Believe it or Not, The Republican Obamacare Replacement Plan Might Come Together

(A version of this Health Alert was published by Forbes.)

(A version of this Health Alert was published by Forbes.)

Earlier this month, Speaker Paul Ryan announced six task forces, each comprised of House Committee Chairmen, to develop a “bold, pro-growth agenda.” What was remarkable was that one of the task forces was on health care reform. Many had thought Congressional Republicans were investing too much time and energy grandstanding Obamacare repeal, and not enough developing a credible alternative.

That may have changed with the selection of four Committee Chairman to the Health Care Reform Task Force. They are: Budget Committee Chairman Tom Price (R-GA), Education & the Workforce Committee Chairman John Kline (R-MN), Energy & Commerce Committee Chairman Fred Upton (R-MI), and Ways & Means Committee Chairman Kevin Brady (R-TX).

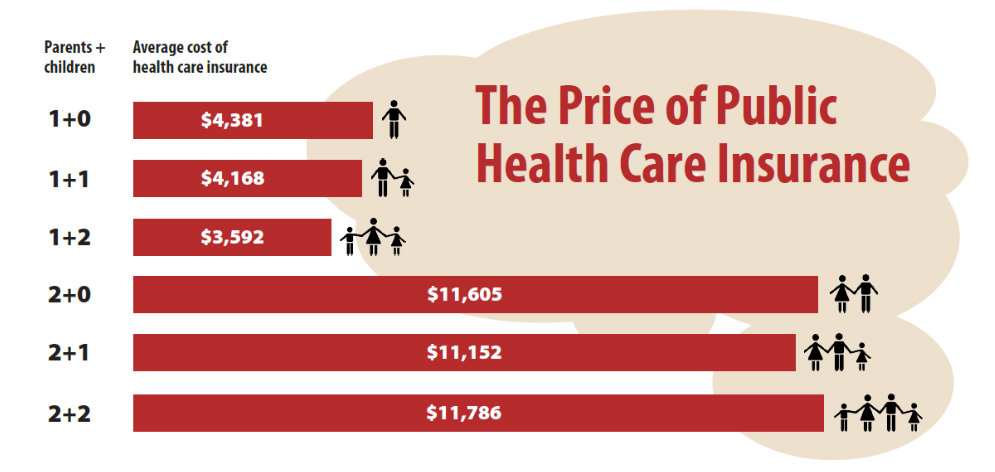

With respect to private health insurance, the composition of the task force indicates the emerging House Republican plan will improve the post-Obamacare health system not only versus Obamacare, but versus the pre-Obamacare system. One of the reforms will almost certainly be refundable tax credits to finance health care for those of us who do not have employer-based benefits. Importantly, these tax credits will likely be much simpler to calculate than Obamacare’s tax credits, which impose high marginal income taxes at certain incomes, and reduce people’s incentives to work.

So, even when we combine the most optimistic estimates of gains in mortality and morbidity, the average uninsured person would gain about 16 healthy days a year…As a comparison, 75-year-olds with foot problems prior to chiropody treatment rate their quality of life at .956. For the average uninsured person, having health insurance coverage provides health benefits that are roughly equivalent to averting the foot problems experienced by typical 75-year-olds.

So, even when we combine the most optimistic estimates of gains in mortality and morbidity, the average uninsured person would gain about 16 healthy days a year…As a comparison, 75-year-olds with foot problems prior to chiropody treatment rate their quality of life at .956. For the average uninsured person, having health insurance coverage provides health benefits that are roughly equivalent to averting the foot problems experienced by typical 75-year-olds.