Saving for Health Care

Newly announced regulations under the Patient Protection and Affordable Care Act threaten the very existence of consumer directed health plans in the individual market (including the anticipated health insurance exchanges), according to Roy Ramthun. Yet according to a RAND study, these plans have the potential to reduce health care spending by 30% without causing any harm, even to vulnerable populations.

In what follows, I will review some of the advantages and disadvantages of the various health savings options, based on a recent post of mine at Health Affairs. But let’s begin by jumping to the bottom line: none of them is ideal. As Mark Pauly and I explained in Health Affairs some time ago, an ideal account is one that does not distort incentives.

In the current period, people must choose between spending on health care and spending on other goods and services. When saving comes into play, people must choose between current and future health care and between future health care and future other goods and services. An ideal savings account is one that keeps all these choices on a level playing field with respect to the tax law. I call this account a Roth Health Savings Account, or Roth HSA.

All the things I could do

If I had a little money.

There are two ways people can insure for medical expenses: third party insurance and individual self-insurance. Under the former, a third party (insurance company, employer or government) pays the expenses. Under the latter, people must save and pay the expenses directly, from their own resources.

This division of insurance responsibility is a normal aspect of every insurance market. In health care, however, the tax law complicates our choices. In general, employers are able to pay third party insurance premiums with pre-tax dollars (untaxed to the employee), whereas out-of-pocket payments by patients must normally be made with after-tax dollars. A second problem is that most families are not in the habit of saving while they are healthy for expenses that will arise with an unexpected illness.

To overcome these two problems, the law allows people to save on monthly basis in tax-favored accounts by using several vehicles. Unfortunately, the rules governing these accounts are arbitrary and inconsistent — reflecting no clear public policy purpose.

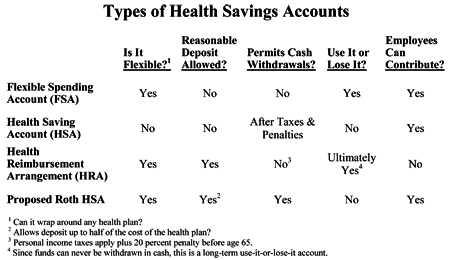

Comparing the Accounts. With all the acronyms in use these days, readers can be forgiven if they get confused. The table below gives an overview, but let’s start with the two most popular accounts: Flexible Spending Accounts (FSAs), which hold funds available only for the current period, and Health Savings Accounts (HSAs), with funds that roll over from year to year tax-free. In general:

- Both accounts are established by employers, and employees can make pre-tax deposits to them to pay medical expenses not covered by the employer’s health plan. The HSA contribution limits are currently $3,050 (individual) and $6,150 (family). Starting January 1, 2013, FSA deposits will be limited to $2,500 per employee.

- Employers are allowed to make deposits to both accounts; the HSA deposit is limited, but there is no limit to how much they can deposit in an FSA.

- HSAs must be combined with rigidly designed health insurance plans (with minimum and maximum deductibles, limits on out-of-pocket costs, etc.); in contrast, the FSA account is completely flexible — it can wrap around any health plan.

- Employees have a more secure property right in their HSAs; they can take their HSA funds with them when they leave an employer, but they have no legal right to unused FSA balances.

- The FSA account holder can never take the money out in cash; by contrast, employees can withdraw their HSA balances if they pay ordinary income taxes and a 20% penalty if the withdrawal is before age 65.

- Unlike the HSA approach of use-it-or-save-it, FSA accounts are use-it-or-lose-it; any account balance left at year end (or after an extra 2½ month grace period) is forfeited.

Although employers are allowed to make deposits to FSAs, few take advantage of this opportunity. Because of the use-it-or-lose-it feature, these plans are additions to, rather than integrated parts of, employer health plans. Because the deposits are tax free, they almost certainly add to health care spending, as they are currently structured. They encourage employees to purchase designer eye glasses with pre-tax dollars, for example, rather than purchase other goods and services with after-tax dollars. At year end, employees will view almost any kind of wasteful spending as preferable to forfeiting the money left in the account.

Why are these accounts use-it-or-lose-it? Apparently this feature is the result of a Treasury Department ruling, not the result of any act of Congress.

Here is how Flexible Spending Accounts and Health Reimbursement Arrangements (HRAs) differ from each other:

- Like FSAs, the HRAs are also created by employers and they are completely flexible, in the sense that they can wrap around any health plan.

- Unlike FSAs, HRA balances roll over from year-to-year.

- Like the FSA, HRA balances can never be taken out in cash (so they are long-term use-it-or-lose-it).

- Finally both FSA and HRAs are notional accounts — in contrast to the HSA, no money is actually deposited in an employee-earmarked account — and employers can abolish the employees’ claims if they leave the company.

The 401(k) Option. Although 401(k) plans were never designed to function as a health account, the law does allow employees to make a hardship withdrawal for a large medical bill. The withdrawal must be for an immediate financial need for which the employee has no other funds available and it is subject to a 10 percent penalty plus federal income taxes.

Employees may also borrow from their 401(k) and this could be a source of funds to pay medical bills. Plans with loan provisions generally allow an employee to borrow up to half of a vested account balance, but not more than $50,000. Federal law requires that the borrower be charged a “reasonable rate” of interest, which is normally fixed at the prime rate plus 1 percentage point and the loan must be repaid within five years.

The primary disadvantage of taking a 401(k) loan is the loss of compound interest and dividends that would have accrued if the money had not been borrowed. Moreover, the interest paid back into the account is unlikely to equal the interest earned by 401(k) investments. For example, if an account were earning a market interest rate of 6.25 percent, and a 47-year old plan holder borrowed $10,000 at a lending rate of 3 percent for two years, he would have $80,000 less at retirement (age 67) than if he had not borrowed.

Making Flexible Spending Accounts Better. There is something rather simple the Obama administration could do that would have a very large impact on health care spending. Apparently, this is something that can be done administratively, without Congressional action. The simple step: Allow deposits to Flexible Spending Accounts (FSAs) to roll over at year end and grow tax-free.

Currently, there are about 25 million people with an HSA or HRA account (roughly evenly split) and another 35 million people with FSAs. That means that over half the people with a health account have an incentive to spend rather than to save. If FSAs could roll over and become use-it-or-save-it accounts:

- There would be a huge immediate impact on the incentives of the 35 million current account holders; instead of end-of-year wasteful spending, they would be tempted to save for more valuable future health care spending.

- Employers across the country would consider integrating these accounts into their health plans, making employer contributions to them and experimenting with new health plan designs.

Moreover, employers and their employees would have a vehicle much better than any option currently available to them to control health care spending:

- FSAs could be combined with high deductibles, allowing employees to directly control, say, the first $2,500 of spending without all of the pointless restrictions that hamper the usefulness of HSAs.

- FSAs could be created to allow employees control of whole areas of spending, say, all preventive care and all diagnostic tests — services for which individual discretion is both possible and desirable.

- FSAs could be created for the chronically ill — allowing, say, diabetics or asthmatics to manage their own health care dollars, much as home-bound, disabled Medicaid patients manage their own budgets in the Cash and Counseling programs.

- FSAs could be combined with value-based purchasing insurance plans — where the insurer only pays, say, for certain drugs, doctors and hospitals, but allows patients to add money out-of-pocket and make other choices — thus allowing the development of a real market for more expensive health care services.

The Potential Impact of High Deductibles. Every serious study that has ever been done on the subject has found that patients spend less on health care when they are spending their own money. The latest study by the RAND Corporation estimates that families with high deductible plans and Health Savings Accounts spend about 30% less than families with conventional insurance. And that’s with HSA plans designed by Congress. Think how much more effective the accounts could be if they were designed by the marketplace.

Achieving the Ideal. Finally, good as the idea of FSA rollovers is, it is still short of the ideal. For starters, people need to have the option to withdraw cash from their FSA and spend it on non-health care goods and services. Beyond that, we should consider more fundamental reform.

As the table shows, today we have an array of account options — each with advantages and disadvantages when compared to each other. This reflects the complete lack of a public policy purpose. Why should the contribution limit be $3,050 for an HSA, $2,500 for an FSA and unlimited for an HRA? Why should people be able to withdraw cash from the HSA, but not from the FSA or HRA?Why are FSAs and HRAs flexible, while HSAs are not?

As noted, the ideal account is a flexible Roth HSA. The Roth account involves after-tax deposits and tax-free withdrawals. It is the account that is most compatible with subsidizing health insurance with lump sum tax credits — an approach advocated by Sen. John McCain and incorporated in the Coburn/Burr/Ryan/Nunes health reform bill.

It is amazing how controversial the concept of self-insurance and personal health accounts are among some public health advocates. To them, the notion that financial incentives should have any bearing on medical spending seems anathema. Yet, it seems self-evident to me that we could spend our entire GDP on medical care — and that would leave little money left for anything else. If nothing else, requiring people to control the dollars that pay for incidental health care would reduce a mountain of paperwork — allowing insurers to concentrate efforts on this big ticket items. It would also require a measure of competition among providers that might create spill-over effect in other areas of medicine beside ambulatory care.

I’d prefer not allowing FSA withdrawals for non-medical expenses; but allowing any remaining funds to pass to the estate. This would reduce the possibility of ending up in a safety net, and also reduce the “use it or lose it” temptation.

The only problem with the Roth approach is in today’s market they would be competing with employer-sponsored coverage that is tax free going in (when premiums are paid) and tax free when coming out (when claims are paid). That puts them at an incredible competitive disadvantage. I know you and Pauly have argued against doubling down on mistaken policy (the exclusion for employer-plans), but as a practical matter it is a competitive reality. To make the Roth approach work we also have to fix the exclusion.

Good post.

John,

This may be too esoteric for you, but within Texas Oncology we have been offered a chance to craft a solution to the problem of Medicaid cancer care. The amount of money Texas spends on cancer in the Medicaid population is adequate to cover most recipients yet only about 40% of this population gets good care. The real problem is that the fraction getting the good care are spending more than a commercial patient would because they have to get most of their care in the costly hospital setting instead of in outpatient clinics. To repeat, no new revenue would be needed to give these patients good care…just different rules and access. Of course there is the political problem that we would not be offering “Lexus” care but “Ford” care. You can still get from here to there in a Ford…it’s just not as nice. Some politicians find this unacceptable, but everyone would have the same chance of being cured in our model.

Greg makes a good point. We want the treatment of third party insurance and individual self insurance to be on a level playing field.

So if premiums are deductible, deposits to the saving account should be deductible. If premiums are excluded from taxable income, deposits should also be excluded. If there is a tax credti for premiums, the same tax credit should apply to the deposits — with additional premiums and additional deposits made after-tax. It is in this latter case that the account needs to be a Roth account.

Of course! What about a single all purpose Roth account? It is difficult enough to get people to save effectively for retirement. People only have so much money. Forcing them to decide which account (health or retirement)is inefficient and wasteful. More accounts, more account fees, more hesitancy to make any decision.

Will any of us live long enough to see legislators heed the old say, “KISS”? (Keep it simple stupid.)

There is nothing wrong with savings accounts to help fill the gap below the deductible.

The problem is twofold:

1. The deductible is met, dollar for dollar, plus minimal interest

2. Under current law, the deductible is a set amount, even if the savings account is higher.

In the plan we are working on with Milliman, we have a savings account that is merely a number. It is not money that can be withdrawn, dollar for dollar.

The reason we have this savings account is to assign a multiple to, such as 3.

If we are able to do that, the insured earns 300% on his savings account and accelerates the paid-up coverage under the deductible.

Don Levit

All this is great until one retires. What about some opportunities for those of us who no longer have an employer. Why not allow us to save on a pre-tax basis from our taxable pensions, Social Security, and IRA’s to help pay those expenses not covered by Medicare,such as co-pays, drugs, eyeglasses, etc. Perhaps we would be less of a burden on society, our children or the welfare system and make wiser choices.

Again, I am not opposed to these types of savings. What we are trying to do is to accelerate the savings amount every month , and to provide the coverage on a paid-up basis, with no further premiums due. In order to accomplish this, the reserves must be owned by he insurer, not the insured. In return, the insured gets a paid-up policy underlying the catastrophic coverage, which starts at $25,000-$50,000.

Our plan can be used for a lifetime, so it could coordinate with Medicare.

Don Levit

John, A huge difference in FSA’s vs HSA’s is the pre-determination of contributions under the FSA. You must ‘pre-determine’ your emplyee contribution prior to the year, with some exceptions to add funds upon pregnancy, etc. Due to the use/lose it, many people seriously underfund their FSA and consequently pay more taxes and still have after tax health care services.

The HSA must be set up prior to incurrance of any tax free reimbursement of health care services, may with as little as a $25 account minimum. You can then contribute up to the max AFTER you incure medical expenses, but you must make deductible contributions prior to April 15th.

The basic difference is ‘pre-determination’ vs after the fact health care services paid tax deductibly of tax planning, or just plain savings accounts growth.

I’d sure like to see all these retirement/FSA/HSA/college accounts be merged into one – more people would use them since they would be easier to understand and easier to publicize.

That post explains a great deal. I agree that the exclusion would have to be fixed under the Roth approach.

Excellent column, and I totally agree, why have different requirements, different contributions limits for these accounts. Make it a single account type. Also, Maximum contribution for $2012 to an HSA is $3100, $50 more than in 2011 (whoopee!! Don’t spend it all in one place!)

Some good ideas, and there are plenty of innovators — Don Levit’s post is yet another — that have many of other notions as well. The MLR issue that you (and Roy Ramthun, in your link) have repeatedly warned about is critical. The MLR rule has already driven out many small/medium-sized insurers. It has created a ton of business for accountants and lawyers. And it penalizes any innovator who can lower premiums. A game that has a limited upside but an unlimited downside is not one worth playing, and the moves by all major carriers to isolate their risk businesses are quite logical. They need to be able to hive them off could be before them at any time.

The Big Insurers can wait this out for now, and have. Most smaller innovators, though, cannot afford the sovereign risk. The proclamations of the new Federal regulators will make or break many an idea, and most small companies cannot devote their energies in such an uncertain environment.

A small number of innovators is still pushing in the market, but as a country we should see thousands of young upstarts. The soil is just not fertile at present. Despite (or because of) all the fertilizer.

tdp:

Thanks for updating us on the insurance environment in reaction to the ACA.

Personally, if the AcA passes constitutional muster, it could very well be a demon we will have to deal with.

I believe otherwise, though.

Back in 1986, Blue Cross (and similar insurers) lost ther federal tax-exempt status because they had evolved into their for-profit competitors, and were no longer deserving of the tax advantage.

With the passage of IRC section 501(m), insurers which were 501(c)(3)s amd (c)(4)s had a wake-up call.

Be distinctive, or lose your very reason for existence.

Here we are, 26 years later, and not one insurer I am aware of has truly distinguished itself.

As the IRC refers to, those insurers selling “commercial” insurance no loinger earn tax-exempt status.

What is commercial insurance. It is defined as insurance available commercially.

The solution: provide insurance that is not available commercially.

Different ground rules apply to not-for profits that earn their tax-exempt status.

I have over 30 pages of IRS rulings, papers, etc. which makes this very clear: whether you are an insurer, a museum, or a debt counseling agency, distinguish yourself from your for-profit competitors or forfeit your tax-exempt status.

In order to distinguish itself, an insurer needs to be under different ground rules than commercial for-profit insurers.

It still needs to be solvent in order to pay claims, and not defraud the customer.

But many of the other ground rules simply are not applicable.

Don Levit

I work with small business and the HRA program is great for them because it gives them away to give their employee’s healthcare coverage that they can afford. I combine it with our Renco Direct program. This way it is a win win for both.

Good post. The only issue I have with FSAs at present is that the employer is on the hook for the entire amount when expensed at the beginning of the year. The rules need to change to allow individual ownership of the FSA and portability.

Hello There. I discovered your weblog the use of msn. That is a really well written article. I will make sure to bookmark it and return to read extra of your useful information. Thanks for the post. I’ll definitely return.

Throw a little class wafrrae into the soup, eh Evelyn??We don’t have “private healthcare” here where did you get that idea?The medical system is truly another instance of crony capitalism. We may designate it elsewhise, but as long as a third-party pays- whether that third party is an insurance carrier or a government entity- costs will increase, and quality will decrease .and prices will rise over and above other market sectors The best system would be where a competitive pricing model is allowed (advertising charging rates as well- sorry AMA!); where medical liability insurance is either purchased by a patient at time of treatment, or future legal action is prohibited; and where the individual pays for care directly from their own pocket.That is the best and only solution to the monstrosity under which we presently labor .(What about an insurance that assigns a yearly dollar value to a person .from which that person directly pays all medical costs ..with a split of any remaining funds between patient and insuror? Or patient/insuror/doctor???)Other than such a system, it doesn’t matter much: the crony capitalists- and the AMA- will be the only winners

I do not even understand how I ended up here, however I thought this post used to be good. I do not understand who you might be however definitely you are going to a famous blogger for those who aren’t already. Cheers!

It’s impressive that you are getting thoughts from this article as well as from our discussion made at this place.

My blog – ganhar massa muscular rápido