HSA Update: Assets in Health Savings Accounts Almost $23 Billion in June

Key findings from the Midyear Devenir HSA Research Report:

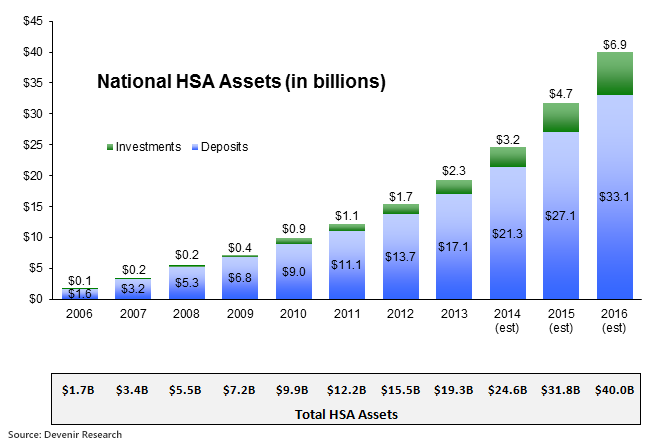

- HSA assets almost reach $23 billion. HSA accounts rose to 11.8 million, holding assets totaling over $22.8 billion, a year over year increase of 26% for HSA assets and 29% for accounts for the period of June 30th, 2013 to June 30th, 2014.

- Health plans drive growth. In the first half of 2014, health plans were the leading driver of new account growth, accounting for 31% of new accounts.

- Continued strong stock market bolsters HSA investments. HSA investment assets almost reached an estimated $2.9 billion in June, up 45% year over year. The average investment account holder has a $12,473 average total balance (deposit and investment account).

- Investors show solid returns. Investors achieved a 10.6% return on a 5 year basis.

The good news is $23 billion is socked away in HSAs. The bad news, that only equates to about $1,500 per person. Since the average investment account is $12,000, and I have more than double that amount in my HSA, that suggests there are many people not really taking advantage of the opportunity to save tax free. The purpose of an HSA should be to take on the small health risks (i.e. medical bills under a high-deductible insurance plan) and put the premium savings in an HSA to accumulate.

I think that is why the administrative costs of HSAs are so high. Most people have to pay monthly maintenance fees of $2-$3.

I never did take in to account the maintenance fees and high administration costs. Thank you for pointing that out.

“The bad news, that only equates to about $1,500 per person.”

This is underwhelming, but if more people are participating in an HSA and continue to see and learn about the benefits of putting more money in an HSA and having lower premium health insurance.

Devon

Thanks for making the figure more real for the average account

Another purpose the HSA provides is the ability to increase the deductible knowing the deductible is fully covered

Unfortunately you cannot increase the deductible to $25,000 and save about 60 percent off the premium

The law allows the deductible to be half that amount even though your HSA has twice that amount

If you had Health Matching Insurance of $25,000 you could increase your deductible to $25,000

In addition you reach the amount faster for we are providing a portion of our reserves for your account and not the profit off of our investments

Don Levit

Treasurer of National Prosperity Life and Health

Creator of Health Matching Insurance

This shows positive signs that HSAs are growing and should continue to grow. The more people are using HSAs, the better off they will be to combat high healthcare costs.

Hopefully this is an indicator that HSAs will become a dominant form of investment and payment in healthcare costs.

HSA Bank holds 10% of all HSA balances. They had their $2 Billion Party sometime ago.

With a small balance the tax-free HSA is free and has investment options with the very 1st dollar.

I met the head MSA Bank guy there when I went to the 1st National MSA Salesperson convention in 1999. I left when Greg Scanlen told everybody that the big thing is HRAs not MSAs. The MSA/HSA Bank guy and I just looked at each other and rolled our eyes.

Scanlen also said that because of HIPPA uninsurables in Florida had no problem getting health insurance.