Strange Bedfellows Defending Obamacare

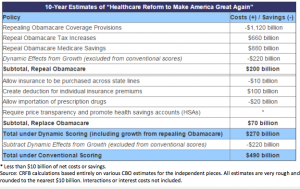

The primary component of GOP presidential candidates’ health policy proposals is to repeal Obamacare. Once GOP frontrunner Trump released his plan, the Committee for a Responsible Federal Budget took notice and performed an analysis of the likely fiscal effects from Trump’s plan. Presumably, these fiscal effects would also apply to the other Republican candidates who support repealing Obamacare as well.

The Committee for a Responsible Federal Budget (CRFB) is a budget watchdog that began 35 years ago. For the past few years it has been housed with the neo-Democratic think tank, New America. The two organizations parted ways over the former’s campaign to balance the federal budget partly by cutting social programs. The CRFB is truly a bipartisan organization, with both Democrats and Republicans as members, supporters and staffers. It is mostly known for its support of a “Grand Bargain,” encouraging Democrats to cut entitlements in return for Republicans ending some tax breaks and raising taxes.

The CRFB analysis argues repealing Obamacare in general — and Trump’s Plan in particular — would increase the federal deficit. Although the CRFB does some great work, its analysis is wrongheaded in this case. The group correctly concludes repealing Obamacare’s coverage provisions (the subsidies for exchange coverage and Medicaid expansion) would save taxpayers’ significant amounts — about $1.1 trillion over a decade. Its dynamic scoring model even suggests doing so would boost economic growth over a 10-year period by more than $200 billion. The primary reason why the budget watchdog believes repealing Obamacare will boost the debt is due to repealing the Obamacare taxes and repealing the Obamacare cuts to Medicare.

First of all, taxes on health care raises the cost of health care. There are something like 19 different tax hikes enacted by the Affordable Care Act (ACA). There are taxes on drugs, taxes on medical devices and taxes on insurance premiums. There’s a Cadillac Tax on high-cost health plans and a prohibition on using flexible spending accounts (FSAs) and health savings accounts (HSAs) to purchase over-the-counter drugs. There’s also a payroll tax on high-income individuals. By raising the cost of health care, consumers and taxpayers ultimately bear the higher costs.

In addition, these taxes were intended to offset the cost of Obamacare’s coverage provisions by clawing back some of the additional profit the medical industry presumably would earn from the expansion of health coverage. With Obamacare’s coverage provisions gone, there’s little excuse for these taxes to remain.

Finally, CFRB estimates repealing the ACA’s cuts to the Medicare program would save nearly $1 trillion ($880 billion) over 10 years. The problem with this estimate is: most of the cuts have not taken place and are unlikely to, according to the Office of the Actuary for Medicare. Cutting Medicare in this manner would likely reduce seniors’ access to care — which is why most health policy analysts believe the cuts unlikely. Indeed, the Independent Payment Advisory Board, that was granted the power and responsibility to cut Medicare spending if expenditures breach a predetermined growth threshold, has not seated a single board member in the six years since the ACA was signed into law. Cuts to the Medicare Advantage (MA) program have been far smaller than the ACA called for mainly because MA plans are popular with low-to-moderate income seniors.

Conservatives have always believed the proponents’ estimates of the cost of Obamacare are disingenuous precisely because the cuts to Medicare are not likely to take place. Likewise, arguing that repealing Obamacare would add $880 billion to the deficit over the following 10 years (by repealing Medicare cuts that are never likely to take place) is equally disingenuous.

The CFRB estimates the Trump specific provisions — purchasing insurance across state lines, making individual coverage tax deductible, importing prescription drugs and requiring transparency and boosting HSAs would cost taxpayers $70 billion over 10 years. This is primarily due to the cost of making individual coverage tax deductible.

It’s foolhardy to disagree with this assessment. Extending the tax exclusion to individual health insurance is something that many policy analysts worry will add to health care inflation and further erode the tax base. However, the tax exclusion for employer coverage (absent the Cadillac Tax) is open-ended. The employer tax exclusion causes people to purchase more insurance than they otherwise would purchase. When individuals purchase their own coverage directly, they tend to economize and select higher deductibles than are the norm in employer plans. This is even true of the self-employed who can deduct the cost of health coverage off their taxes. People with less generous coverage consume less health care.

If nothing else, repealing Obamacare with its costly coverage provisions — including massive open-ended subsidies and abled-bodied adults added to Medicaid — would be a symbolic gesture that the welfare state is being corralled. Furthermore, the cost of Obamacare’s coverage provisions will rise over time. A truly responsible federal budget should repeal the most recent entitlement added to the welfare state.

—A truly responsible federal budget should repeal the most recent entitlement added to the welfare state.—

Lets don’t stop there. Social Security and Medicare discriminate against black males who have the shortest lifespans between the races and genders. Black males pay high entitlement taxes their whole lives then die before they get their 1st payments and all of their money goes to old white women instead of their children. It’s like slavery.

That’s why white women will vote for Hillary to prolong their plantation and keep the black man a slave to the government, their Master.

I think I’ve had enough of this stereotypical victimization(Stop smokin’ your menthol cigs and swillin’ gin an’ smokin’ crack). Let me buy health insurance that I want. (Look at laser eye surgery, which is not covered by insurance; the cost has decreased because of competition.) Duh! Can’t you let the market work without inserting crony preference rules?

I think it’s interesting to note that Medicare spending has grown significantly more slowly since 2009 than most experts expected. In 2009, the CBO estimated that by 2015, Medicare spending net of beneficiary premiums and other offsetting receipts would be 3.6% of GDP. The actual number came in at 3.0% of GDP or about $125 billion lower than its 2009 estimate. That’s a big deal, in my opinion.

It’s also worth noting that total federal spending, including ACA related spending, was 20.7% of GDP in fiscal 2015 vs. federal revenue of 18.2% of GDP resulting in a deficit of 2.5% of GDP. By contrast, federal spending was 21.0% of GDP or more for seven of the eight years of Ronald Reagan’s presidency.

In short, the ACA isn’t killing us and millions of people who didn’t have health insurance before have it now. The ACA certainly has plenty of room for improvement but I haven’t been very impressed with anything coming from the Republican side so far. They’ll have to do a lot better than letting people buy health insurance across state lines and making it tax deductible for those who buy their coverage in the individual insurance market.

Barry, you say, “They’ll have to do a lot better than letting people buy health insurance across state lines and making it tax deductible for those who buy their coverage in the individual insurance market.”

YOU have NEVER paid for your health insurance with after tax dollars for your whole life and letting other people have what you have always enjoyed is not important to you.

That’s creepy and selfish Barry!

Ron – My wife and I spend a lot for Medicare Part B and Part D premiums, our supplemental plan and the IRMAA surcharge. The total for 2015 was over $12K and for 2016, it’s over $15K. It will be even more next year. All of it is after tax dollars. On top of that, our long term care insurance premium was over $5K last year and will approach $6K this year, also all after tax dollars. I would hardly call that selfish.

As for making individual insurance premiums tax deductible, even though it further erodes the tax base, I don’t really care because it’s not a huge sum in the scheme of things. Before the ACA, no more than 20 million people bought their insurance in the individual market. Total premiums were probably no more than $60-$70 billion. Given the demographic profile of that population, forgone revenue probably wouldn’t exceed $15 billion per year if the premiums were deductible. My main point though is that even with tax deductibility, it wouldn’t shrink the number of uninsured people anywhere near as much as the ACA did and the people who need insurance the most would still be out of luck if we went back to medical underwriting.

Let me add to yesterday’s comment Barry’s statement about the ACA shrinking the uninsured.

http://kff.org/uninsured/fact-sheet/key-facts-about-the-uninsured-population/

You have been saying that for a long time. When we actually look at the numbers we see a good portion of that is the number of people placed on Medicaid something we didn’t need the ACA for. Another large portion have their premiums paid for almost entirely. Still another large portion that were considered insured dropped out.

The uninsured among the elderly in 2,000 was 16.8

The uninsured among the elderly in 2,013 was 16.9

This is not what I would call progress due to a new healthcare program rather a total failure where the people have rejected the program.

“The uninsured among the elderly in 2,000 was 16.8

The uninsured among the elderly in 2,013 was 16.9”

Of course, both the exchanges and the Medicaid expansion program didn’t start up until the start of calendar 2014.

Another example of trying to use data to mislead people about the ACA and its impact on the number of uninsured. The current uninsured percentage is closer to 10% and that includes the 11 million illegal immigrants.

(Correction: Should be non elderly above.)

AS far as misleading, where did you get that idea? Those are true statistics and reveal exactly what is going on.

The ACA did nothing to reduce the number of uninsured until they placed people on Medicaid or gave subsidies. Both of those things could have been done without the ACA.

Additionally we are seeing more statistics. 25% of those on the exchanges today dropped their insurance. That is a pretty big number and again demonstrates that the ACA is a failure.

Add to all that the increased premiums and deductibles making the ACA cost even more. Then look at the narrow networks that reduce access. With all these facts and statistics I don’t know how anyone can claim the ACA is a good program.

Barry, you say, “The total for 2015 was over $12K and for 2016, it’s over $15K.”

YOU have a ZERO deductible that pays 100% for $1,250 a month and YOU and your wife are over 70 years old. [[That is dirt cheap Barry.]] A younger couple on Obamacare will pay more with a $13,700 Out-Of-Pocket annually and next year this increases to $14,300.

PLUS, the younger couple is paying these sky high Obamacare premiums with after tax dollars and YOU NEVER paid taxes on your health insurance at your employer.

Barry, admit it, Obamacare is a nightmare that picks winners and losers. YOU say forget about the people on Individual Medical (IM) because it would cost additional tax dollars that we don’t have. Trust me, we don’t have the tax dollars to pay for your Medicare either. We are making the unborn pay for you and your wife.

YOU and your wife should probably be paying $2,500 a month with a $10,000 per person deductible if you were pulling your own weight at your age living in your expensive zip code.

The young couple on Obamacare will pay little or nothing for their healthcare as opposed to their health insurance premium if they are basically healthy. Even someone who has some health issues won’t pay that high deductible every year and won’t pay anything close to it in most years.

For the record, I paid over $210,000 in Medicare taxes over the course of my career including the employer share which was part of my compensation. I think I’ve more than paid my way when it comes to Medicare.

Barry, what are you talking about? You say healthy people won’t pay their deductible, that means nothing to someone with a $38,000 kidney stone, like the woman I just talked to. Your argument is meaningless.

You didn’t pay taxes on your health insurance which would have been more than your Medicare payments so you are still one of the lucky ones under the tax code.

I just find it creepy that you don’t care if people have to purchase Individual Medical (IM) with after tax dollars when you admit that you used the tax dodge of employer-based insurance your entire life.

Your wife could easily use your entire $210,000 in Medicare taxes in one year and the taxpayers could pay millions and millions more if your wife lives another 25 years. It’s not fair that you figured out how to suck out so much from the taxpayers yet you don’t care about younger people buying their insurance with after tax dollars in addition to paying Medicare taxes for your wife. I know you think you have already paid your share but you should be realistic about strapping America’s young people and unborn with your wife’s medical expenses.

Ron — I always supported getting rid of the employer tax preference even when I was working and doing so would have cost our family several thousand per year in incremental taxes. We’re not getting rid of it because the special interests, especially the unions, have enough political power to ensure that we keep it.

If you think it would be so wonderful for people who buy IM coverage to have a tax deduction, it’s fine by me even though it erodes the tax base but I don’t care one way or the other. That means I wouldn’t oppose it but I wouldn’t work to pass it either.

What I do find strange when it comes to health insurance is that there seems to be a perception that if you don’t incur more in medical claims than you paid for your insurance premium, you were ripped off and should have been allowed to just deposit your premium into a Health Savings Account. People don’t seem to have that attitude toward any other type of insurance. Why is that?

Barry, a tax free HSA is not insurance like you say. You have never heard me say to GAMBLE and not have health insurance.

Anybody who suggests to not have insurance is not playing with a full deck of cards.

So we agree on this point.

Barry, that’s an interesting point. In most other insurance markets your premium (at least as it was explained to use in grad school) is the sum of all probabilities times their expected costs, plus an administrative premium to reward the insurer for assembling the risk pool. Your premiums about equal your expected loss, plus a small risk premium (which is a small percentage of your premium).

For instance, my house may have a very small probability of burning to the ground, but a slightly higher probability of my grill damaging an exterior wall. The odds of hail damaging the shingles is much greater but the likely cost is easily calculated. There is an element of community rating but it’s a small portion of the premium. The risk of a break-in is considered, as is our security system. Even seemingly innocuous variables are used, like our credit scores since people with poor credit seem to file more claims. The maintenance cost is solely ours, but if we fail to perform upkeep our insurer can decline to underwrite our homeowner’s policy. The latest estimates to insure our home ranges from 0.0035 to 0.007 times its value. For an average of $100 per month my wife and I can have assurances we won’t suffer a financial lose – it’s easy to dismiss that cost as pure insurance. It’s just a small part of the cost of owning a house.

Other areas where I willingly have insurance: I only pay about $225 this year for coverage on my Harley. The cost has gone down every year since I’ve owned it. I pay for comprehensive coverage because someone could steal it and ride it off into the sunset. Comprehensive coverage on a Corvette, a Mercedes C230, a GMC Sierra 1500 and a Harley Sportster is slightly more than $2000 a year. That’s a fair amount of money, but it’s less than half what my health coverage will cost this year. Add in the cost of coverage for my wife and her Audi TT and about two-thirds to three-quarters of our insurance costs are for health coverage.

A portion of health coverage is prepaid medical care, while a huge portion is to pay exorbitant fees for people who don’t care what they spend (paid to inefficient providers who are not competing on price). Increasingly, deductibles are so high that the prepaid component is gone, but the cost for medical insurance is outrageous. It’s pretty hard not to look at the $10,000+ annual cost of insurance for my household and not feel like we’re taken for a ride. The sole consolation people often feel is when they have something happen they at least know they are getting something for the cost.

Barry, you say you paid $210,000 over your lifetime and you feel you have more than paid your costs. Assuming a 40% marginal tax rate (15+% FICA included) your actual payment was $126,000. Assuming a lifespan of 84 years you will have been on Medicare for 19 years. That makes your payment ~$6,631 per year for the most expensive years of your life. Compare what your deductible is to those that are below age 65 and have narrow networks.

I’d like you to explain to me using real numbers how you believe what you say to be true. Maybe it should be true and isn’t because of things like the ACA and so much government involvement.

Allan — Where do you get the 40% marginal tax rate from? Medicare taxes are not deductible and are part of my gross income on which federal and state income taxes are calculated. Besides, my family life expectancy is closer to 80 years.

Even using 84 years, $210K works out to a bit over $11K per year which is slightly less than Medicare’s gross spending per capita today a significant piece of which is offset by premiums I pay including the IRMAA surcharge. Moreover, my contribution toward the premium during my career allows zero for a return on investment that would have been earned if the money were invested. Bottom line: I’ve paid my share and then some which, by the way, most people can’t say. Remember that the Medicare tax applied to all wage income no matter how high starting in 1994 and I didn’t retire until the end of 2011.

“Allan — Where do you get the 40% marginal tax rate from?”

Should the number be higher?

Had your health insurance not been paid by your employer you would have paid for your health insurance with after tax dollars. I don’t have the slightest idea of how much you earned or the amount of money you paid or even if your calculation is correct (the income taxed for Medicare purposes used to be a limited portion of ones income). I do know you haven’t shown much concern for those that have to pay for their health insurance *after* taxes when you paid yours *before* taxes.

There is no way I can actually run the numbers of how much money you lost being self employed plus what that extra income would have generated so I took a potential tax rate and instead of asking personal questions and running questionable calculations I took the opportunity to tax the amount you said you paid so you could experience what a person paid that did not have the tax favoritism you experienced.

Thus today when you say you believe you have paid your fair share I was being generous to you in saying that the amount was only ~$6,631 per year.

Allan – How much more I would have spent for health insurance if my salary were increased by the amount my employer spent for insurance on my behalf and I then bought a similar (or different) policy with after tax dollars and how much I paid in Medicare taxes are two completely separate and different issues.

I know to the dollar what I paid in Medicare taxes because the Social Security Administration keeps track of it and reports it in its annual statement sent to each participant in the program. It reports how much the employee paid directly and how much the employer nominally paid which is part of each employee’s total compensation. My $210,000 includes both the employee and employer share and is, by the way, probably significantly more than most people paid over the course of their career.

I don’t have good data on the aggregate cost of insurance nominally paid by my various employers on my behalf. For about half of my career, I needed to cover three people and the other half I needed to cover two people. In the later years, I estimate my employer plan was probably worth about $15,000 gross or $13,500 net after my contribution toward the premium. The tax preference may have been worth in the range of 40% of that amount but I also may have chosen a higher deductible plan for a significantly lower premium.

To Ron’s point about Medicare being a Ponzi scheme, gross per capita Medicare spending, including beneficiary premiums, payments by the states for dual-eligible Part B premiums, and the IRMAA surcharge, is currently less than $12,000 per year and has only been growing at about 1% per year on average since 2009. Net Medicare spending after those payments is about 88% of that amount or $10,560. Based on average life expectancy at 65 of 19 years, $10,560 per capita spending today growing at 1% per year for 19 years implies $219,763 of average aggregate net spending for a beneficiary who lives 19 years. Some, of course, will die much sooner and others will live longer but that’s the average. Some will cost Medicare a lot more than that and some will cost much less. Average per capita spending is the relevant number in this context despite how much or how little might be spent on any specific person.

“are two completely separate and different issues.”

Barry, they are two different issues to you because you weren’t the one that didn’t get the tax benefits. Think of how this abuse hits young families where not only don’t they get a tax break, but they are forced to carry overly expensive insurance that subsidized your group just a few years ago. Today, it may not matter too much, but when you had young children and few resources those thousands of dollars meant a lot.

I didn’t say you didn’t pay $210,000. I said I didn’t know, but it is not a matter of how much we paid, rather how much our children and our children’s children are and will be paying. I want to stop the Ponzi scheme and change healthcare so that we attack the costs where they occur. In order to do that the patient must be involved. It doesn’t help to make the young pay more than insurance is worth for then they will never want to buy it and your only way for you to make them is to use force. That is what dictatorships do.

Barry, you say, “Based on average life expectancy at 65 of 19 years…”

You can’t use this average because black males don’t live as long as white females. YOU are not married to a black male Barry. Your wife and many white women will live to be 100 so the ponzi scheme of Medicare discriminates against against large populations in favor of your wife. It’s not fair and you and your wife should pay your fair share.

PLUS, you live in one of the most expensive zip codes in America for medical care so you should pay extra for that too.

Gee Ron, who made you god? What someone pays is really not your call. I really get a charge out of how you state “we don’t have the tax dollars to pay for your Medicare either. We are making the unborn pay for you and your wife.” You got a mouse in your pocket?

Why don’t you “go forth and multiply” by yourself. Incidentally, I am a justice of the peace, and would be happy to marry your parents, gratis, if you ever locate them.

Mitch, you say, “Incidentally, I am a justice of the peace, and would be happy to marry your parents, gratis, if you ever locate them.”

Barry wants to keep Obamacare and he doesn’t want people who purchase individual insurance to get the same tax breaks as employees get.

So Mitch, you and Barry love Socialized Medicine and Obamacare! But you also state, “Duh! Can’t you let the market work without inserting crony preference rules?

So Mitch you are confused, very confused.

Mitch, my parents are dead so it will be hard to get them married now.

Among other things that I won’t mention is the comment about spending during the Reagan administration. It is almost completely ridiculous to make such a statement. Firstly, the high spending rate was not something that was praised by fiscal conservatives. Secondly, Reagan ended the cold war without firing a shot. That by itself is worth the few extra percentage points, but additionally he had a long lasting effect on the economy where tremendous growth occurred during his and successive administrations.

We haven’t seen that happen under this administration who according to your comparison would be the equivalent of a Reagan administration in his successes. Reagan pushed us to be freer while this administration that you consider equivalent by your statement has made us less free and the world far more dangerous. The likelihood of economic success a la Reagan is very low and appears to await a leader that is more like Reagan and less like Obama and his ACA.

You write

“In 2009, the CBO estimated that by 2015, Medicare spending net of beneficiary premiums and other offsetting receipts would be 3.6% of GDP.”

Isn’t that just a matter of bad estimating? The growth rate has been headed lower since the 1997 Balanced Budget Act not counting the uptick for one year for Part D (not that I think any legislation has anything to do with the trend lines; it’s all demographics).

Why is it that the same number of people who did not have health insurance still don’t have insurance now ? Not he same people, granted, but it is still a considerable amount. Why don’t we make health insurance mandatory and anyone without health insurance subject to summary execution? How’s that for total control?

The number of people who are nominally insured has increased by 13 million to 18 million (depending on the time of year). About 5 million to 7 million are in Medicaid but have a hard time finding primary care providers who will treat them for the fees Medicaid pays. About 8 million to 11 million have exchange coverage. Many of them are in narrow networks, and have to pay for care out of pocket because their deductibles are so high. The ACA has increased coverage, but it has not increased access to care — except for the very sick.

I went to see my optometrist yesterday. He asked me what a health economist does on a daily basis so I explained what I do. He said his deductible is now $10,000 and the premium is around $900+ a month. (It wasn’t clear to me whether this was for him or him and his wife.)

It seems like everywhere I go it’s easy to strike up an anti-Obamacare discussion that quickly turns into a rant by whoever I’m talking to. My wife was at CVS and the lady in line ahead of her blew up and (loudly) started complaining about how much she hated Obamacare, because it destroyed her insurance, premiums were unaffordable and she was now paying huge sums out of pocket for her drugs. The pharmacist said “I don’t like Obamacare either!” and the line (which by that time was about five people deep) basically all agreed, including my wife.

Obamacare regulations are driven up the cost of premiums to an unaffordable level. Many people are now paying for virtually all their health care needs out of pocket because their deductibles are so high.

Obamacare was partly about covering the uninsured and partly about making coverage accessible for sick people. As deductibles rise, more and more people will become accustomed to paying out of pocket. Maybe we need to start thinking in terms of access to medical care rather than access to insurance that doesn’t provide access to medical care. Rather than try to maximize the number of people with health coverage, why not increase the convenience and affordability of medical care for people who do not have health coverage?

—Obamacare was partly about covering the uninsured and partly about making coverage accessible for sick people.—

You are a sucker if you believe that. People have good reasons for their REAL reasons. The REAL reason Obamacare was passed was to stop the competition that Individual Medical (IM) was subjecting the employer-based group plans to, slowly stripping them of market share year after year. Well, they put a stop to that by making IM so expensive.

I talk to people every day that are purchasing health insurance and I can confirm that the are hopping mad. Their anger is much larger this year than it has been in the past. People are really upset with the deductibles and Out-Of-Pocket (OOP).

Most people would be better off to deposit their Obamacare premiums into an HSA and forget about insurance coverage (if either were legal). I know people who have taken that route and believe paying cash is a better system.

You are way too kind calling Obamacare HMOs – “insurance”.

Hillary Clinton told CNN that she supports illegal immigrants being able to enroll in taxpayer-funded Obamacare.

Come to the USA if you are sick and the small number of Americans that purchase Individual Medical (IM) will pay your medical bills.

Does Hillary want a Special Enrollment Period (SEP) for illegals to get Obamacare any time of the year that they cross the border or do the have to wait till January 1st with their cancer?

Hillary’s FREE Trade: Ford Motor Co. plans to build a new assembly plant in the Mexican state of San Luis Potosi.

Mexican cancer patients should get medical treatment paid for by Americans.

The USA sends are manufacturing to Mexico and Mexico gets Americans to pay for sick Mexicans.

Trump is right that Hillary is incompetent! Trump would be more accurate to call Hillary a traitor.

Devon, I loved your comment about people putting their $8,000 yearly premiums into an HSA and not having insurance at all.

Of course you know that some small percentage of such persons will fall off a roof or get cancer, and some money must be devoted to those catastrophic events…..

but let’s take a hard look at how this might work if no one was forced to buy conventional insurance.

Everyone with no insurance WOULD be forced to contribute to the American emergency care system. Let’s say they were forced to contributed 3% of income, which is getting to be the ObamaCare penalty for not having creditable coverage.

If 50 miliion adults were uninsured, with an average income of $25,000 each, their little 3% penalty would bring in $37.5 billion for emergency assistance.

That might well be enough for a by-definition healthy group of persons.

Of course this would devastate the fragile risk pools of Obamacare…..but you can’t have everything.

You are correct Devon in that it is better to have 50 million persons entering age 65 with a large HSA account, than to have 50 million persons essentially broke from the large insurance premiums that they have paid in their last 15 years of work.

A few years ago several studies estimated the cost of charity care for the uninsured at about $35 billion to $40 billion, so your estimate is pretty accurate.

I like the Singapore health system. Rather than try to get enough healthy individuals who are willing to overpay so a few unhealthy individuals get a bargain, people should begin funding an HSA account while young. The only way I can imagine this working is if young people pay a risk-rated premium and the remainder of their payroll contributions (say, 10% of payroll minus the cost of catastrophic coverage) goes into the HSA. That’s one situation where I would support a mandated payroll tax.

The beauty of this system is that people cross-subsidize their own health across their working lives. When people get old and their health status begins to fall, they will naturally begin spending down their HSA on higher premiums and health care. A subsidy could assist those with incomes too lower to fully fund an HSA. The HSA balance would be annuitized at some point with the remaining balances at death used to subsidize other people. We’ve had Milliman model this concept for seniors in Medicare.

Keep in mind that if nobody had comprehensive coverage, hospitals as we know them would cease to exist unless they figured out how to care for patients at a cheaper rate. I’m not discounting the value of insurance. But, the way it’s conceived in this country, the cost is outrageous. Currently, about tow-thirds of out-of-pocket hospital bills are never paid. They’re written off to bad debt. Given that only about 3% of hospital bills are paid out of pocket. And that hospitals claim that about 10% of their revenue is out of pocket, something is amiss. If people cannot afford hospital bills even when they only owe a small percentage, then something is wrong.

When you say ⅔rds of hospital bills is that based upon hospital charges or what they are usually paid by insurers they readily accept? It is a big difference

I think they are referring to the cost-sharing (deductibles and co-insurance) patients owe after insurers have paid.

http://healthblog.ncpathinktank.org/two-thirds-of-patients-hospital-debts-unpaid/

Thanks, my error. I interpreted it as the uninsured.

I agree with your premise. Hospitals have a whole lot of funny numbers running around to demonstrate how much money they are losing.

You’re not really trying to tell me Obamacare is revenue positive are you? Good grief.

That is the argument the CRFB is making but we know that’s not the case.

Devon, what the Singapore system is to control hospital prices so that many hospital claims can be paid right from the HSA.

There are no disgusting ‘chargemasters’ in Singapore, which could put a patient at risk for $25,000 or more in charges for a C-section or several broken fingers.

Let’s dream that we in America could impose the following regulations:

1. Uninsured persons would be charged Medicare rates when they used a hospital. Medicare has many fees under $10,000 for hospital care, and these could be covered from an HSA. Medicare pays down to $290 for a quick Emergency Room screening.

2. A hospital could not charge more for outpatient care than a free standing facility would charge.

With regulations like these, people could live with a huge deductible catastrophic plan.

Any care that takes place within a hospital or a hospital owned outpatient facility accounts for much of our problem of high healthcare costs. Much of the rest is attributable to overly expensive medical devices and drugs, especially specialty drugs. Fix those problems and health insurance will be a lot more affordable.

Economists tend to dislike price controls. But regulations could facilitate hospitals being more transparent. I could see Medicare rates being a reference price with hospitals being forced to provide binding quotes that are a function of Medicare + some percentage.

CalPERS allowed enrollees to go anywhere for joint replacement and cataracts. But, used reference prices to encourage prudent behavior.

Firms like Compass Health, Healthcare Bluebook or Vitals could assist HSA holders. Binding arbitration and / or mediation could be used to resolve disputes.

Medicare rates as a reference price is a fine idea, I think. It should probably also be the default price for any care that must be delivered under emergency conditions and there is no opportunity for price shopping. There are no Medicare rates for drugs, however.

Will you force a physician to perform a surgical procedure at a lower price than he usually gets or will you let the surgeon pass on that surgery?

How much should the patient have to pay if there is no meeting of the minds on price?

Barry, I wasn’t drawing conclusions. I asked a simple question. Will you force a physician to perform a surgical procedure at a lower price than he usually gets or will you let the surgeon pass on that surgery?

It depends on whether the procedure is a life and death matter and whether there are other surgeons available willing to do the operation for the Medicare rate. If it isn’t and there are, then I would let him pass. If it is and there aren’t, I wouldn’t.

There is an alternative solution though. That is for the hospital to guarantee the surgeon some minimum price above the Medicare rate as part of his arrangement to practice at that hospital regardless of what the surgeon would be allowed to bill an emergency procedure for. The hospital would incur additional costs but it can offset those somewhere else on the outpatient side and on inpatient procedures that are scheduled well in advance.

Barry, you haven’t answered the question. All you are doing is offsetting the price onto another entity. When the patient comes into the hospital there may be no surgeons in the hospital or even close by. One has to create a principle they can live with.

How are you going to handle the matter? Which surgeon are you going to force to do the procedure at a price that all the surgeons consider too low? Right now you are trying to distribute that cost on other people “on the outpatient side…”

This is the way you seem to handle things. Involuntarily increase the insurance of the young (or someone else) so that they pay more than they should and thereby attempt to increase everyone’s bills pay for things that should not be their responsibility.

Assuming the hospital actually does what you suggest. The insurers aren’t going to give them a higher amount than already contracted for. That leaves the self pay patient as the only viable person to offset the bills to. How is that fair?

When one moves away from Adam Smith’s willing buyer and willing seller one becomes dictatorial. There is no freedom unless the individual has property rights that include intellectual property rights. Are you proposing a dictatorship?

First, there seem to be plenty of surgeons willing to treat Medicare and even Medicaid patients. Second, if an insurer has a contract rate with a hospital or a surgeon, the insurer doesn’t care whether the procedure was performed under emergency conditions or scheduled in advance.

The issue here is now much can the patient be billed, especially if he’s uninsured, when there is no opportunity for price shopping and no meeting of the minds on price and how much does the provider realistically expect to collect and how aggressively will he try to collect it.

Ambassador Barry, (I call you ambassador because ambassadors are trained to avoid answering questions) again you are avoiding the question. Presently your answer is that “there seem to be plenty of surgeons willing to treat Medicare and even Medicaid patients.” If that is the case then there was no problem for you to complain about from the start. Same with the contracted surgeon. But since you did have a complaint and will have the same complaint in the future (as you have in the past) we get back to the original question:

“Will you force a physician to perform a surgical procedure at a lower price than he usually gets or will you let the surgeon pass on that surgery?”

If your free market surgeon deems a legislated default price for care that has to be delivered under emergency conditions too low, he’s free to refuse to perform the surgery. If the patient dies as a result, so be it. That’s your free market capitalism at work.

You didn’t answer my question. How much should patients be expected to pay, especially if they’re uninsured, for care that has to be delivered under emergency conditions and there is no meeting of the minds on price?

It’s not my free market, it’s yours as well unless you choose your dictatorial socialist marketplace that provides much worse care.

But, it wasn’t the free market that caused the patient to die, rather your dictatorial preferences where you wished the government to force prices on the surgeon so that the patient wouldn’t be balance billed. The blood is on your hands. The market place handles things differently and provides far better care.

What might be interesting to you is that my wife is not American and was born in a communist country where the prices were set by government. Everyone got the same price and everyone would show up at the clinic waiting for hours and sometimes days to be seen. Apparently there was more of a marketplace there than you want here. There instead of dying the patient made sure they saw the doctor before hand to pay a fee and then was happily seen in the clinic.

I have answered your question over and over again. I let the marketplace decide. But I also permit charity and even government to help the patient outside of the marketplace.

When it comes to emergency care, there is no free market and no meeting of the minds on price. So, if the patient is uninsured and the surgeon then presents his bill for 10-20X what he accepts as full payment from Medicare when he treats Medicare patients, there is a lot wrong with that picture in my book.

Moreover, the patient isn’t buying the service because he wants to but because he has to. Heck, he may not even be conscious at the time. So what’s reasonable payment under that circumstance?

“no meeting of the minds on price.”

Barry, when there is no meeting of the minds on price there is no contract. When there is no contract there is no fee except one agreed upon by the two parties or adjudicated by the state. It is not the surgeon who has caused the patient to die, but you.

“isn’t buying the service because he wants to but because he has to.”

We don’t necessarily buy food because we want to spend money on food rather we buy food because we have to.

If Medicare is the reference price, that does not mean doctors would be forced to work for the reference price. They would be free to charge Medicare + 30%, Medicare + 100% or whatever they believe the market will bear.

But they will also know that the patient bears all costs above a predetermined level. That level may be Medicare +0%. That would essentially allow balance billing — but only if the doctor had an agreement. I envision a system where doctors are free to charge what they want as long as they engage in full disclosure.

Past experimentation has found that when patients know the prices vary, and when doctors know patients are price sensitive, providers (hospital in the experiment) were far more likely to compete on price.

A doctor may not choose to do a given procedure at a certain price. But other may. MediBid has a system where doctors willing to compete on price log into a system and bid on the right to perform a given service on patients. Maybe it wouldn’t work for emergency room services, but a medical home facilitator could have a list of doctors and hospitals and could engage them to find a mix of price, quality and convenience for the patient.

DEvon, your last comment is sort of half very right and half very wrong.

You are right that medical costs will come down if doctors and hospitals were forced to compete on price.

But you may be very wrong in assuming that this will lead to better medical care.

I do not think that doctors want to be price quoters. I think they want to do what is best for each patient and never pay attention to prices.

I remember about 15 years ago a reporter in Mpls followed a top-tier HMO doctor on his rounds for a 10 or 12 hour a day.

As I remember the article, the doctor went from patient to patient and spent 100% of his time on clinical issues. He never spent five seconds on the price of what he was recommending.

From my reading, this is the way that Mayo Clinic still operates today.

And Mayo Clinic is a vastly expensive place.

Doctors are pound for pound some of the smartest people in America. They should be able to preserve clinical care while controlling costs, in some way other than putting ads on bus benches.

I read recently that in some hospitals, when doctors are about to prescribe an expensive drug electronically, $$$$$ flashes on the screen to indicate that the drug is very expensive just as Zagat uses that symbolism to identify expensive restaurants. Seeing that, they might think about whether a less expensive drug would suffice or not. I think that’s a helpful nudge toward better cost control.

Bob, most doctors pay attention to prices, their prices and as you say not to everyone else’s. Outside of procedures they provide advice as to what should be done that is not based upon specific prices unless the patient gives them a reason to concern themselves with price. They should not be put in the middle to control global costs. They should help control the price their patient’s pay when price is an issue for the patient.

@Bob, Barry and Al

One of the few industries where this is discussed this was is health care. In most industries, cost is a primary consideration — but no the only one by any means. In most industries, the organization seeks to create a product the consumer will ultimately buy. Walmart procures from China placing suppliers on very tight margins so Walmart can sell for prices lower than its competitors. Walmart doesn’t tell Chinese manufactures how to build the products. It basically negotiates what it’s willing to pay and gives them the quality parameters. Or maybe the supplier show Walmart what it can do and the two parties negotiate. Because Walmart is competing on price its suppliers have to compete on price. Because Chinese suppliers are competing on price, their design engineers, manufacturing engineers and quality control people have to help hold the line on both cost and quality.

Years ago I had a professor who told us that the engineers at Boeing largely did not transfer between the civilian/commercial division and the military division. Engineers in the defense divisions were trained price was not really an object. Thus they would over-engineer parts of the product. When it comes to civilian jetliners price is an object even though safety cannot be compromised. Boeing supposedly didn’t want defense engineers in the commercial division because they raised costs too much.

Of course the reason why health care is difference is physician care is still largely a cottage industry and third parties pay 89% of medical bills. If the hospital was competing on price, it would require all the participants to squeeze unnecessary costs out of the system.

To Bob, Would this lead to better or worse health care?

Quality improvements would likely be incremental and over time would improve. However, there is the possibility that some aspects of care would worsen from the standpoint some hyper costly research would languish. That’s all fine. What we need is an efficient health care system that is affordable and sustainable. Not one that promises extremely costly treatments that are only very marginally better than the treatment costing one-tenth the cost. Such a system may get better at preventing disease and emphasize less the aspect of treating it once disease has set in. There’s no way to predict the ultimate outcome. But as our former CEO was fond of saying, if doctors/hospitals don’t compete on price, they are unlikely to compete on quality either.

Thanks for those comments Devon. I’ll address this from several perspectives.

First, I once covered a capital goods company called Ingersoll-Rand which made pumps, compressors, locks and other equipment. IR had a corporate culture dominated by engineers. One of the problems they had was a tendency to develop products that were too good relative to what customers needed or were willing to pay for. Too many customers opted for competitors’ products that were less expensive and deemed good enough.

I know a fellow who farms something like 20,000 acres in western Kansas and eastern Colorado. He uses J.I. Case farm equipment though he tells me that Deere equipment is the Cadillac of the industry. The problem is that while Deere’s equipment is slightly better than Case’s, it also costs about 10% more and the Case equipment is good enough so that’s what he buys even though he could easily afford to buy Deere equipment.

In healthcare, we probably will always need third party payer to pay for the really expensive stuff including most hospital based care and expensive drugs and medical devices. There are usually multiple ways to address most medical issues at varying costs. There may be many cases where the less costly option is a bit less effective or, in the case of drugs, less convenient to take but much cheaper. People seem to want the state of the art whether it’s necessary or not. I don’t know how to attribute that mentality to third party payer, physician’s fear of being sued if they don’t offer the highest tech options, or ignorance about the cost of each option on the part of both providers and patients.

At a minimum, the more knowledge we all can have about healthcare costs, meaning contract rates as opposed to list prices, the more likely we are to get better value for our healthcare dollars.

Finally, with respect to hospitals, I’ve said many times that I’ve never seen a study comparing hospital costs per licensed or occupied bed in the U.S. vs. costs per licensed or occupied bed in similar hospitals in other developed countries including Canada, Western Europe, Japan and Australia. I suspect that hospitals in other countries are somewhat more spartan than ours and have fewer employees per bed but are good enough in terms of the outcomes they produce.

“In healthcare, we probably will always need third party payer to pay for the really expensive stuff including most hospital based care and expensive drugs and medical devices”

Barry, I do not believe insurance bought by the individual instead of the employer is third party insurance. It is employer sponsored healthcare ( insurance) that creates so many of the problems faced in healthcare.

We need to get rid of third party healthcare. That in one stroke will do more good than almost any other change we could make. That doesn’t mean the employer couldn’t offer insurance rather the employee would have a right to use the employer’s insurance or buy it himself.

Allan – Thanks for refreshing my memory about your definition of third party payer.

If we were starting fresh, we would not have health insurance sponsored by an employer. The best way to get rid of it, I think, is to eliminate the tax preference and make it taxable income. However, since employers effectively price their health insurance on a community rated basis, they would probably say either everyone signs up with certain exceptions like being covered by a spouse’s plan or we don’t offer it at all.

If they were to attempt to offer employees additional salary as an alternative, the extra pay would most likely be valued on an age-rated basis. So, if the employer’s health insurance cost was, say, $5,000 per year for single coverage, the extra (fully taxable) salary might only be $1,500 for an employee in his 20’s and maybe $9,000 for a 60-64 year old.

It probably wouldn’t work though because the healthy people would mostly take the extra pay and the employees with health issues would stick with the health insurance. The most likely outcome then would be to eliminate the health insurance offering and gross up taxable salary by an amount roughly equal to what it was spending on health insurance before.

That would all be fine as long as there was a mechanism to take care of the people who can’t pass underwriting or have family members who can’t pass. One downside is that there are higher administrative costs associated with selling health insurance policies one at a time as compared to hundreds or thousands at a time.

Thanks Barry for letting me know from where the confusion arises. It’s really not my definition rather a definition I learned from Greg Scandlen who used to write some of the blogs here. I think it is important to distinguish between insurance provided by the employer on a take it or leave it basis and insurance where the individual had the opportunity to use the tax benefits privately or on the employers plan.

We are not starting fresh so we don’t have the luxury of saying that we wouldn’t vote for the tax advantage today. Right now those without the tax break are severely disadvantaged. Therefore a new method should be created to equalize the two parties either by removing the tax break with or without another way of providing a subsidy to all or by giving everyone the tax break equally. Letting the individual control the tax break or incentives (rather than the employer) will radically improve the marketplace, transparency and all those things you say need to be corrected. This would be my number one provision of any new law with preference towards no tax break what so ever for healthcare.

You are creating a whole bunch of ways that ending the tax break solely to the employer can be done and then tearing each idea down. You do this utilizing a lot of myth and by using a limited number of variables not recognizing all the other things that come into play. Let the marketplace work and a way will be found that will improve with time and save a lot of money.

Perhaps you should read up Greg Scandlen’s myth buster series on this blog in particular Myth Buster #20 @ http://healthblog.ncpathinktank.org/myth-buster-20-third-party-payment/

Greg Scanlen’s link about the Blue Cross MONOPOLY is interesting. Greg writes:

—(Blue Cross)For instance, they were exempt from insurance reserve requirements because their hospital members guaranteed their solvency. They were set up as not-for-profit organizations and had Boards of Directors that were controlled by their hospital members. This would have been a flagrant antitrust violation but for the “state action” doctrine, which exempts state-regulated companies from anti-trust law.—

I have always known that Blue Cross is the evil one. Blue Cross in Florida spends more on politics than any other entity. Blue Cross controls the newspapers because they are major advertisers.

I’m impressed with Greg’s post on Blue Cross.

That’s a very informative post and an interesting history about the early days of Blue Cross and Blue Shield.

Barry, here is a link that also exposes Blue Cross for the UnAmerican cheaters that they are.

100 Years of US Medical Fascism

4/16/2010 —“After this, organized mainstream medicine waged an intense war on non-Blue plans. Goodman (1980) contends that some physicians lost hospital privileges and even their licenses for accepting non-Blue plans.24 The Blues also gained government-supplied advantages not available to non-Blue plans. In many states, they paid no or low premium taxes and sometimes no real-estate taxes. They also weren’t required to maintain minimum benefit/premium ratios and could have no or low required reserves. With government advantages, the Blues steadily came to dominate the industry. By 1950, Blue Cross held 49 percent of the hospital insurance market, while Blue Shield held 52 percent of the market for standard medical insurance.25 They merged in 1982 and today cover one of every three Americans.26

Blues-created “insurance” was anything but true insurance.”—

https://mises.org/library/100-years-us-medical-fascism

Ron — I curious if you know or have seen an estimate of roughly how great a cost advantage the Blues had over non-Blue plans as a result of the government and regulatory advantages bestowed upon them. Are we talking 10%, 15%, 20%? Just curious. Also, how much of that advantage still exists today, especially now that Anthem (formerly Wellpoint) is for profit and accounts for 14 of the 36 Blues licensees?

Barry, Blue Cross is a giant fascist monopoly that controls your world. They own the politicians. In Alabama Blue Cross has over 90% market share and a reporter wrote, “almost unanimous support from lawmakers who – let’s face it — would sooner gnaw off a thumb than thumb their noses at Blue Cross.

The money is just too good.”

Blue Cross has a deal for politicians that they can’t refuse.

Blue Cross has gotten a vast majority of government contracts for employee insurance for years. The Blues have the State employees, the county employees, the city employees, the universities, if there is a government contract, Blue Cross will have it. PLUS – MEDICAID!

We have laws in America against giant monopolies but Blue Cross doesn’t care because nobody dares to even mention their name.

That’s interesting Ron and I knew about the Blues’ dominant market share in certain states. Why is it, though, that they aren’t very strong in Medicare Advantage especially compared to UNH and HUM and, to a lesser extent, AET?

Also, aren’t their capital requirements much stiffer today than they were in the old days? Presumably, the politicians want to be assured that their constituents’ claims will be paid. No?

You have both touched on the precise problem. If patients were acting like consumers they would often opt for J.I. Case rather than John Deere (or maybe opt for John Deere rather than the handmade, machinery costing 10 times John Deere.)

(Side not: my late father farmed 3,000 acres in Western Kansas and would only buy John Deere. He thought J.I. Case was junk).

A doctor once told me physician care is a cottage industry. That was more true when he told me 10 years ago than today. Hospitals raise costs because they’re not competing on price or efficiency, they are competing to maximize revenue from reimbursement formulas. Rather than buying physician practices to integrate and coordinate care, hospitals employ physicians to capture referrals and charge facilities fees.

I agree if hospitals were trying to maximize efficiency so they could offer better prices, they would operate the MRIs, ORs 24/7. As far as using older equipment, I used to know a guy who worked in medical office real estate. He told me much of the equipment is leased rather than bought. That way, the manufacturer can often demand a cut of each procedure. Also, when the lease is up, the manufacture can refurbish the machine and ship it abroad — thus guaranteeing it doesn’t stay in the United States to compete with new equipment.

I heard a presentation from someone at Virginia Mason Medical Center who showed us a diagram of the number of steps it took to perform certain repetitive functions. It was ridiculous how many steps had to be taken. They changed the layout like an assembly line designed by an industrial engineer would do. It reminded me of the steam lined assembly stations/food line at Taco Bell or McDonalds. It made me wonder why every hospital hasn’t done that. Answer: many are regional oligopolies that don’t have to competing on efficiency.

Devon, I like your comparison between military and civilian. I think that hits the nail on the head regarding the practice of medicine even though we call healthcare a cottage industry. Even there I am not sure if this so named cottage industry causes increased costs. It could also decrease them. I am sure the costs coming from my office were much lower than if those costs were provided by government or larger groups.

In medicine things are done in a fashion similar to the military because there is no substantial civilian pressure to do otherwise. High tech is a major cost factor. Take MRI’s or CT scans. One has to ask themselves why older technology isn’t used for problems where the newer technology isn’t needed? If patients paid they would be glad to use this older technology and that would save millions on machines. They could also use this expensive equipment at all hours of the day instead of just the standard 8 hours.

Take note that when a colonoscopy is done in the hospital the Medicare price is almost double than when done privately in that cottage industry. Also take note that when a portion of the cottage industry is suddenly owned by a hospital the payment rates also increases even if the physicians billing do not get one dime of it. In some cases the volume of testing increases.

Economic credentialing by these larger organizations can mean utilizing higher code numbers more frequently or denying necessary care to patients. Patients need an advocate when fighting the combination of government, hospitals, insurers, pharmaceutical companies, suppliers of DME. With the ACO we have removed the doctor from the patient side and placed it along with government, hospitals, insurers etc. The patient is left to struggle alone.

Devon makes a great point that if large entities compete on price, then individual suppliers (i.e. doctors) will compete to add value at reasonable rates.

In reading this I felt a twinge of memory…this is exactly the vision of the much-derided managed care movement of the 1990’s and the Bill Clinton plan.

I cannot remember the exact author, but the writer had this vision:

– everyone would be insured in an HMO

– the HMO’s would compete on price, since they would not be allowed to underwrite

– doctors and hospitals would be forced to compete on price and quality so that HMO’s would contract with them.

Well, this sure did not come true in the 1990’s. Fascinating though rather sad.

The names Alain Enthoven and the Jackson Hole group come to my mind as the authors of this concept.

Enthoven is the originator of the concept managed competition.

Bob has a tear in his beer that HillaryCare was rejected, ha ha. Bob says he can’t remember the author, geez, but says, “Well, this sure did not come true in the 1990’s. Fascinating though rather sad.”

Devon, Enthoven switched the word “collusion” to “managed competition” to try and make it sound legal.

Collusion is an agreement between two or more parties, sometimes illegal and therefore secretive, to limit open competition by deceiving, misleading, or defrauding others of their legal rights, or to obtain an objective forbidden by law typically by defrauding or gaining an unfair market advantage.

HMOs should pay at least Medicare’s price, or at least Medicaid’s price, for a procedure or supply instead of NOTHING. HMOs are not insurance.

Ron, what is with you? Would it not be better to have medical providers competing by offering lower prices? Now it could be that the Bill Clinton plan of 1994 would not have worked, but calling it “HillaryCare” is not an argument.

Going back to a comment of Al’s, it would be progress if an outpatient procedure done in a hospital are not reimbursed higher than the same proceduresdone in a free standing clinic.

I think Medicare has taken some baby steps in this direction.

The struggle to contain health costs is to a large extent a struggle against hospitals and specialty drug companies.

When Medicare began in 1965, many hospitals were kind of a tin cup industry dependent on charity, and Medicare wanted to buoy them up with high and steady reimbursements.

It has taken many years to correct this, and the task is not yet done by any means.

“Would it not be better to have medical providers competing by offering lower prices?”

Bob,how can there be competition if the fee is fixed? If the fee isn’t fixed then one can only assume the patient is doing the picking. If that is the case the patient is responsible for enough of the bill to make it worth their while. That would mean they would focus more on what is done and how than in reducing the doctors fee noting that the doctor could help them in reducing those other costs. Remember many people are willing to pay more and do when the physician isn’t attached to Medicare or healthcare plans. The big costs that can make big differences in total healthcare costs are outside of the physicians profits.

Allan – When people by health insurance from a private insurer, they expect the following: (1) a list of what’s covered and what isn’t, (2) a network of providers, (3) information about deductibles, coinsurance amounts and out-of-pocket maximum liability, and (4) a contract reimbursement rate that will be accepted by network providers as full payment subject to any patient liability under item #3 above. They don’t expect or want to be balance billed for some uncertain amount that can easily add up to thousands of dollars. What good is insurance if they’re subject to that kind of financial exposure? Also, haven’t you told me in the past that if patients bring up cost as an important issue for them, the doctor will try to provide lower cost options to the extent that he can without expecting to balance bill beyond the insurance reimbursement?

Out-of-network situations are, of course, different. If the doctor didn’t agree to accept the insurance reimbursement, if any, as full payment, he has a right to balance bill then. Ditto if the patient is uninsured as there is, of course, no insurance reimbursement at all.

I also get that Medicare and Medicaid use administered (dictated) prices but doctors don’t have to participate in those programs if they don’t want to except that they might not be able to sustain their practice if they don’t participate in Medicare.

“What good is insurance if they’re subject to that kind of financial exposure?”

Barry, who bought the insurance policy? You or your physician? I’ll give you a hint. Your physician had no involvement what so ever. Who is earning the profit off of issuing you insurance? I’ll give the answer, your insurer, not the physician or any other provider. Who has a copy of the insurance policy? You and the insurer. No one else unless you give it to them. Who is knowledgeable about the insurance policy? The insurer and perhaps the agent that sold it to you.

What makes you think your personal physician should be privy to these things? IMO they shouldn’t even know you have insurance because their advice should be the same to everyone except if the patient brings up extenuating circumstances. But, suddenly you want the physician intimately involved in all the details and you want responsibility transferred to him. Is that what you pay him for? He has a contract with your insurer. That contract tells him what he can do or not do and how he will be paid. Do you think the contract says “when Barry comes in you must tell him…”? Of course not. That would be a contract between Barry and the physician. Have you drawn up such a contract and paid the physician cash for this task? No? Then why would you expect him to take such responsibility?

You are constantly requesting that responsibility be divided among other disinterested parties. With the ACA you want the young and healthy to pay for the risk of the old and sick. You want the physician responsible for your secretarial duties. Start taking responsibility for yourself and read your own contracts. Speak to your insurer along with your agent and become informed. Then check out everyone you might come in contact with that might send out a bill because you didn’t choose a good enough policy.

If all that fails see me. I will for a good sum of money handle all these things for you under contract and I will take responsibility. Make sure you pay your attorney handsomely to take the responsibility off your shoulders of making sure the contract is written correctly. See to it those attorney fees include enough money for your attorney to consult with an attorney that is expert in insurance law to further distribute responsibility. There seems to be no end as to how far responsibility can be distributed except for the resources involved that are finite.

Take responsibility.

Allan – My perception about contracts between health insurers and doctors is that there is a contract reimbursement rate for various services, tests and procedures that the doctor agrees to accept as full payment along with any patient deductible and copay. You seem to be saying that insurance pays what it will pay and the doctor neither knows nor cares how much that is. He just expects to be able to bill the patient for the difference between his usual and customary fee and whatever the insurer paid him. Patients don’t know what the insurer will pay and usually can’t find out ahead of time even if they try.

I would be interested to hear Ron Greiner’s or Bob Hertz’ perceptions of this issue at least with respect to the policies that they sell. Would it be reasonable for patients to be balance billed and not even have the billed amount above the contract rate count toward their deductible and out-of-pocket maximum liability or not? Should this approach apply to hospital charges as well?

If the policy is an indemnity plan where the insurer pays a certain amount and the doctor is specifically allowed to bill for any excess between the indemnity payment and the customary fee, that’s a different story. I don’t think there are many policies like that anymore though I don’t know for sure.

You are correct. If the physician’s fee is bound by contract he must live within the contract parameters and not balance bill if that goes against the terms of the contract. It’s not the best way to set prices because the same exact fee is paid to the expert and the dunce, but a contract is a contract.

However, you have also been complaining about balance billing where the billing entity is under no such restriction. In that case the patient has to be more vigilant and take more responsibility. Remember, it is your insurance policy not anyone else’s.

Over a 40 year career with four different employers, I’ve never received a balance bill from an in network provider. My wife hasn’t either. In the case of hospital based care, I’ve received bills several times from anesthesiologists who I didn’t know and had no role in choosing. Many doctors in this specialty deliberately refuse to join insurance networks specifically so they can balance bill knowing that patients generally have no role in choosing them. I don’t know how common insurance plans that allow in network doctors to balance bill are.

It’s a problem I don’t like either, but that is why one has to be vigilant and if that is a problem for someone he should go to a hospital where the anesthesiologist is part of the network. Alternatively one can try and see if the policy can be changed.

I always wondered why surgeons, including many veteran senior surgeons with stellar reputations are willing to join at least some insurance networks while many anesthesiologists, radiologists, pathologists and ER docs are not. What those four specialties all have in common is that patients generally have no role in choosing them.

Doctors can’t just show up and practice at a hospital. They have to have an agreement with a hospital to allow them to practice within its facility. Since the hospital is the entity that the patient is probably most angry with when surprise bills show up from these specialists, it should be up to the hospitals to fix the problem by either requiring them to join the same networks it participates in or strike an agreement with them over how much they can bill a patient maybe as some reasonable percentage of what the surgeon is paid by the insurer.

I told you awhile back that I thought the hospital should be involved as a responsible party for these excess bills. That would suddenly increase transparency.

But that also takes us to many questions including:

Should there be CON for hospital construction?

Should there be CON for surgi center construction?

Should hospitals be open staff?

What are hospitals?

My belief is that by inhibiting competition we have created monsters that have to be fought off. We are making (though policy decisions) insurers bigger, hospital groups bigger and physician groups bigger. All of that eventually artificially changes the playing field and leaves us with less competition.

Friends:

This is a graduate seminar in these knds of issues.

I have a small contribution:

Hospital prices to the patient are actually mediated by the insurer, so there is actual price transparency, or contracts that limit price increases per time period.

The cost to the patient cannot be determined in advance, as it will depend on the specific collection of services the patient is given.

The idea that there scan be competition solely on price means at least two choices of provider where the attending physician is on staff, they are located near the patient, and they have capacity. Many communities have only one hospital.

By omission, you all are setting aside the important variables in hospital prices:

the amount/percentage of capital being spent on construction and debt service, and the salaries being paid for staff, which represent 50 to 60 percent of the total budget. The same liberals who want to regulate hospital prices are fine with union-pushed salary schedules. By competing only on prices, you are implicitly asking that patients choose older hospitals that employ the kinds of low quality staff willing to work for less.

Certificate of Need has been around for many decades–I once worked in a planning agency that was converted from planning to regulation with such a law. The assumption that CON cuts costs is utterly wrong, as the community members on the review board wanted the services they were reviewing. The future impact on prices was unknown. And the cost of going through a review represents additional administrative overhead for which there is no corresponding benefits, except to call off political forces.

I’d love to go down these important issues, but don’t have the time. The back and forth was very interesting. I’ll keep it as a reference to the mind-sets of people who only look at healthcare economics, but don’t understand healthcare delivery.

Cheers….

Wanda Jones

San Francisco

I think it is to America’s absolute shame that patients have to be vigilant about balance billing.

I have no problem with consumers having to be vigilant when they are buying lottery tickets or paying cash to park their cars.

But medicine should be held to a much higher standard.

That is why I am much more tolerant of national fee schedules such as France’s, Germany’s, or Japan’s. I think it creates a more ethical environment.

I am not an enemy of free enterprise, but aggressive billing and collections should not be part of health care.

Now, America will not have national fee schedules tomorrow, but there will be patients tomorrow. I would thus suggest a consumer-protection law that has actual “teeth”.

The “teeth” would be a four word provision —

No disclosure, no liability.

If the provider does not tell me in advance what a scheduled procedure will cost, then I do not have to pay for it, nor does my insurer have to pay.

Of course there must be qualifications for unexpected complications. That can be worked out.

Bob I’m not necessarily opposed to a reference price or a benchmark fee schedule. I don’t believe doctors and hospitals should be forced to adhere to it if they’ve negotiated other terms with their patients. Balance billing isn’t a problem if it’s agreed on in advance. Of course, when the balance bill is very high, the patient knew nothing about it in advance and could have found an in-network provider had they been advised, that’s different.

However, I believe the problem runs much deeper than that. In our culture, there is a believe that people who are lower middle-class shouldn’t be required to pay for medical care if it’s an “undue burden” on them. EMTALA is an example of this. Making matters worse, there is a believe that the sky is the limit when it comes to hospital prices or surgeries. Of course, many highly qualified medical providers will perform the procedures for much less at the margin, but it’s accepted that very high prices for some payers are a necessary evil to offset the write-off of others people’s bills and charity care.

What would a good system look like? I’ve said it before. Singapore requires payroll deductions for Medi-Save accounts. I believe you or Barry has pointed out Singapore also has some sort of price controls. I’d make the control a reference price with full disclosure and network affiliation. A network would just be providers who agreed to some arrangement. A system where everyone is required to save for their own medical care and where contract law spelled out enforceable billing agreements, more people would pay their bills and providers would compete to attract paying customers.

Devon, what is wrong with medical providers scamming the uninformed consumer?

Socialism is always less-efficient than capitalism because there is no reward for innovation in a socialist system; you cannot take market share from someone else since market share is not a function of market success or failure.

This, in turn, means we’re definitely overpaying by more than twice for medical care; we are in fact probably overpaying by as much as 80% across-the-board.

It is not hard at all to find examples of people being billed 10 or even 100x a price in another nation for a given thing. It is cheaper for me to fly to Narita, Japan, round-trip, and have an MRI done there by more than 50% than the average amount charged for the same scan here in the United States.

While you can in some cases get that scan done for a few hundred bucks here they’re all $200 or so in Japan, and most people grossly overpay here in the US. Why? Because of various practices that all amount to consumer deception, extortion, price-fixing or all of the above — all acts that are supposed to be crimes.

WE SHOULD BE DRAWING UP LISTS OF PEOPLE AND FIRMS TO BE INDICTED AND IMPRISONED. AFTER JUST THE FIRST FEW WERE SERVED THIS ENTIRE EDIFICE OF FRAUD WOULD COLLAPSE IN UPON ITSELF AND PRICES WOULD FALL LIKE A STONE.

In the past the consumer was insured for UCR, Usual, Customary and Reasonable, expenses. This doesn’t work with Hillary’s HMOs.

http://market-ticker.org/akcs-www?post=231295

Ron,the $200 MRI’s in Japan do not exist because Japanese providers are kinder than Americans; and they certainly do not exist because of competition and price disclosure in Japan.