HSA Update: Assets Up 25 Percent to $24 Billion

Key findings from the 2014 Year-End Devenir HSA Research Report, which reports on Health Savings Accounts:

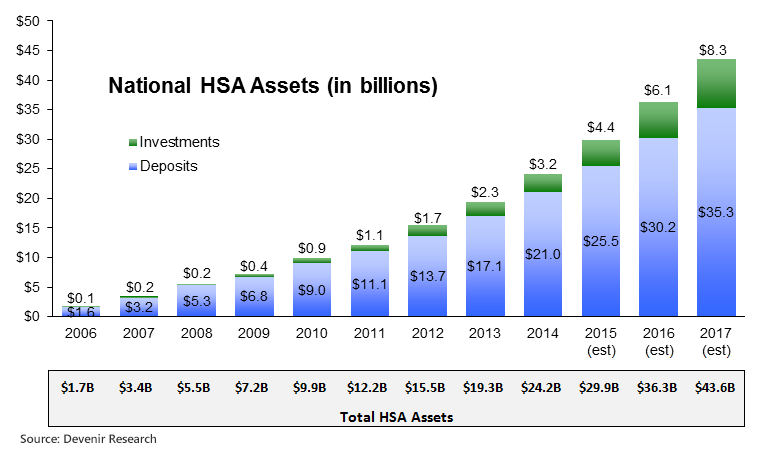

- HSA accounts approach 14 million. HSA accounts rose to 13.8 million, holding over $24 billion, a year over year increase of 25% for HSA assets and 29% for accounts for the period of December 31st, 2013 to December 31st, 2014.

- Health plans drive growth. During 2014, health plans were the leading driver of new account growth, accounting for 35% of new accounts.

- Continued strong market fuels HSA investment growth. HSA investment assets reached an estimated $3.2 billion in December, up 40% year over year. The average investment account holder has a $12,995 average total balance (deposit and investment account).

- Investors show solid returns. Investors achieved an average annualized return of 12.5% on their HSA investments over the last 3 years.

- HSA assets exceed $27 billion January 2015. The 2015 January HSA Supplement Survey found that HSAs grew to over $27 billion in assets by the end of January, 2015.

The finding that I find most interesting is that “health plans were the leading driver of account growth”. This must mean that health plans are partnering with banks to offer HSAs in a bundle to their group accounts. Ten years ago, when HSAs started, I was interested to see whether banks would offer HSAs through the retail or institutional channel. I was hoping that they would be opened via the retail channel, but that has not happened outside a few banks. (I challenge you to walk into your bank branch and ask an employee to open an HSA for you.)

The survey does not report how much employers deposit into employees’ HSAs but I’d bet it is pretty widespread practice. I doubt it would be attractive for a bank to offer an HSA product through the group market unless employers kept the balances topped up.

“I was hoping that they would be opened via the retail channel, but that has not happened outside a few banks.”

If HSAs were made widely available through retail banking channels, what level of impact do you predict it would have on account growth?

I think the fact that they are not tells us what we need to know. The HSA itself is likely unprofitable for a bank. The HSA-holder also has a checking account and a savings account, so there are no opportunities for cross-selling that don’t already exist.

$24 billion seems like a lot of money for banks to ignore. Since HSA funds are investible within the account (while bank checking and savings typically are not), why isn’t this a BETTER cross-selling opportunity than what presently exists via those two standard types of bank accounts?

Many banks have proprietary or affiliated mutual funds that would seem ideal for this purpose. No? What am I missing?

Well, my poorly educated opinion is that people who have an HSA already have a checking account. So, the bank already has the opportunity to sell a mortgage, asset management, etc.

Yah, I see that. I may not have explained myself very well. See if this makes any more sense, limiting it to consideration of cross-selling bank-sponsored mutual funds.

My thinking is that, while a checking account is most often used for cash flow (wages paid in; household, auto, etc., expenses paid out), HSA accounts are used for tax-advantaged longer-term saving in addition to paying current medical expenses. (Esp. with the yearly carry over.)

And, so long as an HSA holder is putting money aside and [hopefully] building his principal over time, I suspect that he may be MORE susceptible than a checking acct. holder to a sales pitch for investing some portion of his HSA funds in, say, bank-sponsored mutual funds. Because he’s already proven that he’s financially prudent and a saver.

I’m looking at it as which holder type may be more receptive to a pitch for his savings to earn a bit more than otherwise. A checking holder would have to change his financial habits to make room for some savings to invest.

Anyways, nobody’s earning much of anything these days, so it’s probably moot at best…. Thx for reading and responding!

Thank you and that is good insight. However, the HSA custodians in the retail market are usually banks without the capacity you describe. For example, HSA Bank in Sheboygan, WI has a deal with TD Ameritrade. Once you have $5,000 in the account, you can open an account with TD Ameritrade. However, TD Ameritrade is not an HSA custodian. So, you can only get to TD Ameritrade through HSA Bank, which adds an extra administrative fee.

It invites another question: Why haven’t TD Ameritrade, Fidelity, Schwab, E*Trade, etc. set themselves up as HSA custodians and use their money-market funds as the entry-level asset? They are very retail-oriented operations. You would think they could make money out of it.

Whoa! $24 billion? That’s enough to pay for an appendectomy and two hip replacements at today’s prices!