The Affordable Care Act Not so Affordable for Families or Taxpayers

The Affordable Care Act will provide generous subsidizes to Americans who lack access to affordable health coverage. Yet, advocates for the poor fear many families won’t qualify for subsidies even if they cannot afford their employee health plan. The Hill explains:

At issue is a so-called “firewall” in the law that denies subsidies to workers whose employers offer quality, affordable coverage.

The firewall applies to plans with premiums that cost less than 9.5 percent of a worker’s income. If a worker has to dole out more than that amount to buy coverage, the employer coverage is considered unaffordable and the worker is eligible for subsidies to buy coverage on the new exchanges.

But in calculating the bill’s cost last year, Congress’s Joint Committee on Taxation (JCT) took the law to mean that employers and their families aren’t eligible for subsidies as long as the individual plan is affordable — regardless of the price of the family plan.

The fix would seem simple: modify the regulations to allow families to qualify for subsidized coverage in the health insurance exchange if family premiums for the employee health plan consume more than 9.5% of family income. But that creates another problem. If the program is made too flexible, employers (and workers) might game the system to maximize the subsidies available to workers. Employers could adjust the ratio of individual premiums to family premiums in such a way to help workers qualify for more generous taxpayer subsidies.

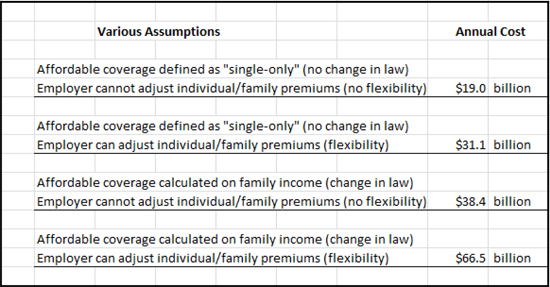

The Employment Policy Institute calculated the cost of changing the law under different assumptions. They calculated the cost if firms had little flexibility to adjust workers’ premiums so workers would qualify for taxpayer subsidies. They also calculated what might happen if employers had broad flexibility to game the system by adjusting workers’ family plan premiums. It concluded the cost of changing the law could reach $50 billion dollars a year or more if employers could game the system to make lower-income workers qualified for taxpayer subsidies.

The entire sytem of tax subsidies in the bill is completely screwed up. I don’t know anybody who defends it.

The subsidies in the exchange will be much larger than a moderate-income family would get in tax subsidy for an employee health plan. Employers will naturally try to maximize the taxpayer subsidy to make their workers better off. The estimated $66.5 billion annually cost of exchange subsidies is probably too low.

This is a disaster.

So, Obamacare doesn’t reduce the cost of health insurance by $2,500 per family per year?

http://www.youtube.com/watch?v=0yRc1GR9nO0

Great post, Devon.