The Cost of Over Insurance: National Health Expenditures Rising Again

(A version of this Health Alert was published by Forbes.)

Actuaries at the Centers for Medicare & Medicaid Services, the government agency that runs those programs, have released their estimates of national health spending for 2014 through 2024:

Health spending growth in the United States is projected to average 5.8 percent for 2014–24, reflecting the Affordable Care Act’s coverage expansions, faster economic growth, and population aging. Recent historically low growth rates in the use of medical goods and services, as well as medical prices, are expected to gradually increase.

The health share of US gross domestic product is projected to rise from 17.4 percent in 2013 to 19.6 percent in 2024.

It is a little too easy to say that this outbreak of higher health spending is just due to Obamacare. To be sure, Obamacare has increased health spending with only marginal improvement in access to care. However, the population is aging, too; and the actuaries also take account the positive relationship between economic growth and health spending. The actuaries expect the economy to be relatively strong over the next decade, and estimate the rate of growth of health spending will exceed the rate of growth of Gross Domestic Product by only 1.1 percent. This is less excessive than in most recent decades. Yet, it is still excessive, and a change for the worse.

One reason is “over insurance.” American patients still do not control enough of our health spending directly to have an impact on national health expenditures. You do not have to go far to find higher deductibles and co-pays identified as an important factor controlling health spending over the last few years. There is evidence that allowing patients to control more health dollars directly reduces costs and does not harm most patients. Further, Americans are increasingly accustomed to using tools that make such spending tax-advantaged, such as Health Savings Accounts, Health Reimbursement Arrangements, and Flexible Spending Accounts.

This has led to increased adoption of consumer-driven plans in the employer-based market. A 2014 survey by Mercer, a firm of consulting actuaries, declared “Modest health benefit cost growth continues as consumerism kicks into high gear.” The survey found average found enrollment in high-deductible, consumer-directed health plans had reached 23 percent of all covered employees in 2013; and that nearly half of large employers offered a consumer-driven health plan. Remarkably, plans that are eligible to be paired with Health Savings Accounts are widely available in Obamacare’s exchanges.

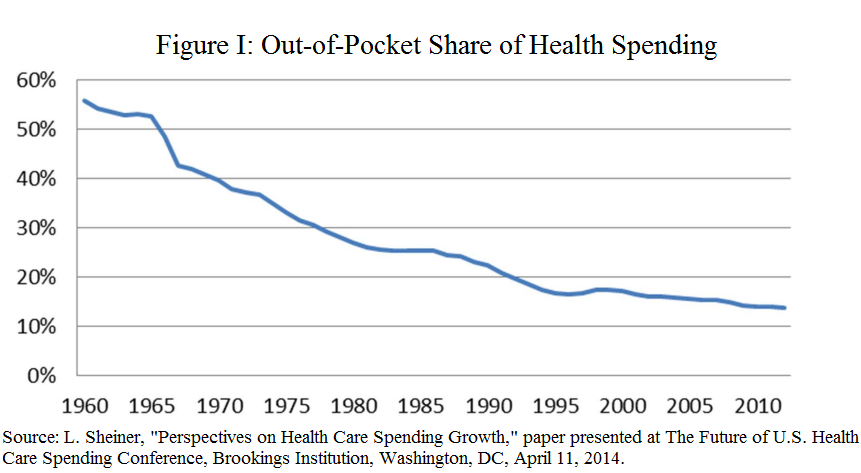

However, despite their successes, consumer-driven plans have not increased the share of health spending controlled directly by patients. Nor will they in the next decade, according to the actuaries. U.S. health care will continue to suffer from a crisis over insurance. As shown in Figure I (from Louise Sheiner of the Brookings Institution), out-of-pocket spending as a share of health spending declined from well over 50 percent in 1960 down to below 20 percent by 1990 and has kept dropping since.

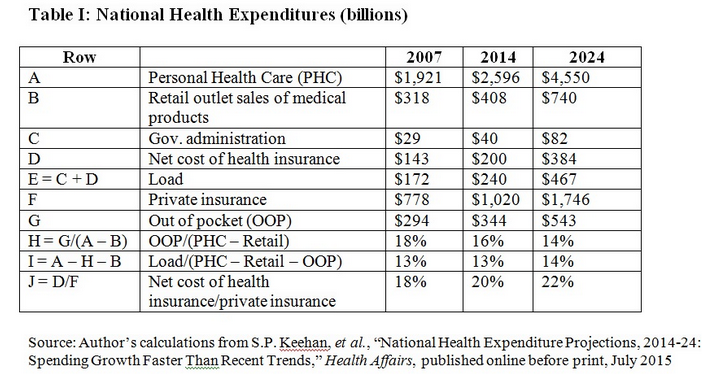

Table I shows a number of figures and calculations from the actuaries’ report. “Personal health care” is a subset of national health spending, comprising the dollars received by actual providers of medical goods and services. “Retail outlet sales of medical products” is highlighted because these are items which we do not expect will be covered by health insurance. More importantly, we do not expect their prices to be fixed by government or health insurers. “Government administration” and “net cost of health insurance” comprise money that does not flow through to providers. I refer to the sum of both of them as “load.” Table 1 also shows the amount of health care dollars spent by health insurers and patients directly (out-of-pocket).

Out-of-pocket spending as a share of personal health care (net of retail sales) dropped from 18 percent in 2007 to 16 percent in 2014, and will continue down to 14 percent in 2024. The administrative burden of over insurance by government and private insurers also increases. This is the added cost due to having claims processed by an administrative bureaucracy that stands between the patient and the provider. Overall, the load as a share of personal health care (net of out-of-of pocket spending and retail sales) rises from 13 percent to 14 percent over the years. For private insurance alone, the net cost of health insurance rose from 18 percent of insurers’ payments to providers in 2007 to 20 percent in 2014, and will rise to 22 percent in 2024.

As long as patients continue to lose control of their health dollars to third-party bureaucracies, American health care will be plagued with inefficiency, inability to change, and rising costs.

Something does not track here.

If 23% of those in employer plans now have a high deductible, that amounts to many millions of persons.

Plus, the 7-10 million persons in the individual ACA market have in most cases high deductible plans.

Yet you say that health expenses are growing…….

I am tempted to ask, what more can we do?

Maybe these are some factors to consider:

a. high deductible plans reduce the amounts spent on primary care, but hospital care costs more and more;

b. maybe the formula of higher deductibles to lower spending is flawed in some deep way.

Just curious.

A lot more. Please see http://healthblog.ncpathinktank.org/moving-beyond-the-heliocentric-doctrine-of-health-insurance/.

Just to expand on my second point above…..

maybe having ‘skin in the game’ does not control health costs.

Dr Don McCanne makes strong comments on this in the PNHP blog

http://pnhp.org/blog/

see the article by Krugman on dentistry, and McCanne follow up

Prof. Krugman’s article is (as usual) awful. However, the Washington Post WonkBlog article to which it refers is (as usual) very good.

WRT to dentistry: Licensure of dentists and the subservience of hygienists to dentists is one cause of high costs.

WRT to dental insurance: It is the worst type of insurance possible! It “covers” routine care and not catastrophic care. I expect that this type of dental insurance is a legacy of benefits before Flexible Spending Arrangements, Health Reimbursement Arrangements, and Health Savings Accounts. I expect it will wither away in years to come.

WRT to dentists’ incomes: I wonder how much is cosmetic? Unlike doctors, dentists do both and I certainly see dentists advertising cosmetic services. Until we know how much income is from cosmetic versus dentally necessary services, we cannot really say much about the lessons of their profession for medicine.