Yippee! Medicare Won’t Go Bust Until 2030!

The latest Congressional Budget Office’s latest Long-Term Budget Outlook now asserts that Medicare’s so-called “Trust fund”. Talk about kicking the can down the road!

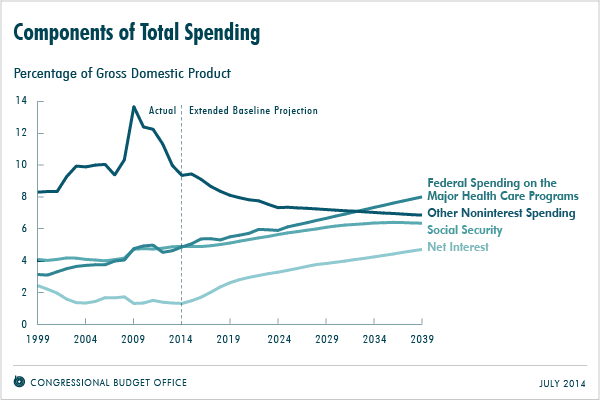

As the chart below shows, the problem is not that the “trust fund” will go bust in any given year, but that the federal government is borrowing money to finance consumption. “Other non-interest spending” includes major infrastructure and defense, tasks which constitutionally and under a proper economic understanding fall to the federal government. These were the purposes for which the Founders gave Congress the power to borrow money in the people’s name. Borrowing to finance seniors’ healthcare consumption does nothing for future generations’ prosperity.

Citizen activists who rail against Obamacare and political interference in our health care need to realize that the hand of government will never release its grip on health care as long as we tolerate this fiscal situation.

“Yippee! Medicare Won’t Go Bust Until 2030!”

Yeah, maybe its “yippee” for the baby boomers, but not for the rest of us. The millenials get a staggering economy, a broken ObamaCare, the student loan bubble and now busted Medicare.

The next immigration crisis is going to be out of the US and into Canada.

“Borrowing to finance seniors’ healthcare consumption does nothing for future generations’ prosperity.”

The next decade will possibly be the most important in US history. Future generations prosperity is being held hostage just so the current generation can get by. There needs to be not just Medicare spending reform, but health care reform that will cost effective and will work.

Finding a way to fix the budget is going to have to be more than just moving numbers around and borrowing. There are going to have to be painful reforms for awhile to get out of this mess.

We can keep kicking the can down the road, but eventually the road will dead end. Then where will we go?

Kicking the can? I think the can’s been squashed.

It sounds like both Social Security and Medicare will go broke about the time that I sign up for benefits. I can imagine going to my local Social Security office and having them tell me they’re out of money. I say “what am I supposed to do?” They motion me to another window and tell me to go sign up over there. I investigate and discover that the other window is where you register with the Medicare Death Panel!

At least its 5 years longer than they expected!

http://online.wsj.com/articles/cbo-sees-growth-in-medicare-costs-continuing-to-slow-1405434582

( politico.com/news/stories/0412/75603.html )

Social Security trustees: We’re going broke

04/25/12 – Politico by John C. Goodman

What the current value of the unfunded liability means:

=== ===

The latest report of the Social Security and Medicare trustees shows an unfunded liability for both programs of $63 trillion, about 4.5 times the U.S. gross domestic product GDP. [$20.5 trillion of that is from Social Security.]

The unfunded liability is the amount we have promised in benefits, looking indefinitely into the future, minus the payroll taxes and premiums we expect to collect. It’s the amount we must have in the bank today, earning [3%] interest, for these entitlement programs to be solvent [fully funded].

=== ===

( cato.org/publications/commentary/social-securitys-sham-guarantee )

Social Security’s Sham Guarantee

05/29/05 – Cato by Michael D. Tanner [edited extract]

=== ===

Social Security [and Medicare] benefits are not guaranteed legally because workers have no contractual or property rights to any benefits whatsoever. In two landmark cases, Flemming v. Nestor and Helvering v. Davis, the U.S. Supreme Court ruled that Social Security taxes are not contributions or savings, but simply taxes, and that Social Security benefits are simply a government spending program, no different than, say, farm price supports. Congress and the president may change, reduce, or even eliminate benefits at any time.

As a result, retirees must depend on the good will of 535 politicians to determine how much they will receive in retirement. And what could be less guaranteed than a politician’s promise? In fact, Congress has voted to reduce Social Security benefits in the past. For example, in 1983, Congress raised the retirement age.

=== ===

( insureblog.blogspot.com/2012/09/elephant-in-room.html )

Spocial Secrity funding: The elephant in the room

09/14/12 – InsureBlog by Bob Vineyard [edited]

=== ===

Well, there is a trust fund, but there isn’t any money in it. Not real money. Only IOU’s [a government promise to find the actual, consumable resources somewhere, somehow.] Those in denial say the federal government has never defaulted on their obligations so the IOU’s are “secure”.

Here is the truth. The accumulated debt is $16 trillion, roughly 100% of GDP. As if that isn’t bad enough, you need to factor in our unfunded liability, the amount we owe for future obligations. Things like federal pensions, Social Security promises, and Medicare promises. The unfunded liability exceeds $100 trillion.

=== ===

This must always be added to any discussion of any government “trust fund”.

There is nothing of value in the Social Security “trust fund” (or in any US government trust fund such as Medicare). There is only a politician’s promise to find the money [real resources] somewhere that was paid in at one time, but has already been spent. The trust fund bonds are only a paper record of what was collected in taxes “in excess” of the immediate cash needs of Social Security. That amount “in excess” was put into the general Treasury and spent, leaving a bond behind to note the borrowing.

( easyopinions.blogspot.com/2009/01/ponzi-schemes-like-social-security.html )

Ponzy Schemes Like Social Security

Social Security is a direct-pay program. Amounts collected this year are all paid out, either to recipients or to government programs. The Ponzi scheme is ending. From this time on, more will be paid out than collected in cash. Only continued government borrowing can make up the shortfall. Or, the government will reduce benefits or inflate the currency. Seniors may get $100 in distributions, which may buy only what $50 buys today.

( xtranormal.com/watch/11226537/?listid=18148621 )

Here is an XTraNormal video (2:12) which presents the facts about the Social Security Trust Fund bonds. (Don’t be bothered by the name of the video, “Pharmacy tech qualification test”.)

Summary: The trust fund bonds are obligations of the US government payable to the US government. They have no more value than a check which you write to yourself.

Amazingly, this is exactly like an insane person saving up for his children’s college education. He puts $100 each Friday into his savings account. Each Monday he takes out that $100 and spends it on entertainment, but he carefully records what he owes to the “college fund”.

When his kids are 18, he tells them that he saved $50,000 over the years, as shown on his “fund account paper” (the trust fund bonds). He only has to pay back what he took out, or borrow the money in the name of the children. Are they happy at that result?

This has been justified over the years with the bromide “we owe the money to ourselves, so why not spend it now?” OK. Now, in retirement, someone (the young?) will have to generate the real resources to pay for the seniors, if they can be forced to do this.

” “Other non-interest spending” includes major infrastructure and defense, tasks which constitutionally and under a proper economic understanding fall to the federal government.”

That’s exactly right, but Thomas Jefferson also said that it is the natural order to things for the government to gain ground at the expense of the peoples’ liberty, and this is one of the results. A broken promise, just like Social Security, that leads to a false sense of security, only to go bust as more and more people need it.

As many of you know, the Medicare trust fund is merely an accounting mechanism. The borrowed dollars from the trust fund comprise the entire balance.

Every dollar redeemed from the trust fund adds to the debt held by the public.

What may be less known is that all taxes go into the Treasury’s general fund, from which the money can be spent on any governmental spending, including Medicare, defense, etc.

There is no such thing as a dedicated tax. That is why programs which have obligations further than one year should be privatized.

There are over 20 trust funds which are completely borrowed from, in which dedicated monies were spent on general expenses. The intragovernmental debt is over $5 trillion.

Don Levit

The Medicare payroll tax has not increased in its percentage for about 20 years.

(The tax was stretched to cover all incomes in about 1995, and incomes over $250k were hit for a higher per cent in 2010.)

But as noted here, that has not been enough.

A grown up political class would have raised the payroll tax percentage as the number of senior citizens increased. That is more or less what Germany has done.

I don’t know who I blame more — the Democrats who pretend that taxing the rich will solve it all, or the Republicans who follow Grover Norquist like sheep, and take anti-tax pledges while expanding Medicare.