What is Driving Health Prices Up?

The recent arrest of Martin Shkreli, former CEO of Turing Pharmaceuticals, for securities fraud, reminds us that high prescription drug prices are today’s whipping boy for the costs of health care. Hillary Clinton and other politicians have promised to impose federal controls on pharmaceutical prices.

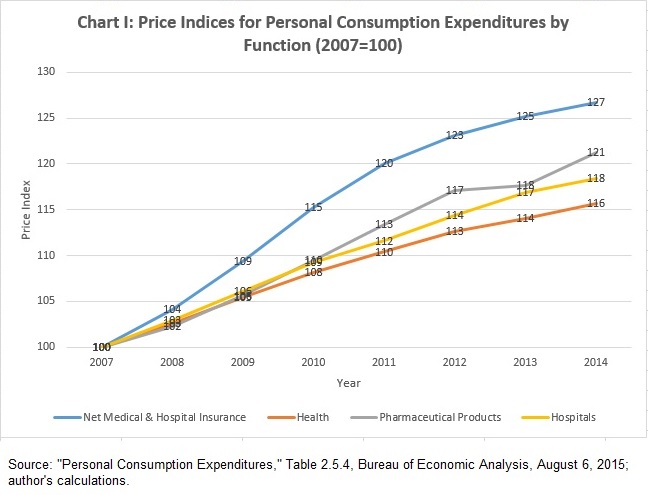

However, prescription drugs have not been the fastest growing item in health care since the economy started to enter the Great Recession in 2007. That distinction belongs to health insurance (specifically, medical and hospital insurance, not workers’ compensation, income replacement, or long-term care). Table I shows price indices for various components of personal consumption expenditures, indexed such that 2007 equals 100.

“Net” medical and hospital insurance (that is, premiums less claims paid out to doctors, hospitals, and others), increased 27 percent over the period. Spending on actual health goods and services rose only 16 percent.

To be sure, prices of prescription drugs increased 21 percent. However, prices for hospitalization increased 18 percent. For some reason, politicians generally do not berate hospitals for their greed, like they do drug makers.

Obamacare makes the purchase of private health insurance mandatory for most Americans. While it regulates insurers’ profit margins, it does not regulate premiums. If the government did not force us to buy insurance, or otherwise encourage us to use insurance for medical spending that would be more efficiently purchased directly, we would not see this remarkable price inflation for health insurance.

I wonder if these data are capturing the true increase in the cost of health insurance; for example, the effect of changes in plan design.

If a benchmark plan reduces costs by increasing copays, deductibles, and coinsurance, that is, in effect, a rate increase. If it reduces costs by limiting choice (narrower networks), that is a rate increase.

Reducing costs (taking value out of the plan) by 10% is the equivalent of an 11% rate increase. That jacks up the nominal average rate increase of 7% to almost 19%. Which number is being tracked?

You have hit the nail on the head. The AON Hewitt report I discussed in a nearby blog post gets to it.

Underwriterguy is correct and I don’t believe any of these numbers. It’s like asking Al Capone how much he is spending to bribe politicians. Of course Al Capone is going to low ball you.

Insurance companies are in business for one thing and one thing only and that is to make a profit. Granted any business should make a profit but how much of a profit and at what expense. Every year insurance premiums go up and what they cover and the amount that they cover goes down. We pay higher premiums and have to pay higher deductibles etc. And we should not be mandated by the Government saying we must buy health insurance or be fines at the end of the year. Not everyone can afford health insurance. And the people that made this a law should have to take the same insurance as everyone else.

Plus prescription drugs are less than 10% (9.3) of the total spend on healthcare says:

http://www.cdc.gov/nchs/fastats/health-expenditures.htm

Does this take into account compliance and reporting costs? IMHO the regulatory burden alone will cause premiums to rise without affecting net profit – all the extra money is spent hiring people to fill in and submit forms for government regulators.