What are the Causes of Projected Growth in Spending for Social Security and Major Health Care Programs?

We’ve already noted that the media and many other got overly excited about a trivial delay in the date of the impending bankruptcy of the Medicare “trust fund”, as estimated by the Congressional Budget Office (CBO).

The CBO has followed up with a more sober article on its blog:

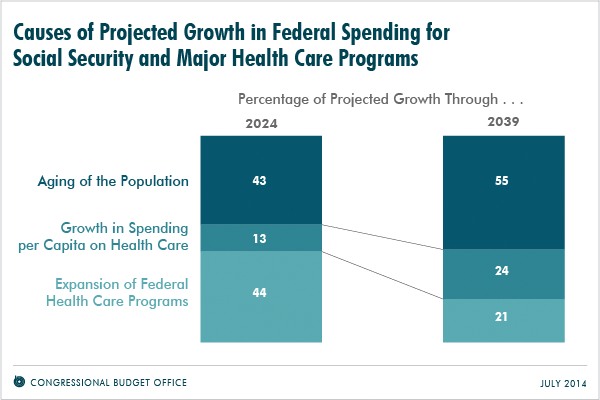

Under current law, spending for Social Security would increase from almost 5 percent of gross domestic product (GDP) in 2014 to more than 6 percent in 2039 and beyond (see the figure below). Even more of the anticipated growth is expected to come from the government’s major health care programs (Medicare, Medicaid, the Children’s Health Insurance Program, and subsidies offered through health insurance exchanges): CBO projects that, under current law, total outlays for those programs, net of Medicare premiums and certain other offsetting receipts, would grow much faster than the overall economy, increasing from just below 5 percent of GDP now to 8 percent in 2039.

The three drivers of this growth are: Aging of the population, growth in spending per capita on health care, and the expansion of federal healthcare programs.

Medicare and other federal health spending is driving our fiscal crisis, more than ever.

I still fail to see how Obamacare is going to bring down healthcare prices and thus spending.

There’s also the fact that as baby boomers retire effectively less people will be there to ‘support’ their benefits.

I read that in 1960 there were five workers supporting every retiree, while in 2030 it’ll be just two workers per retiree.

Yep, we are going to have 77 million baby boomers retiring in the next 30 or so years, apparently. Good luck dealing with that if we can’t reduce the spending on Social Security and healthcare programs..

I really don’t know how things like Medicare or the Old Age Social Security program aren’t just going to end up bankrupt if we are basically going to just have more people depending on them and can’t cut spending.

It is certain that changes have to be made. The ACA was one step in helping to reduce the healthcare costs that would otherwise be imposed on programs like Medicaid. For SS, there is always talk of reform but it is very difficult to build a consensus on what the proper approach should be. It seems like the retirement age is one place where discussion can start.

How does ACA “reduce the healthcare costs that would otherwise be imposed on programs like Medicaid”?

Obamacare significantly increases Medicaid spending.

Yes it sure does. Medicaid is going to continue to be a fiscal burden on us until the bureaucrats get the message that we cannot sustain these outrageous deficits year after year.

Forgive the lack of clarity in my comments on this post (was in a bit of a rush…According to the CBPP, Medicare would have become insolvent without the ACA because the costs of the program would have spiraled out of control. The ACA implemented cost-control mechanisms to sustain the program. Yes, there was an INITIAL expansion of the program through the enactment of the ACA, but it seems that over the long-run healthcare costs will decrease.

My only point was that the costs increases were inevitable. It is only a question of how substantial the cost increases are. People that talk about how spending on healthcare programs and insurance premiums have gone up since the President has been in office should also talk about what the alternative would have been. Spending on healthcare programs and insurance premiums have been on the rise for decades and would have happened with or without ACA.

We just posted an entry on the Medicare Trustees report. That ACA will be able to execute its Medicare cost cuts is pretty unlikely.

Just to get the demographics right, we baby boomers have already been retiring for 3 years and will stop retiring in less than 15 years. Whatever happens after that, don’t blame we baby boomers. We bit the bullet for our SS costs in 1985 by accepting a higher retirement age and a doubling of SS payroll taxes and later we made the amount of income on which we had to pay Medicare tax unlimited. I agree those of you born after 1962 or so (the nominal cut off of the baby boom I believe) are screwed but stop blaming us and trying to screw us.

Let’s watch the language, please. The retirees vote more than the young and the workers. So, I don’t think you have to worry about them hurting your benefits.

Please delete anything you find offensive; it’s your blog. But when someone says “Yep, we are going to have 77 million baby boomers retiring in the next 30 or so years…. the bad math and demographics, the lack of understanding of history, and all the bad policy proposals that both lead to needs to be called out. I’m not worried at all but senior voting hasn’t stopped the current War on Seniors: the money taken out of Medicare to pay for PPACA, the increased B and D premiums (as a percent of Medicare population) to pay for PPACA, the attacks on the D plan, the complete lack of knowledge of how bad Medicare is (and pretense that it’s great), the incessant claims that C costs “taxpayers” 14% more than “traditional Medicare,” and so forth

We have to realize that healthcare costs were inevitably going to go up, it was a matter of how we could reign in some of the costs. The jury is still out on the ACA but to say that spending on federal programs like SS and Medicare are absolute nonstarters.

Obamacare is here, and yet healthcare is only becoming more expensive. Medicaid spending, as a percentage of GDP, will continue to rise simply because there are no incentives in it to reduce costs, either on the part of doctors or on the part of patients, because a third party (Medicaid) will pick up most of the tab.