock Health’s definition of digital health with MoneyTree™’s more traditional definitions. There may be considerable overlap. It may be that the future of health care is simply digital. On the other hand, the most obvious difference between digital health and the other sectors is that the latter suffers Obamacare excise taxes and sales taxes, while the former does not.

Digital health care will be a leading catalyst in the creative destruction of medicine.

Well said. All included in the secular movement for goods and services to be offered digitally.

All you have to do is follow the trajectory of Apple’s products and the number of people who crave them. Digital is definitely in. We have a legacy healthcare system, which will devolve down to surgery and trauma.

Patients will be able to mix their own beds into a single patch.

On the other hand, there are new tools that will bring new customers into a system that has not had much for them before. 3-D printing can make bone replacement, and exoskeletons. And deep brain stimulation can correct epilepsy.

For other innovations, check into the Future Edition by John Peterson.

Cheers…

Wanda Jones

San Francisco

While famous malapropist Yogi Berra is most often cited for the quote, “Prediction is very difficult, especially about the future,” it appears that the source was actually Danish physicist and Nobel Prize laureate Niels Bohr. Bohr, whose pioneering work in quantum physics would naturally equip him with a keen sense of the limits of knowledge, also had a sense of humor. (He also said, “An expert is a man who has made all the mistakes that can be made in a very narrow field.”)

Michael Dobson – The SideWise Institute

Seems pretty natural. Medical data is rapidly becoming some of the most valuable (and available) assets these healthcare firms have, VC must realize this.