PPI: Health Prices Mixed Amidst Inflation

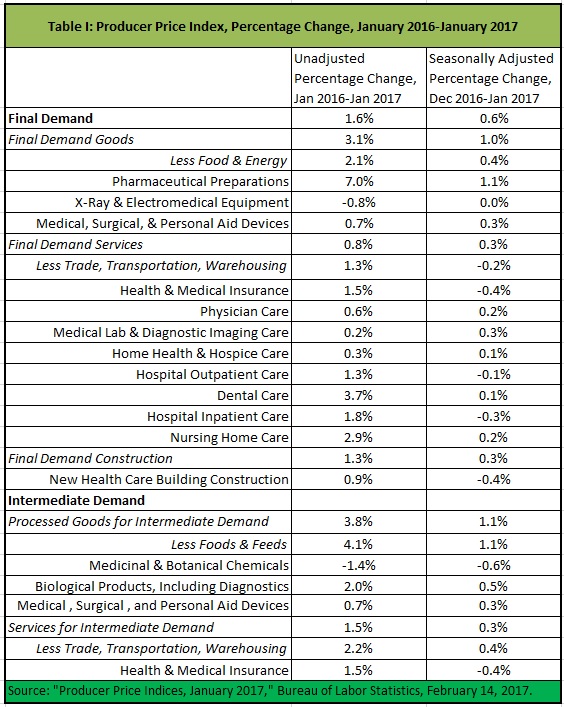

January’s Producer Price Index rose 0.6 percent. However, prices for many health goods and services grew slowly, if at all. Nine of the 16 price indices for health goods and services grew slower than their benchmarks.* Prices for six of the categories of health goods and services deflated in absolute terms.

January’s Producer Price Index rose 0.6 percent. However, prices for many health goods and services grew slowly, if at all. Nine of the 16 price indices for health goods and services grew slower than their benchmarks.* Prices for six of the categories of health goods and services deflated in absolute terms.

The outlier was pharmaceutical preparations for final demand, which increased by 1.1 percent (0.7 percentage points more than final demand services (less trade, transportation, and warehousing.) The largest decline (relative to its benchmark) was for prices of health and medical insurance for intermediate demand, which declined by 0.8 percentage points versus services for intermediate demand (less trade, transportation, and warehousing).

With respect to diagnosing whether health prices are under control, the January PPI is more mixed than December’s was. Nevertheless, although pharmaceutical prices stand out, most excess inflation is in health services, not goods.

See Table I below the fold:

Over the last twelve months, prices of 10 of the 16 health goods and services have increased slower than their benchmarks. Prices of X-Ray and electromedical equipment stand out, having shrunk 0.8 percent, an absolute decline of 2.9 percentage points versus final demand goods (less food and energy). Pharmaceutical preparations stand out on the high side, having increased 7.0 percent, or 4.9 percentage points more than final demand goods (less food and energy).

*The benchmarks are the core measurements under which the health measurements are found. That is, final demand goods less food and energy is the benchmark for the three measurements (pharmaceutical preparations, X-Ray and electromedical equipment, and medical, surgical, and personal aid devices) listed under that core measurement; final demand services less trade, transportation, and warehousing is the benchmark for the eight health measurements listed under that core measurement, et cetera.

**Dental care is dominated neither by government nor private insurance, so dental price increases are not explained by NCPA’s usual theory of health inflation. I addressed dental price increases in a previous article.

So Obamacare is really helping, right John? Good news! Even though not one newspaper in America is reporting on how America’s only low-cost health insurance option is being outlawed in just days I was able to get a “Letter to the Editor” in the Tampa Bay Times to warn the locals here:

“Low-Cost Insurance Option Being Outlawed

The media is not reporting that a low-cost health insurance option is being eliminated April 1. Short-term medical insurance lasts until the next Affordable Care Act (Obamacare) open enrollment. Obamacare mandates that employers “offer” insurance to employees’ families, which automatically disqualifies them for tax credits. These families must purchase Obamacare insurance with after-tax dollars. Megyn Kelly doesn’t pay taxes on her insurance but poorer American must.

Pasco County schools are charging teachers $1,213 a month to add a spouse and child to the school’s Blue Cross PPO with a $3,000 out-of-pocket. Short-term medical coverage in Tampa for a 30-year-old husband and child is $260 a month with a $2,500 deductible, then 100 percent coverage.

Florida Healthy Kids is expensive. Its “Full Pay” program costs $205 a month with a $3,000 deductible and $6,700 out-of-pocket. Parents with two children pay $410 a month. Short-term medical insurance for two children is $170 a month with a $2,500 deductible then 100% coverage. With accidents, the deductible is just $250. Parents who cannot afford $410 might be able to afford $170 so their children can be insured.

A 50-year-old male can purchase short-term medical insurance for $194 a month with a $5,000 deductible, then 100 percent coverage. Medical underwriting is required.

Being uninsured is dangerous. The Orlando Weekly reported that 20 Florida hospitals charge uninsured patients 10 times the cost of care. I have contacted the governor’s office and asked him to warn Floridians that their short-term medical insurance option will soon be outlawed. I’m still waiting.

Ron Greiner, Holiday”

It’s bizarre that not one newspaper is reporting that millions of Americans on Short Term Medical will not be able to renew their plans. Surprise America!

We have a woman at FORBES lying about the tax-free HSA named Carolyn McClanahan, an uninformed doctor. She writes,– “Today, I will tackle the fallacies of using health savings accounts to solve our health care problems.

The GOP doesn’t share a dirty little secret – they expect you to use your health savings accounts to pay for the care [not covered] by your HIGH DEDUCTIBLE health insurance plan.”—

What could that possibly mean? Only covered expenses can be applied to the deductible. I can only guess that is what she means. I called her office here in Florida and they are investment people and not licensed to sell health insurance. I checked with the state of Florida and she is not licensed but likes to say really negative things about tax-free HSAs and health insurance with a deductible.

I look at the comments and our own Dr. John Graham has the 1st comment and he says, “Thank you for this. Can patients as consumers not also save money where most of the costs lie? For example, CALPERS’ experience of reference pricing for joint replacement limited the about it would indemnify for procedures but people were free to go to more expensive facilities and pay the difference. It was very transparent.”

She tells John, “John, thanks for the comment. This works for elective procedures such as joint replacement, but not the expensive emergencies such as heart attacks or strokes. Also, people with serious chronic disease such as cancer or ((autoimmune disorders)) don’t have the time or energy [for figuring out the costs]. Most practicing physicians don’t want to be bothered with this mess and don’t want to have discussions with patients about charges either, so putting the main responsibility on cost control on consumers and providers is misguided. The biggest cost in the system is overhead through inefficient billing practices and our fee for service payment system – cure these and health care costs will decrease significantly.

My son has crohn’s and my daughter MS and their medication is $100K each per year. Trust me, they care about cost with their ((autoimmune disorders)).

John why do you thank someone who lies about the tax-free HSA?

Here is the nasty FORBES article if you care.

http://www.forbes.com/sites/carolynmcclanahan/2017/02/14/health-savings-accounts-dirty-secret-and-how-the-gop-can-fix-it/#3ee57001671c

Ugh that article was more painful than the debate. What a bunch of liberal 💩