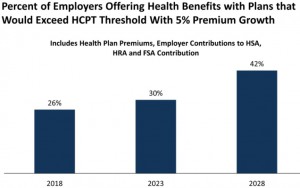

More than 40% of Employers will be Exposed to the Cadillac Tax in Coming Years

A controversial part of Obamacare imposes an excise tax on high cost health plans. Beginning in 2018, the so-called Cadillac Tax will impose a penalty of 40 percent of all costs in excess of $10,200 for employee-only coverage and $27,500 for family coverage. The threshold increases annually with inflation; that is regular inflation, not medical care inflation which rises at more than double the rate of general inflation.

Employers have a few options to avoid the tax. But all are things workers dislike, such as increasing cost-sharing, eliminating covered services, eliminating tax-free dollars for HSAs, HRAs and FSAs and adopting narrow networks.

The Kaiser Family Foundation looked at the proportion of firms offering health benefits plans that are expected to reach the threshold.

If you only look at large firms employing 200 workers or more, nearly half (46%) will have health plans subject to the tax in 2018. More than two-thirds (68%) will have health plans subject to the tax by 2028.

The tax exclusion for employee health insurance is worth approximately 40% to 45% (25% marginal tax rate, 15.3% payroll tax and maybe 5% state and local tax). What the Cadillac Tax does is impose a 40% tax on the excess costs over the threshold. What that basically means is the open-ended tax exclusion for employer sponsored health plans has been limited to $10,200 per individual and $27,500 per family.

Pro: Limiting the tax exclusion may encourage health plans to look for ways to reduce medical spending.

Con: Over time more and more people will be subject to the tax.

Should the Cadillac Tax be repealed? Let me know what you think!

Other things equal, I think the Cadillac tax should absolutely NOT be repealed. My preferred approach, however, would be to eliminate or at least phase out the tax preference as part of a broader revenue neutral tax reform effort for health insurance provided through an employer.

I think higher deductibles are, on balance, a good thing because they reduce moral hazard and make people more conscious about the actual cost of healthcare services, tests and procedures. I also think it’s important for insurers to start to view the individual as their customer and not the employer. That can only happen if the individual instead of the employer starts to pay the insurance premium even if he also receives a subsidy to help cover the cost.

The public sector unions and the remaining old line private sector industrial unions still have very comprehensive and expensive health insurance coverage. So, the main opposition to the changes suggested above will come from them. Since labor unions are a key and core constituency for democrats, actually getting rid of the employer tax preference would be a huge uphill battle to put it mildly. If it’s too big a lift, the Cadillac tax, which is already part of the ACA, is a step in the right direction, in my opinion. We need to keep it in place.

Barry, I agree completely. You’ve made a very compelling argument. Until health insurance is delinked from employment there is little hope to have a real market in health care.

So what you’re saying is that half of us should be driving Cadillacs?

The good news is that the Cadillac tax starts at $27,500

for a family

The bad news is there is no Cadillac tax at $27,499

I wonder if employers and employees are spending one third of medical expenses for retirement?

Don Levit

Of course it should be repealed! Another anomaly is that in high cos areas (NY, San francisco) you will have a choice of paying the penalty or the Cadillac tax. The minimum value insurance (at 60%) cost will exceed the $ for the Cadillac tax – so every plan, even the minimalistic plans – will be taxed. That’s totally absurd!

Are the Cadillac thresholds the total premium that the insurance company gets? If the cost is shared by the employer and employee will they also share the tax liability? Will the gov collect from both of them?

At minimum, any proceeds from the Cadillac tax should be earmarked toward a tax credit for individuals who don’t benefit from other tax breaks. There should be restrictions:

1. To qualify for a tax credit, coverage must at minimum meet same HIPAA Title 1 requirements as employer-sponsored insurance, including no underwriting, guaranteed issue subject to previous creditable coverage and other reasonable restrictions even if ACA is eventually repealed.

2. This tax credit could not be combined with other tax breaks, such as the employer exclusion, self employment deduction, or exchange subsidies.

Examples of coverage that would qualify for the credit: COBRA, HIPAA continuation coverage, exchange plans when the individual earns too much to qualify for other subsidies (obviously a graceful cut-over could be arranged).

If such a tax credit were large enough, there would be no need for an individual mandate or associated penalties, or a prohibition against underwritten health insurance (underwritten insurance wouldn’t qualify for the credit). Instead, the tax credit should provide most of the incentive needed for qualifying plans to survive.

The tax credit should not be so large as to disrupt employer-sponsored plans, although lower-income employees would likely move to after-tax arrangements.

The main rationale of the Cadillac tax is that rich employer plans give out rich payments to doctors and hospitals, which just encourages providers to set very high fee schedules that hurt all patients.

Kind of like when free agency came to baseball, and the highest-spending owners like George Steinbrenner were lambasted by the frugal owners for driving up salary levels.

There is some truth to this, but I wonder if you really need another complex and (probably) unenforced tax to change the dynamic. If a rich employer plan adopts reference pricing for scheduled care, and employees are driven by self interest to choose cheaper providers, this will probably do more to reduce medical inflation.

Bob I agree. Reference pricing would be a great way to hold costs down — as would selected contracting and domestic medical tourism. There are those that think it will require something as drastic as the Cadillac tax to prompt employer plans to begin using these tools, however. The tax exclusion for the average two-income, upper middle-class family is worth 40% to 45%. I find it no coincidence that the Cadillac tax is 40% of all cost beyond the threshold. It is basically a recognition that the tax exclusion should not be open ended. Because the Cadillac tax threshold only rises with inflation (not medical care CPI), over time it will be ratchet down the threshold to where most Americans with employer-sponsored coverage will reach the threshold.

The teacher’s union NEA commissioned the Milliman actuarial firm to study just which employers were most likely to face the Cadillac tax.

Milliman found that the two major factors were geography and networks. An employer in Boston or San Francisco was far more likely to face the tax than an employer in Iowa or West Virgina. The dominance of large health systems in a city was the other major factor.

Gender was another large factor. Heavily female plans in school districts and hospitals and government were more likely to face the tax.

Well, at least the ACA had the temerity to take on some Democratic constituencies with this particular tax.

Incidentally, I think that the tax applies to the total insurance spending of a corporation — both the employer and the employee share. So if the total insurance bill is $28,000, the tax applies even if the employee pays $6,000 of the total.

The tax does look at the total cost of the policy whether nominally paid by the employer or actually paid by the employee. However, the actual amount of the tax only applies to the cost of the policy above the threshold, not the total value. So, if the total cost of the policy exceeds the limit by $1,000, for example, the tax due would be $400.

What I find interesting (and I assume no coincidence) is that under your scenario, the amount of tax exclusion on the $1,000 portion that exceeds the threshold is something like $400 to $450 (i.e. 40% to 45% of the value). That’s why I believe the Cadillac tax is merely a way to cap the open-ended tax exclusion for employer-sponsored health insurance.

I always believed that was the case as well. But I vaguely remember the Cadillac tax proceeds were ostensibly intended to offset the cost of some component or other of the ACA. Does anyone remember which program it was intended to finance? Or is my memory faulty, and there was never a rationale given other than to offset overall costs?

I think it was at least partly about finding revenue sources that could keep the cost of the ACA to less than $1 trillion over 10 years as scored by the CBO. The other stuff helped to rationalize and sell the Cadillac tax provision politically.

Devon is correct that the Cadillac tax is intended to limit the open-ended exlusion of employer benefits from taxation.

But what a convoluted, delayed-action, timid step this is.

We could have passed a one-page bill which said that any employer payment for health insurance that exceeds $10,000 a year per person is taxable as ordinary income to the employee.

The great majority of persons who get that kind of benefit from their employer are solid middle or upper middle class. They will not be murdered by some extra taxable income.

There could be some kind of reduced tax if a lower-income

person finds themselves in this category.

I spend part of each working day quoting group insurance for small and medium sized businesses. I have never seen a plan costing over $10K per person. That I assume is because I am in the Midwest, and I do not work on state govt or university or big union plans.

Per capital Medicare spending is also lower in the Upper Midwest than in many other places including the NYC metro area, Southern FL, much of TX, CA, Southeastern MA and the Chicago metro area. Part of the reason is that physician practice patterns are more conservative there than in many other places. That presumably spills over into commercial insurance premiums as well.