Tim Kane Critiques the Obama Presidency

Here is the scorecard on Obama’s fiscal promises, according to the CBO: the deficit in 2008 was 0.5 trillion dollars. Federal outlays were 2.98 trillion dollars. Since then, the U.S. government has run deficits of 1.4, 1.3, 1.3, and a projected 1.17 trillion dollars during these last four years…with outlays of 3.5, 3.5, 3.6 and a projected 3.4 trillion dollars (through 11 months of the 2012 fiscal year)…

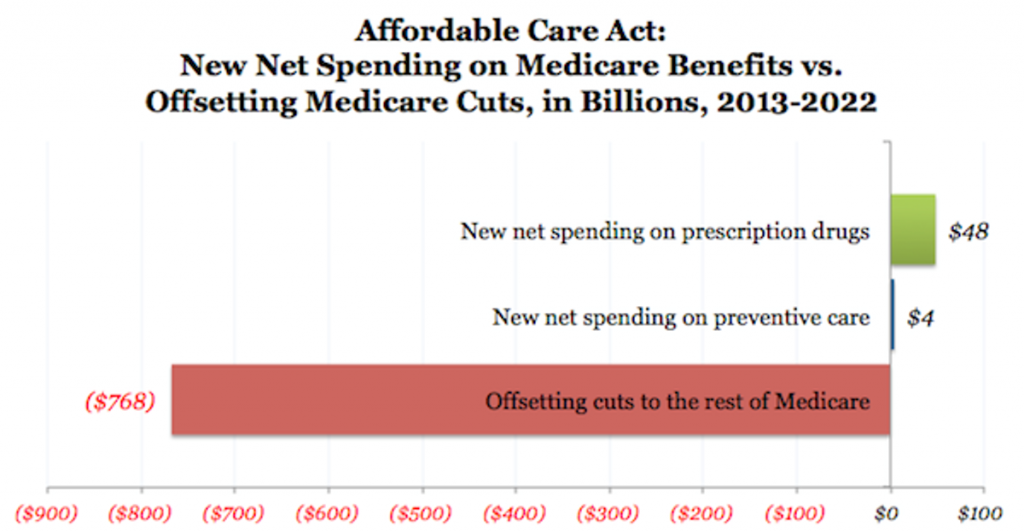

Instead of cutting the deficit in half, Obama has tripled it. Instead of controlling spending, he’s raised outlays by half a trillion dollars a year, which will get much bigger when the health care law takes effect. Instead of a temporary stimulus to bridge the nation back to full GDP, we have a permanently stimulated federal government and zero recovery.

It is entirely understandable that the deficit was not fixed in the first year that Obama was in the White House, the second year, the third year, and even the fourth year. What is not understandable is the absence of any coherent long-term plan, partisan or bi-partisan, to address the issue. What America got instead was another blue-ribbon commission (Simpson-Bowles) that was ignored before the ink on its final report was dry.

Entire post by Tim Kane in the Balance blog.