Hospitals Dominate Health Jobs In November

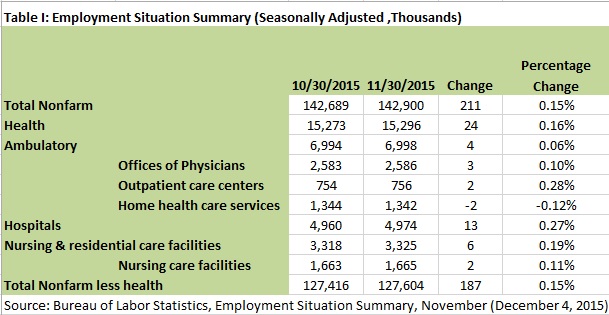

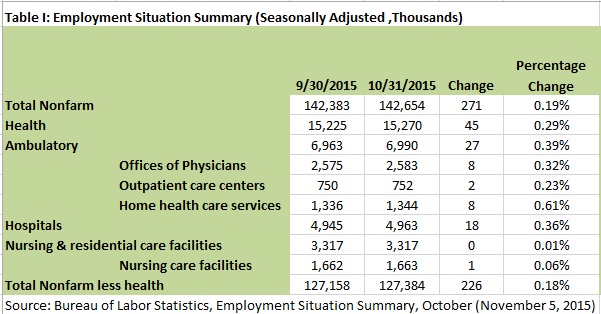

The November Employment Situation Summary came in as expected, with 211,000 nonfarm civilian jobs added. Last month’s report was dominated by health jobs, which was not the case today. The increase of 24,000 health jobs comprised only 11 percent of the payroll hike, and both health and non-health jobs rose by 15 percent on the month (Table I).

The November Employment Situation Summary came in as expected, with 211,000 nonfarm civilian jobs added. Last month’s report was dominated by health jobs, which was not the case today. The increase of 24,000 health jobs comprised only 11 percent of the payroll hike, and both health and non-health jobs rose by 15 percent on the month (Table I).

However, hospital jobs, which increased 13,000, comprised over half the growth in health jobs. This is something we view with concern. We prefer to see health jobs grow in ambulatory settings, because hospitals are the most expensive location of care. Hopefully, technology will move more health services out of the hospitals.