Health Jobs Dominate Great Jobs Report

Observers cheered the October Employment Situation Summary, which reported 271,000 civilian nonfarm jobs added. This is a big turnaround from the September report, which was very disappointing. Nevertheless, the two months have one thing in common: Jobs in health services dominated the growth in jobs. Whether job growth overall is strong or weak, health care keeps increasing its share.

Observers cheered the October Employment Situation Summary, which reported 271,000 civilian nonfarm jobs added. This is a big turnaround from the September report, which was very disappointing. Nevertheless, the two months have one thing in common: Jobs in health services dominated the growth in jobs. Whether job growth overall is strong or weak, health care keeps increasing its share.

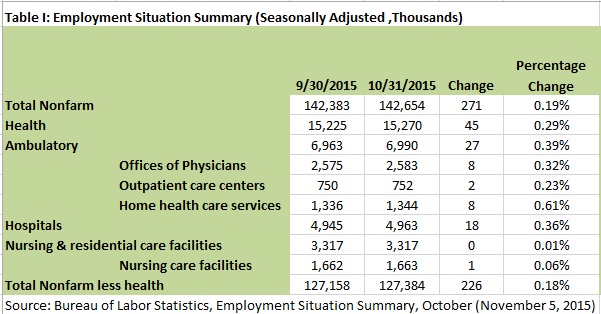

Health care accounted for 45,000 of the 217,000 jobs added overall in October (Table I). That’s a rate of growth of 0.29 percent, much higher than 0.18 percent growth in non-health jobs. Jobs in ambulatory facilities accounted for 27,000 of the increase, which hospital jobs only increased by 18,000. Ambulatory jobs now account for a significantly higher share of health jobs than hospitals do. This change is positive, because hospitals are inefficient and overly expensive facilities for many procedures.

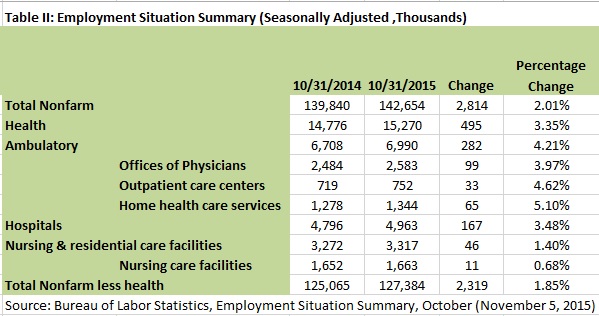

Year on year, health jobs similarly outpace other jobs (Table II). With an increase of 495,000, health jobs increased 3.35 percent, versus just 1.89 percent for non-health care jobs.

Health services workers now comprise 17 percent of the civilian nonfarm workforce.

The cynic in me wants to attribute the rise to hiring lots of people to implement ICD-10.

I think the slow growth rate in employment at residential and nursing care facilities is a good thing. It implies that the number of people winding up in these facilities as a percentage of the elderly population is shrinking.

The number of people in nursing homes has been decreasing for years due in part to a remarkable convergence of what seniors and the government want. Most nursing home care is paid for by Medicaid, and Medicaid has been pushing home-based services. Most seniors would rather live at home.

Unfortunately this convergence between citizens and government seems to occur as frequently as the installation of a new Pope.

Another significant contribution comes from the emergence of assisted-living communities. These are for people who require help with activities of daily living (cooking, bathing, dressing, help with medications, etc) but don’t require daily nursing or medical attention. They usually provide transportation services as well.

These types of communities come in various flavors depending on the level of care required.

I’m aware of the long term decline in the number of people in nursing homes as well as the proliferation of assisted living communities. I even had the opportunity to tour a new assisted living community that just opened near here because their first marketing event was a presentation on atrial fibrillation which I have.

There does seem to be a lot of fraud in the home healthcare business unfortunately. Also, a lot of nursing homes seem to provide services like physical therapy that, in many cases, will drive revenue for the nursing home but won’t provide much if any benefit to the patient.

I also wonder about the cost of long term care services provided by unpaid family members. Often these folks have to curtail their own careers or give up their jobs entirely to care for a loved one. I bring this up because if liberals ever succeed in adding long term care as a benefit covered by Medicare beyond the limited coverage it pays for now following a hospital discharge, I fear that people would come out of the woodwork by the hundreds of thousands and maybe even millions to claims benefits and free themselves of the financial and emotional burden they are currently enduring. That would be a budget buster for sure.

I started in the insurance industry in 1987 selling Long Term Care (LTC) insurance. I only lasted about one month before I switched to health insurance. My Father insisted that I sell him and my Mom before the switch. My Mom was 64-years old and her premium was $900 a year. My Father was more and the insurance company is lucky he died in his sleep and never used the policy. My Mother paid for 22 years then had to go into a nursing home that cost $333 a day and she lived there for 2 1/2 years before she died.

My Father knew what he was talking about because my Mother’s 912 days at $333 per day is $303,696 and her $900 a year premium for 22 years was only $19,800. If people get their LTC when they are younger the premiums are much more affordable. Imagine how much 2 1/2 years in the nursing home will cost in 20 years from now.

Ron –

I don’t know if you’ve been following what’s going on in the LTC insurance business. Numerous companies have exited the business and most of the rest have sharply increased their premiums because their clients are living longer than they expected and more of them are going on claim than they expected. In the early years, they just didn’t have much good information about how to price these policies. They learned what they could from the life insurance industry but the businesses are very different.

My wife and I were both approved to purchase long term care insurance through Genworth in 2002 when we were in our mid-fifties. At the time, the full year cost for the two of us was just under $3,600 for a $150 daily benefit, 5% annual inflation protection, and a lifetime benefit duration. Premiums remained flat until two years ago when Genworth increased the premium for our policy class by 60% over three years at 20% each year. Starting in 2016 when the third of the three annual increases is implemented, we will be paying right around $6,000 per year for the coverage. Genworth doesn’t even offer lifetime coverage anymore, inflation protection is limited to 3% per year and you can’t buy a policy at any price if you’re older than 74 even if you’re relatively healthy.

It’s no accident that fewer than 8% of seniors have long term care insurance. It’s an expensive product even though it’s underwritten. The inflation protection feature roughly doubles the premium from what it would be without it. I have no good ideas to offer on this one.

Barry, I’m told there are annuity products with no medical underwriting that the amount deposited triples up for nursing home benefits. Don’t hold me to this because I’m not an expert on this subject.

Will employees eventually sue employers for offering benefits?

As premiums continue to rise and become more and more unaffordable does the family glitch open up the employers to potential law suits for disqualifying employees and there dependents from qualifying for tax credits?

The family glitch is cost shifting thousands of dollars in costs to employees simply because the employer is offering benefits.

If the employer offers coverage disqualifying the employee and dependents from tax credits. Dose that then give the employee the ability to recover damages from the employer.

Think about a large corporation like hobby lobby that has thousands of lower income employees. Hobby lobby offers benefits and pays a portion of the employees cost. Employees can add a family plan for about $9000 a year. If hobby lobby didn’t offer coverage the family would qualify for $10,000 in tax credits.

Class action law suit for the $10,000 in damages the employees suffered in lost tax credits simply because the employer offered a group insurance plan.

What are your thoughts?

The big ham, good point. The employers avoid a federal fine of $3,000 by disqualifying their employees from $10,000 in tax credits. These employees have to purchase on the exchange with after tax dollars but here at the NCPA people never really look from the poor employees point of view.

Also, the “Family Glitch” should be renamed the “Childrens Glitch” because employers are not mandated to cover the spouse of an employee but just the children.

Obamacare and the “Childrens Glitch” manufacturers uninsured children from coast to coast.