CBO: Obamacare’s Uninsured Up 5 Million, Medicaid Dependents Up 16 Million Since Initial Estimate

(A version of this Health Alert was published by Forbes.)

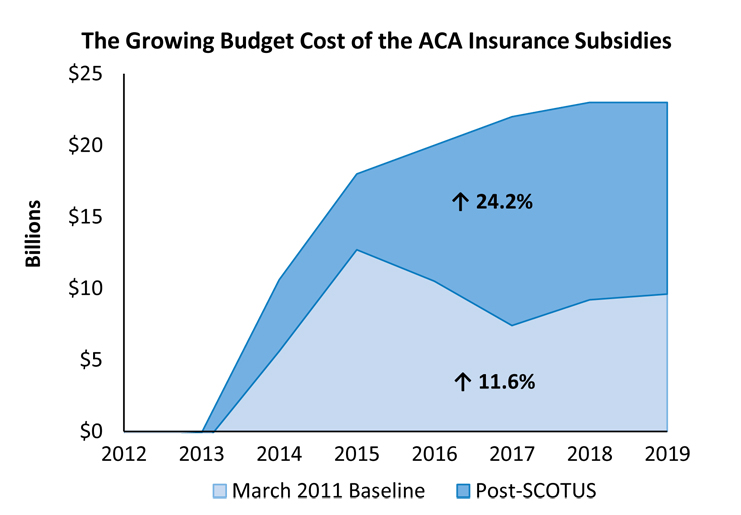

Last week’s Congressional Budget Office’s Updated Budget Projections: 2016 to 2026 significantly reduced estimates of Obamacare’s benefits, relative to CBO’s estimates published in 2010, when the law was signed:

- In 2010, CBO estimated Obamacare would leave 22 million uninsured in 2016 through 2019. This month, CBO estimates Obamacare will leave 27 million uninsured through 2019 – an increase of almost one quarter.

- In 2010, CBO estimated Obamacare would leave 163 million with employer-based health benefits in 2016 and 159 million in 2019. This month, CBO estimates Obamacare will leave only 155 million with employer-based plans. The number will decrease to 152 million in 2019.

- In 2010, CBO estimated Obamacare exchanges would enroll 21 million people in 2016, increasing to 24 million in 2019. This month, CBO estimates Obamacare’s exchanges will enroll only 13 million people this year, and 20 million in 2019.

- In 2010, CBO estimated Obamacare would result in 52 million Americans remaining or falling into dependency on Medicaid or the Children’s Health Insurance Program, the welfare programs jointly funded by state and federal governments that subsidizes low-income households’ health care, in 2016. CBO estimated that figure would drop slightly to 51 million in 2019. This month, CBO estimates 68 million will be dependent on the program this year through 2019 – an increase of almost one third in the welfare caseload.