Can Employers Pay Workers to go Into the Exchange?

Put yourself in the position of an employer that’s looking to save money on the health coverage you offer your workers. Wouldn’t it be great if your costliest employees declined that coverage and instead bought insurance on an exchange?

Put yourself in the position of an employer that’s looking to save money on the health coverage you offer your workers. Wouldn’t it be great if your costliest employees declined that coverage and instead bought insurance on an exchange?

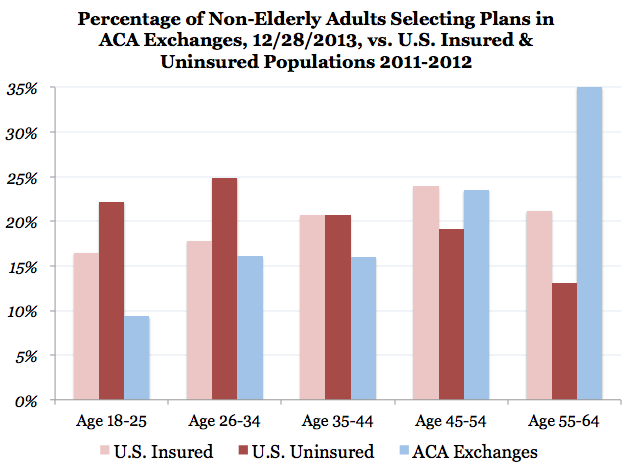

Heck, you’d be willing to pay your sickest employees to refuse coverage. On average, your share of a family’s health plan comes to almost $12,000. Your costliest employees are even more expensive to cover. What if you offered those employees a $6,000 bump in wages if they declined coverage? You’d still come out ahead — and, now that the ACA is up and running, your employees might be better off, too. They could buy comparable health insurance through an exchange and, if the tax credits are rich enough, even pocket some of the $6,000. You win, your employees win. Only the federal government, which pays for the tax credits, loses.