Why Reformers Love Misery

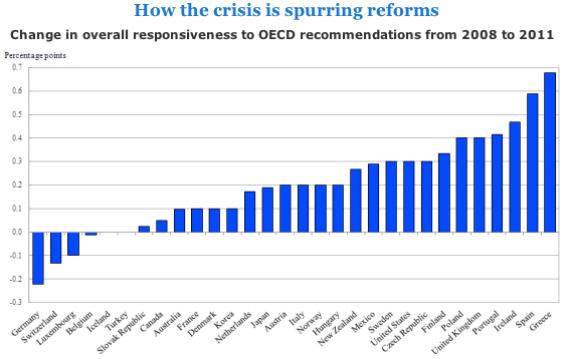

The OECD report assesses and compares progress that countries have made on structural reforms since the start of the crisis, covering the 2007-11 period. It shows that the pace of reform has accelerated where it is needed most – in the European countries hardest hit by the sovereign debt crisis, including Greece, Ireland, Portugal and most recently, Spain and Italy.

Full article by OECD on countries going for growth.

Fascinating chart.

When investigators began inspecting some of these countries’ books, they discovered the debt was far above reported levels. One factor is unfunded liabilities. But there were also cases of vendors that supplied goods knowing they would not be paid for months and months. Some of the earlier efforts to avert the crisis involved offers to lease state assets to private companies for cash now at the expense of revenue in the future.

Germany is labeled as the incorrigible big brother of Europe by the chart, but hasn’t its leadership been more amenable to resolving the debt crisis than that of France? Why did Germany garner such a poor rating?

Interesting. From what you read in the papers one would think that there has been no change from 2007. Sure it took a lot of pain to cause the reforms, but hopefully the international financial system will be stronger as a result.

At some point, most of these countries will have to enact dramatic reforms, but even that may not be enough to save Europe.