Obamacare is Driving Up Medicare Premiums

Obamacare includes a “health insurance providers fee” that is significantly increasing premiums. The fee is a fixed-dollar amount that is divvied up among insurers according to the amount of premium they write.

People who are really getting hit by this fee include Medicare Advantage beneficiaries who are enrolled in through retiree benefits. Because their former employers pay a share of their premium, the insurance fee has a disproportionate impact.

One reader sent me correspondence from his former employer’s HR department explaining why premiums are going up. In 2011, he paid $32.81 per month for both himself and his wife. In 2012 and 2013, the premium was $42.93. In 2014, it jumped up to $121.03, and $138.93 this year.

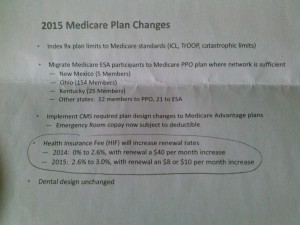

According the HR department, $40 (per person) of the 2014 increase was due to the fee, and $8-$10 of the 2015 increase:

Well, the total increase in premium for 2014 was $78.10. So, we can conclude that the increase was entirely accounted for by the fee. Indeed, their premium would have gone down a couple of bucks, if not for the fee. The same is true for the 2015 increase.

Premiums almost tripled, for the sole purpose of funding Obamacare. No wonder seniors want this repealed and replaced.

From my experience in the Medicare business, I would venture to say that those persons whose employers pay all or part of their MA premiums are almost universally in the upper 25% of American incomes. (at least of retirees’ incomes).

These are persons in general who have defined benefit pensions now, and probably earned good incomes before retirement.

That being said, I am not troubled if this group has to pay something extra, so that low-income persons can get ACA subsidies or Medicaid.

I do not like the way the ACA collects ‘taxes’ from higher premiums on some but not others — in that respect I probably agree with Mr Graham. I would have preferred a straight up increase in income taxes to pay for subsidies.