Report: Hospitals Who Want to Collect Fees should Provide Better Cost Estimates

Historically hospitals have not really had to worry about collect directly from patients. On average patient cost-sharing is only about 3% when patients enter the hospital. Health care providers generally focus on insurance reimbursement. Maybe that is changing with the growing prevalence of high deductible plans. Now hospital patients can potentially owe several thousand dollars depending on whether they’ve met their deductibles and their cost-sharing arrangements.

One complaint about Obamacare is that deductibles have skyrocketed since its inception. To get affordable coverage many people have had to settle for deductibles of $3,000, $5,000 even $7,000 per year. Average deductibles have also increased for employer-sponsored health coverage; about doubling over the past decade — a phenomenon that began long before Obamacare. As a result of higher deductibles, many individuals are essentially paying for much of their medical care out of pocket.

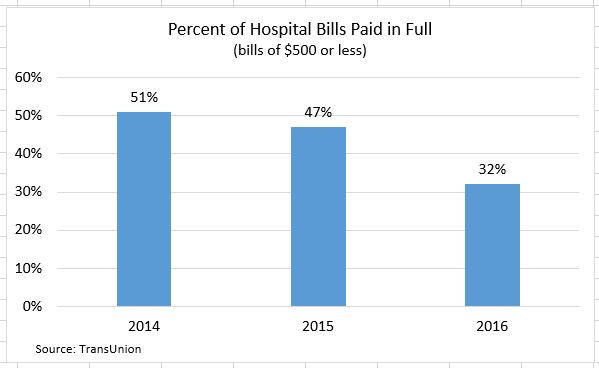

A new report by TransUnion estimates that nearly two-thirds (63%) of patients’ outstanding hospital balances are $500 or less. The consumer credit reporting agency recently found:

- In 2016 68% of hospital patients with bills of less than $500 did not pay the full balance in its entirety.

- This is up 53% in 2015 and 49% in 2014

These bills are presumably outpatient services and patients’ share of the bill after insurance has paid.

- In 2016 about 10% of hospital bills were between $500 and $1,000. Of those, 85% were not paid in full.

- Only a small minority of hospital bills were more than $3,000 but 99% were not paid in full.

Only a few years ago, nearly 90% of patients at least made partial payments on hospital bills. In 2016 this had fallen to around three-quarters (77%). As hospital outstanding debts mount, many hospitals are setting up programs to get patients to pay more of their bills in advance. It is too bad hospital don’t set up programs to lower prices to levels their customers are comfortable paying.

Why are people not paying their outstanding hospital bills? It is not uncommon to have your car need $500 worth of repairs. Presumably, the majority of Americans pay for auto repair when their car breaks down. Maybe a hint can be found in the TransUnion report:

“In just about any retail environment in the U.S., people know how much they’ll pay for something before they buy it. Except when it comes to their health. Patients are often not provided with pre-service estimates because of the complexity involved in estimating healthcare costs.”

The report continues,

“According to one recent study, more than 90 percent of patients felt it was important to know their payment responsibility upfront.”

That last quote should be in the running for understatement of the year! I would argue patients are often not provide pre-service estimates because it is not in hospitals’ self-interest to be transparent in their prices.

The report states it a little more delicately than I am, but it basically says most people (92%) have the capacity and are willing to pay bills of less than $500. Just over half (54%) can and would pay bills that exceed $500. You can infer from the report that Americans would be more apt to pay their outstanding hospital bills if they were “engaged” in advance. That’s a fancy way of saying consumers are generally more loyal and willing to pay their bills when they know what to expect are not blindsided by a bill they did not expect. The article suggests giving patients an idea of bills ahead of time is also an opportunity to get a deposit and collect more of their outstanding fees in advance.

I would argue that competing on the basis of price would also help. It’s not just the unexpected bill that annoys consumers. It’s also the sense that the bill is unfair. After patients leaves the hospital they often receive an undecipherable bill in the mail. Digging through the bill they often find charges of $15 for each ibuprofen and $300 for an admissions kit (Kleenex, a plastic water pitcher and a plastic bedpan). The fact that the hospital then discounts the charges to only $5 apiece and $100 respectively, still does not make consumers excited to pay their remaining share.

The report explores a case study where Arizona-based Banner Health boosted collections by 39% through pre-service estimates and increased collections efforts. Something that all hospitals should take to heart is that pre-care cost estimates not only increases collections, it also increases patient satisfaction. Indeed, the report explains,

“Patients and providers can use effective pre-care cost conversations to create a more rewarding healthcare experience for all.”

The difference is that , if you have insurance, you are only responsible for the allowable amount “negotiated”/set by your insurance provider. Private pay patients face grossly inflated charges that have no basis in reality and are often 1-30 times more than “allowable” values.

Transparent pricing and competition among providers for the healthcare dollar are the only way we will ever get this mess under control.

I don’t think huge tax breaks for billionaires is going to do the trick.

I read an article a while back that claimed some hospitals hare having to price their outpatient services competitively that consumers routinely shop for. The examples were lab tests and MRI’s. There are thing patients ask the price of before agreeing to have the service done.

Decades ago we built an X-ray center because the hospital at that time was permitted to bill 20% on the outpatient portion of the bill rather than what they were being paid. Thus the out of pocket costs for patients on Medicare was very high. We also made the place more convenient and more pleasant.

That changed the hospitals practices and suddenly they accepted Medicare payments and biled the 20% off what Medicare paid. They made things more pleasant and stopped bouncing the patients around making them wait for hospital patients to be taken care of first.

Competition and free markets are a wonderful thing.

Allan, you got that right on competition. When there is one insurance company in PA zip code 28144 Blue Cross charges $19,320 for a 30-year-old couple and 2 children with a $7,150 deductible in 2018.

On Independence Day our new product for this family is only $284.79 per month with a little $2,500 deductible per person.

PLUS, the expensive Blue Cross premium has a deductible that is too high for a tax-free HSA. The smaller premium is perfect for a tax-free HSA and if this young NC family saves $6,750 in their HSA at the bank they will save $2025 if they are in the 30% combined federal and state income tax bracket. The cost of their insurance is only $1,708 for the six months so they save $317 more in taxes than the cost of their insurance. Admit it, this is affordable health insurance.

Closing Question: Would you rather spend $19,320 OR save $317?

Closing Question 2: It’s an IQ test, right?

Ron, the $284 family premium is I assume for short term insurance, which under current law must be re-applied for every 90 days.

The deductibles start all over every 90 days, and if an illness (or pregnancy) started in the first 90 days, then the new application on day 91 would be declined.

In this scenario, the insurance company would virtually never pay a claim. Only healthy families are allowed to buy this plan, so the chance that someone would get cancer in the 90 day span is microscopic. Someone would have to break a leg to get a claim paid.

I disagree as you do with this 90 day limit on Short term medical, but it is current law.

Also some insurers in some states do not permit you to keeping buying a new plan every 90 days.

Bob, I have lost my mind. This zip code is North Carolina.

Starting on July 4th, Independence Day, we start our new program where the consumer may purchase 2 STM programs which will take them till Jan 1st and Obamacare Open Enrollment. There is no additional medical underwriting on the second plan so the consumer is safe. It is hard to stop the free and open markets because freedom finds a way.

You are correct that there is an additional deductible for the second plan. The consumer may drop the deductible to just $250 for accidents for an additional $14 a month.

SO – with accident coverage after the family’s HSA deposit the tax savings is $233 greater than the 6 months of premiums. Bob, be honest with me, who is so broke that they can’t afford to save $233?

I respect that you are trying to take good care of your clients for this year.

However, as of Jan 1 2018 I assume that your clients will face an enormous ACA premium….unless they can keep buying short term medical.

That is depressing.

Heck, I bought short term medical for my wife when she was 63 and one half, and made it almost all the way to Medicare, saving well over $1500 in premiums.

The individual health insurance market has always been a treacherous place for some, where you have to dodge and weave and change plans constantly. Sure hasn’t changed.

Bob, I have been run out of business so many times I can’t count them any more. I answer your questions and show you how the consumer is safe with STM and they save so much in taxes that the savings is greater than the premium which is important in a TIME when premiums are so high that young families are flying naked without insurance on their children.

AND ALL YOU CAN SAY: THAT IS DEPRESSING!

Bob, I’m going to quit talking to you.

Nice article

http://med-school.uonbi.ac.ke

Nice article

http://med-school.uonbi.ac.ke

If you want to read about an aggressive challenge to hospital bills, check out the recent ‘health care reform’ columns on a blog called the Market Ticker.

This writer would make hospital bills utterly uncollectible if there was not a good-faith cost estimate before the care began.

He points out that the car repair industry had to start providing estimates about 15 years ago, and they bitched mightily that it would put them out of business, and of course it has not.

That would be known as “quick-as-hell’ billing reform.

That’s what I’ve (and I believe you) have been saying in past blog posts. There should be a meeting of the minds before a bill is collectable. That would encourage doctors to communicate with their patients ahead of time. If more patients communicated beforehand, some of the egregious charges would probably fall. That’s becoming more common with respect to MRIs when patients ask the price.

I think the hospital is the agent putting all the features of the hospital together so the hospital should be responsible for any unpaid insurance bills not reasonalby discussed with the patient beforehand. Therefore, unless the hospital made it clear to the patient that their anesthesiology department would bill in excess of insured amounts the hospital should be the responsible party to settle these charges with everyone, but the patient.

I agree. There are plenty of other service providers in our economy where one takes the lead and farms out some specialized services to others. In most of these cases, the primary contractor communicates all charges. For instance, I once took my German car to my mechanic. They found an error code for transmission they could not service. They called me and asked permission to take my car to a transmission shop a few blocks away. I agreed and the next day picked my car up at the original shop and paid THEM a reasonable charge. Had the second shop gouged me, my mechanic would have stopped using them. But hospitals don’t seem to care what their contractors charge if they are out of network.

It is a simple fix and as you note is something that widely occurs elsewhere in one form or another.

The difference here is that, with the exception of doctors who are independent contractors with practice privileges, the hospital is the primary contractor generating most of the dollar value of the bill. When I had my ablation in late 2015, NYU billed $220,000 for six hours in the OR and an overnight stay in a cardiac observation unit. Medicare paid $15,700 which was accepted as full payment. The surgeon and anesthesiologist billed an additional $37,000 or so and were paid around $5,000 if I remember correctly.

Even for care that can be scheduled in advance, patients generally have no role in choosing radiologists, anesthesiologists, pathologists and ER doctors whether they are hospital employees or not. Many of these specialists deliberately avoid joining insurance networks so they can bill as much as they want. That’s one reason why they are often collectively referred to as the RAPE doctors and it’s also one reason why patients need protection under the law regarding how much doctors and hospitals can charge for care that must be delivered under emergency conditions.

Is $220,000 for 6 hours an excessive charge? If so then who determines the opinion that it is excessive ? Most would think a $1,000,0000 is not excessive if it was saving their life . What iwould be an excessive charge to save someone else’s life.

I don’t think you can truly have a willing buyer and a willing seller for catastrophic medical care because one party is under duress.

Sir your options are

1. Die today for $10,000

2. Loss of limb for $100,000

3. No loss of limb but years of rehabilitation $1,000,000

4 complete recovery 10,000,000

Alex I would like loss of limb for $100,000 please.

The lifeguard at the beach or pool club who saves you from drowning charges nothing. it’s part of his job for which he’s paid a salary. The volunteer EMT who shocks your heart with the defibrillator and rushes you to the hospital charges nothing. There is a zone of reasonableness that determines charges for everything in our economy or at least there should be.

By your logic, if I come across someone in the desert about to die of thirst and I can save his life by giving him a bottle of water, I should be able to charge $10 million for the bottle of water. Ridiculous.

Your logic is ridiculous. It lacks any understanding of contract law. For payment to be due there has to be consideration and it can’t be unconscionable. Thus $10 million dollar contract isn’t worth the paper its printed on.

There is such a thing as a public good and a life guard at the beach can be considered such an entity. However, understand, we have lifeguards that work in private places like country clubs that have golf courses where people might spend money on golf lessons. If the lifeguard wants to charge someone extra money for each life saved that is the responsibility of the country club not the person whose life was saved. When they advertise their facilities they advertise lifeguards available and that helps provide the facility market share.

Your zone of reasonableness is undefined and therefore based solely upon your whims and not those of the American people. Your whims can be transferred legally into federal law with amendments to the Constitution.

Exactly, Ridiculous. I didn’t say you should I’m saying hospitals are.

The volunteer EMT who shocks your heart with the defibrillator and rushes you to the hospital charges nothing.

Obviously you don’t understand how rural volunteers ambulance service work. I have several of them as clients and they have a problem collecting fees from people they have transported who think like you. The service isn’t free!

You like price fixing, but it doesn’t work. Competition is how prices are kept down. Most expensive medical services can be scheduled even if the incident starts in the ER. Let two hospitals compete on price.

Hospital 1 accepts insurance for all parties involved.

Hospital 2 has significant billing outside of insurance.

Where will the majority of non emergency patients go? Hospital 1 or Hospital 2?

Emergencies go equally to both hospitals

Hospital 2 ends up near bankrupt because #1 is doing almost all the non emergency work plus half of the emergencies while hospital 2 is loaded with empty beds.

Try getting a reliable price quote from either hospital for a surgical procedure that can be scheduled in advance. Then try getting quotes from the surgeon and anesthesiologist. The patient doesn’t even know who the anesthesiologist will be. These are the sorts of procedures most people need insurance to cover. Even if insurance is paying most of the bill, I should still have an interest in a more competitive price coupled with a good outcome because the insurer’s collective claims costs affect my premium. We need price transparency, period.

Of course we need price transparency. That is what many of us have been telling you for a long time, but we need a free marketplace for transparency to be able to work.

I’ve called for price transparency repeatedly since 2006 when I first started participating in healthcare blogs.

Patients and, to some extent, doctors became much more cost conscious in recent years mainly because far more people now have high deductible health insurance plans than in years past.

At my son’s employer, approximately 42% of the U.S. staff now has a high deductible insurance plan coupled with a Health Savings Account. His employer is a pharmaceutical company.

The funny thing is that pharmaceutical companies hate high deductible health insurance plans when they are selling drugs but they like them and embrace them when they are buying health insurance for their employers because, in that capacity, they become a payer, not a vendor / provider.

You have called for controlled healthcare with written price lists that are meaningless unless there is a marketplace where patients can actually choose and significantly benefit. You have stated that price transparency hasn’t worked and we have argued that without a marketplace the price list is meaningless to the patient.

Correction: In last paragraph, I meant to say when buying health insurance for their employees, not employers.

All good points above, but I see one real challenge.

I just got out of the hospital myself, for successful surgery.

Over my 7 days in hospital, including 4 for intensive care due to complications, I was seen by (I would guess) 10 physicians. Some were clearly on the hospital staff, others were probably not.

There were also anestheseologists, pulmonary technicians,etc.

Fortunately I have Medicare plus a supplement, and so basically everyone is in network.

My point however is that if I was a self pay person or stuck in a narrow network plan, the hospital might have had to inform me 30 different times that an extra billing might be coming.

Leave aside the issue that I was doped up on painkillers. If I had been conscious, could I have said no, find me someone in network?

Devon, you have made good points about encouraging price consciousness for outpatient tests. Also for clearly-defined surgical procedures that rarely have complications, like knee replacements, where we are seeing reference pricing be successful.

For anyone in intensive care, the only answer is a firm legal limit on balance billing, along with the legal ability to challenge what might be price gouging.

The meeting of the minds issue is a very important one. However, in an emergency, there is, of course, no time or opportunity for price shopping. The patient may be incoherent or even unconscious. However, the hospitals and doctors should be able to expect reasonable compensation for their services. The question, of course is, what’s reasonable? I’ve suggested in the past that 125% of Medicare is reasonable. Or, perhaps the lowest in network commercial insurance contract rate that the provider routinely accepts as full payment may also be reasonable. Charge the higher of the two.

Obscene and unconscionable chargemaster rates are not reasonable. However, they still have some relevance as part of the formula that Medicare uses to calculate outlier payments for complex patients who need care well beyond what was contemplated by the DRG reimbursement rate that applies to the patient’s disease or condition. That alone gives hospitals an incentive to make them as high as they think they can get away with.

Insurer contract rates should be transparent even though insurance companies have always insisted on maintaining confidentiality mainly because they are afraid that providers that are paid less would insist on receiving the higher rates that the more highly paid providers get. However, there may be very good and appropriate reasons that relate to risk sharing, outcomes quality, and other factors aside from raw market power that can account for rate differentials. I would also suggest that Medicare rates, which are public information, should be made available to patients upon request so they can be used as a benchmark to assess the reasonableness of the rates being charged.

While I know of no hospitals that don’t accept Medicare and most probably also accept Medicaid as well, individual doctors should be free to decline to participate in any insurance contracts. However, they should have to disclose all fees in advance for care that can be scheduled in advance and accept what I would call a default fee set by law for care that must be delivered under emergency conditions when a meeting of the minds is impossible to achieve.

In theory, I suppose, hospitals could insist that all doctors who have practice privileges at their hospital should be required to join the same insurance networks that the hospital has contracts with. However, if the hospital across town is willing to waive that requirement, the big revenue producing doctors will go there to practice so it’s probably just not practical to try to impose such a requirement.

Finally, I would suggest that hospitals and doctors that try to bill unconscionable charges to uninsured and out-of-network patients should ask themselves one simple question which is if you were on the receiving end of these bills, would you consider them fair? If the answer is no, charge something closer to what most people would consider reasonable. It’s not rocket science.

When a person enters the hospital and isn’t carrying insurance the first question we should ask ourselves when discussing “who pays” is why that person doesn’t have insurance. If insurance was available at reasonable cost that means the person was unwilling to pool (share) risk with another and now the pool has to decide how much of the risk they should share with him.

Should we encourage this type of behavior which is probably one of the main reasons for the failure of the ACA? I will state right now that if my fees were guaranteed to be limited to 125% of Medicare I would never carry insurance except maybe an extremely high deductible with lots of zeros. My guess is that if that were the case I would be paying $20,000 for $10,000 worth of merchandise and maybe more.

I agree that unconscionable bills are unconscionable and should be deemed so by the appropriate party, but I also find it unconscionable for the lower middle working class to pay for the affluent because they refused to pool in the first place and spent the money on golf lessons.

Re the theory: “if the hospital across town is willing to waive that requirement, the big revenue producing doctors will go there to practice so it’s probably just not practical to try to impose such a requirement.”

If there is transparency and choice then when that expensive physician gravitates to another hospital patients will choose the less expensive hospital. Therefore, hospitals might use those very special physicians as advertisements to gain more market share that gives them enough profit to pay the extra costs themselves. That is how real businesses work. It is all a matter of how the cake is decorated and who is decorating it, Stalin or Adam Smith. (There are other methodologies as well)

“ask themselves one simple question which is if you were on the receiving end of these bills, would you consider them fair?”

Why don’t you reverse the question and ask that working lower middle class family if it was fair for them to pay higher premiums so that affluent person could get golf lessons in order for him to score better on the golf course.

Allan, everything I’ve read about the uninsured in the past suggests that the vast majority of people who lacked health insurance because they didn’t get it through an employer and weren’t eligible for either Medicare or Medicaid couldn’t afford the premium or thought they didn’t need coverage because they viewed themselves as young, healthy and invincible.

I have no idea who these wealthy golf club members are who deliberately choose to forgo health insurance are or how many of them there might be. I think you would be hard pressed to find a single one though there may be some that would choose a policy with a $50K or even $100K deductible if it were available which would at least presumably entitle them to access to the insurer’s contract reimbursement rates for care within the deductible.

Barry, if that group doesn’t exist then create a law that excludes anyone that has discretionary income to spend that income first on healthcare and then on other things or let them be responsible for the full bill. Those with significant assets will either insure or run the risk of bankruptcy. Those without significant assets can go bankrupt without losing much of anything.

For those good people that need help let them buy into Medicaid or permit them to purchase a normal policy and be subsidized in one fashion or another. Example increase the deductible until the premium is affordable. Then subsidize the deductible.

I suppose I am oversimplifying this, but why not do the following:

Have the government pay for all uninsured hospital care over a number like $10,000.

Pay for this through Medicare, or in some other form of general revenue of the government.

The hospital and all specialists would be paid according to the Medicare fee schedule.

No chargemaster, and no speciaiists billing the highest fee they can get away with.

The person who buys no health insurance pays an extra Medicare tax.

This can be a pure percent of income. The affluent person would pay proportionately more than the poor person.

I like this better than letting people be uninsured and then declaring bankruptcy. I want the hospital to get paid for what they do, which bankruptcy does not accomplish.

Anyone that runs a business knows that they aren’t always going to be paid.

When the government pays those bills >er than $10,000 where is the brake on costs.

NCPA QUESTION: In Indiana zip code 46032 a single parent mother (lawyer) that is 30-years-old with a child can get STM with a $2,500 deductible then 80-20% coverage until $4,000 Out-Of-Pocket (OOP) for $105 a month or $630 for the next 6 months. If she earns $65,000 a year and is in the 30% combined Federal and State Income Tax bracket and she deposits $6,750 into her HSA she saves $2,025 in taxes. In other words, she saves $1,395 more in taxes than the cost of her insurance.

Here is my question: FOX Chris Wallace interviewed Ted Cruz when running for President and Ted said to replace Obamacare he would 1) Sell across state lines, 2) Expand HSAs, 3) Portable Insurance.

Chris Wallace said, “The NCPA says that these ideas will have no effect on getting people with no insurance health coverage.”

That’s right, you heard right. Card carrying Democrat Chris Wallace used the NCPA to say that Ted’s reforms are worthless. I can assure you the above low-cost STM for FAMILY coverage at $105 a month is not available in New York. I can also assure you that we kept track, it was the law, and 43% of all HSAs had no previous health insurance. If the NCPA told Chris Wallace these LIES they were wrong.

What we have is a Liberal Democrat, who has always been an employee his entire life, who has NEVER even purchased health insurance before, being the only schmo that decides the health insurance questions to ask Presidential candidates in the Presidential Debates.

4 minutes

https://www.youtube.com/watch?v=gBHZZbPx0Yw

America, we have been had!

What Wallace said the NCPA said is that selling across state lines “would have minimal effect on expanding access”

I would agree selling across state lines would do little to improve access to health care. Because Everyone already has access to health care.

Too bad Cruz has never sold insurance before because he could have said. Chris You don’t think having low cost underwritten insurance available in New York for the first time in decades would draw people into the Insurance market? Also stop saying health care and health insurance like they are the same thing. they are different you know. These people would have subsides to cover most if not all of their insurance premiums. Now that’s what I call affordable health I N S U R A N C E Chris.

Do you understand now of do I need to get out the Crayons?

If he would have said something like that we could have call Ted Mr. President.

Chris Wallace said, “Health Coverage.”

Ted Cruz said, “Health Insurance.”

Now YOU say “ACCESS” so you can agree with Wallace – nice.

I’m not agreeing with Wallace . Cruz is talking insurance and Wallace is talking about health coverage health care and health insurance like the are all the same thing.

Everyone already has access to health care and health insurance. Can you Name someone who dosent have access in the United States?

The point is Wallace used the NCPA to say that Cruz was wrong about lowering health insurance costs. Clearly, the NCPA would NEVER say that. Granted, Cruz should have shut Wallace down rapidly and he didn’t because he was being way too nice.

Wallace was interrupting Cruz like he always does.

BUT, in America we listen to W-2 employees who have NEVER purchased health insurance in their lives discuss health insurance costs. It’s on every TV channel and also it is every newspaper reporter. I guess we could throw think tanks in there too. All employees who take what somebody else decides to purchase for them.