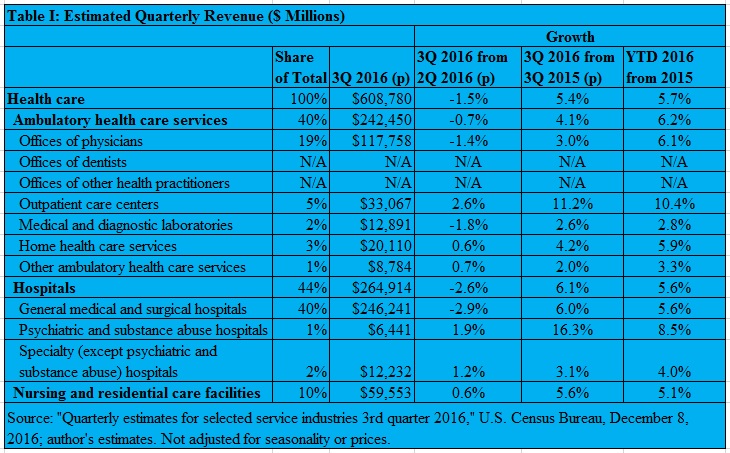

QSS: Health Services Revenue Slides; Hospital Profits Drop

This morning’s Quarterly Services Survey (QSS), published by the Census Bureau, showed a decline in revenues for most health services. Overall, revenue shrank 1.5 percent in the third quarter. However, growth versus Q3 2015 was a strong 5.4 percent and YTD growth is up 5.7 percent.Only outpatient care centers, home health services, other ambulatory services, and specialty hospitals reported growth. Revenue at psychiatric hospitals has grown 16.3 percent, Q3 2016 versus Q3 2015, a remarkable growth which I cannot explain. General hospitals’ revenues have finally begun to shrunk, suggesting they have maximized their Obamacare business opportunities.

See Table I below the fold:

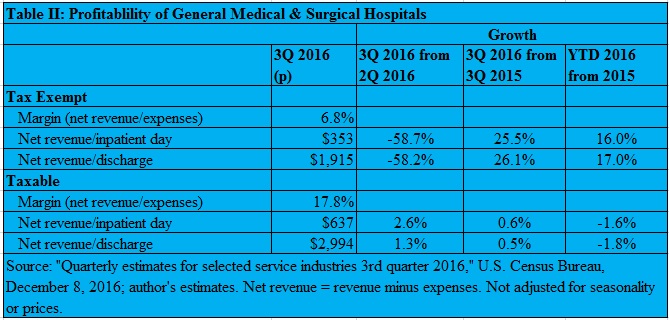

Further, measurements of operating profit at tax-exempt hospitals shrank dramatically: Both net revenue per inpatient day and net revenue per discharge shrank by over 58 percent. However, this is a negative turnaround after recent quarters of explosive growth. Both measurements increased by over 25 percent, Q3 2016 versus Q3 2015, and by over 16 percent YTD. Taxable hospitals’ margins improved a little, but are still pretty flat longer term (Table II).

No wonder hospital lobbyists are working hard to force Republicans to repudiate their commitment to repeal and replace Obamacare. Peak Obamacare has arrived, just in time for a new federal government to implement a new reform.

I find it interesting that for-profit hospitals have a margin (17.8%) that is more than double non-profit hospitals (6.8%). As a former financial manager at a non-profit hospital, I cannot figure out how for-profit hospitals stay in business given the tax disadvantages they have compared to non-profit hospitals.