Health Jobs Pick Up in Booming Jobs Report

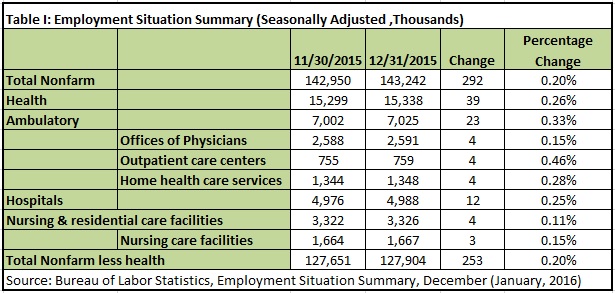

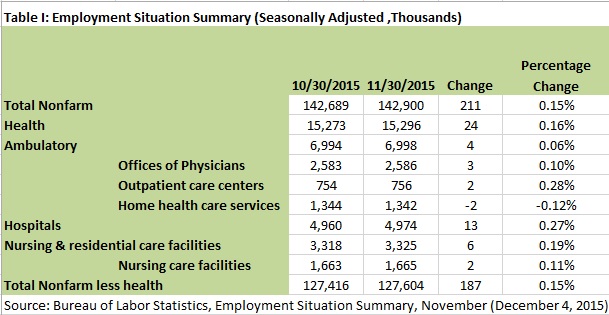

Today’s Employment Situation Summary, which came in above strong expectations, also saw faster growth in health services jobs than other nonfarm civilian jobs. In December, health services jobs grew at 0.26 percent, versus only 0.20 percent for other jobs. Health services jobs comprised 13 percent of the 292,000 jobs added in December (Table I).

Today’s Employment Situation Summary, which came in above strong expectations, also saw faster growth in health services jobs than other nonfarm civilian jobs. In December, health services jobs grew at 0.26 percent, versus only 0.20 percent for other jobs. Health services jobs comprised 13 percent of the 292,000 jobs added in December (Table I).

Within health services, outpatient care jobs grew much faster than jobs at other facilities. Overall, jobs at ambulatory facilities grew faster than hospital jobs. This is a good development because hospitals are less efficient locations of care.