Congress has given up on repealing the Sustainable Growth Rate (SGR) as a way to pay physicians under Medicare. This blog has previously written about the futility of politicians’ efforts to “fix” the way they pay physicians (especially here, here and here).

Congress has given up on repealing the Sustainable Growth Rate (SGR) as a way to pay physicians under Medicare. This blog has previously written about the futility of politicians’ efforts to “fix” the way they pay physicians (especially here, here and here).

The one they just passed last week runs for a year. And, just as always, these politicians who are elected for two-year to six-year terms voted to massively increase spending today, in exchange for draconian cuts a decade hence.

According to the Congressional Budget Office’s score of the bill, it increases Medicare’s physician payments by $15.8 billion over ten years. However, $11.2 billion (71 percent) is spent by 2015, and $13.3 billion (84 percent) is spent by 2016.

The savings to pay for this? Those come later, much later: Savings don’t become greater than spending until 2020, and not significant until 2024 — the last year of the mandated scoring “window“, when the law is supposed to claw back $9.3 billion from hospitals and re-impose the sequester on Medicare.

Good luck with that. Congress continues to make a mockery of Medicare-physician payment reform.

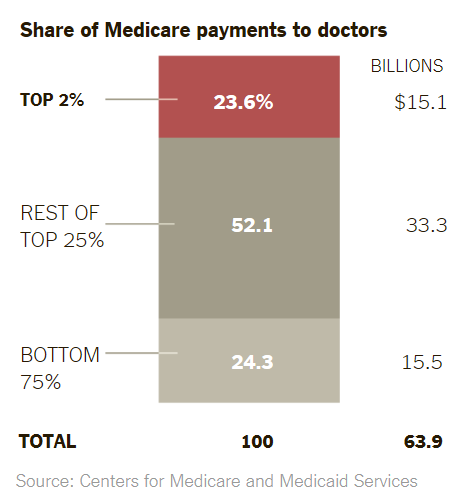

Doctors reacted swiftly and indignantly to Wednesday’s release of government records revealing unprecedented details about Medicare payments to physicians…The top 10 doctors alone received a combined $121.4 million for Medicare Part B payments in 2012…In interviews, many of the doctors said they were just passing through the payment to drug companies. Some said they were unfairly singled out even though they were billing for an entire practice. And still others disputed the accuracy of Medicare data. (Washington Post)

Doctors reacted swiftly and indignantly to Wednesday’s release of government records revealing unprecedented details about Medicare payments to physicians…The top 10 doctors alone received a combined $121.4 million for Medicare Part B payments in 2012…In interviews, many of the doctors said they were just passing through the payment to drug companies. Some said they were unfairly singled out even though they were billing for an entire practice. And still others disputed the accuracy of Medicare data. (Washington Post)