Consumer Price Index: Amid Disinflation, Medical Prices Increasing

Yesterday’s Consumer Price Index (CPI) release confirmed prices of medical goods and services continue to rise at a steady pace, despite the general deflationary environment. The CPI declined 0.1 percent from July to August (seasonally adjusted), and increased just 0.2 percent in the last twelve months.

Yesterday’s Consumer Price Index (CPI) release confirmed prices of medical goods and services continue to rise at a steady pace, despite the general deflationary environment. The CPI declined 0.1 percent from July to August (seasonally adjusted), and increased just 0.2 percent in the last twelve months.

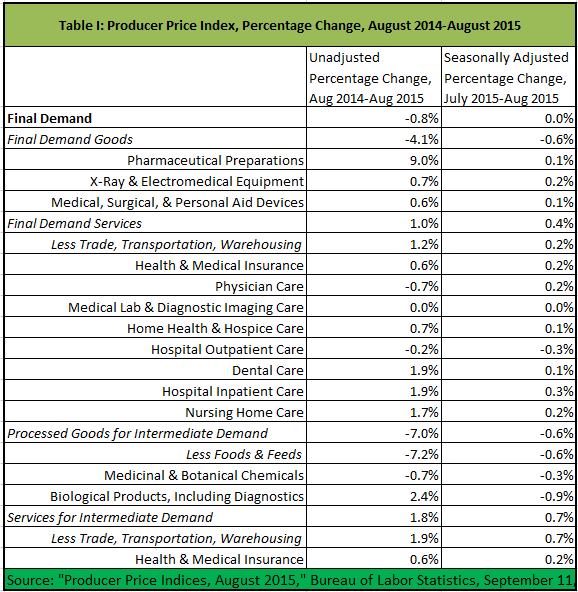

Much of the disinflation is caused by dropping energy prices. Excluding food and energy, the CPI increased 0.1 percent last month and 1.8 percent over the last twelve months. Medical care, although flat last month, increased 2.5 percent over the last twelve months (see Table I). This is moderate by historical standards, but still excessive relative to current CPI.