PPI: Pharma Prices Are Dropping!

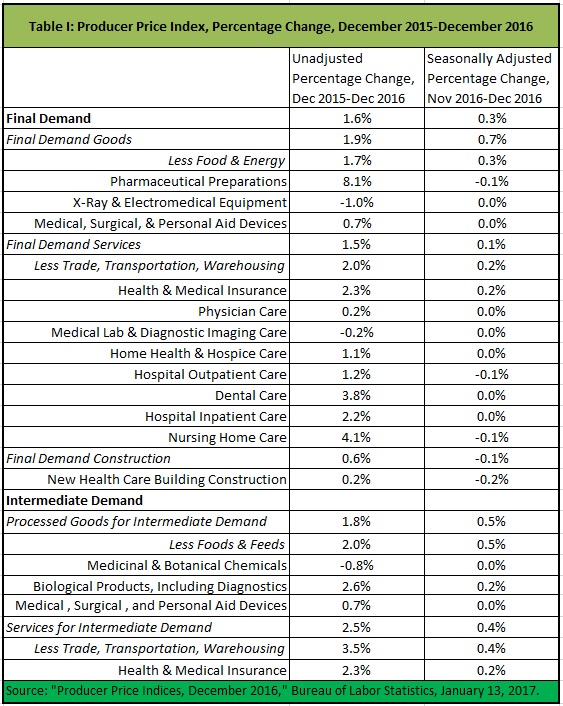

December’s Producer Price Index rose 0.3 percent. However, prices for most health goods and services grew slowly, if at all. Fifteen of the 16 price indices for health goods and services grew slower than their benchmarks.*

December’s Producer Price Index rose 0.3 percent. However, prices for most health goods and services grew slowly, if at all. Fifteen of the 16 price indices for health goods and services grew slower than their benchmarks.*

The outlier was health and medical insurance for final demand, which increased by 0.2 percent, the same rate as final demand services (less trade, transportation, and warehousing.) The largest decline (relative to its benchmark) was for prices of new health care building construction, which declined twice as fast as prices of overall building construction did.

Prices of hospital outpatient care and nursing home care declined versus their final demand services (less trade, transportation, and warehousing) and also absolutely. Pharmaceutical prices decreased 0.1 percent, a 0.4 percent drop versus the price increase for final demand goods less food and energy.

See Table I below the fold:

Prices of health goods and services for intermediate demand, were lower than their benchmarks. It looks like slow price increases for medicinal and botanical chemicals, and biological products have begun to flow through to prices of pharmaceutical preparations.

Over the last twelve months, prices of 10 of the 16 health goods and services have increased slower than their benchmarks. an their benchmarks: Pharmaceutical preparations stand out, having increased 8.1 percent, or 6.4 percentage points more than final demand goods (less food and energy).

*The benchmarks are the core measurements under which the health measurements are found. That is, final demand goods less food and energy is the benchmark for the three measurements (pharmaceutical preparations, X-Ray and electromedical equipment, and medical, surgical, and personal aid devices) listed under that core measurement; final demand services less trade, transportation, and warehousing is the benchmark for the eight health measurements listed under that core measurement, et cetera.

**Dental care is dominated neither by government nor private insurance, so dental price increases are not explained by NCPA’s usual theory of health inflation. I addressed dental price increases in a previous article.