Out-of-Pocket Costs in the California Exchange

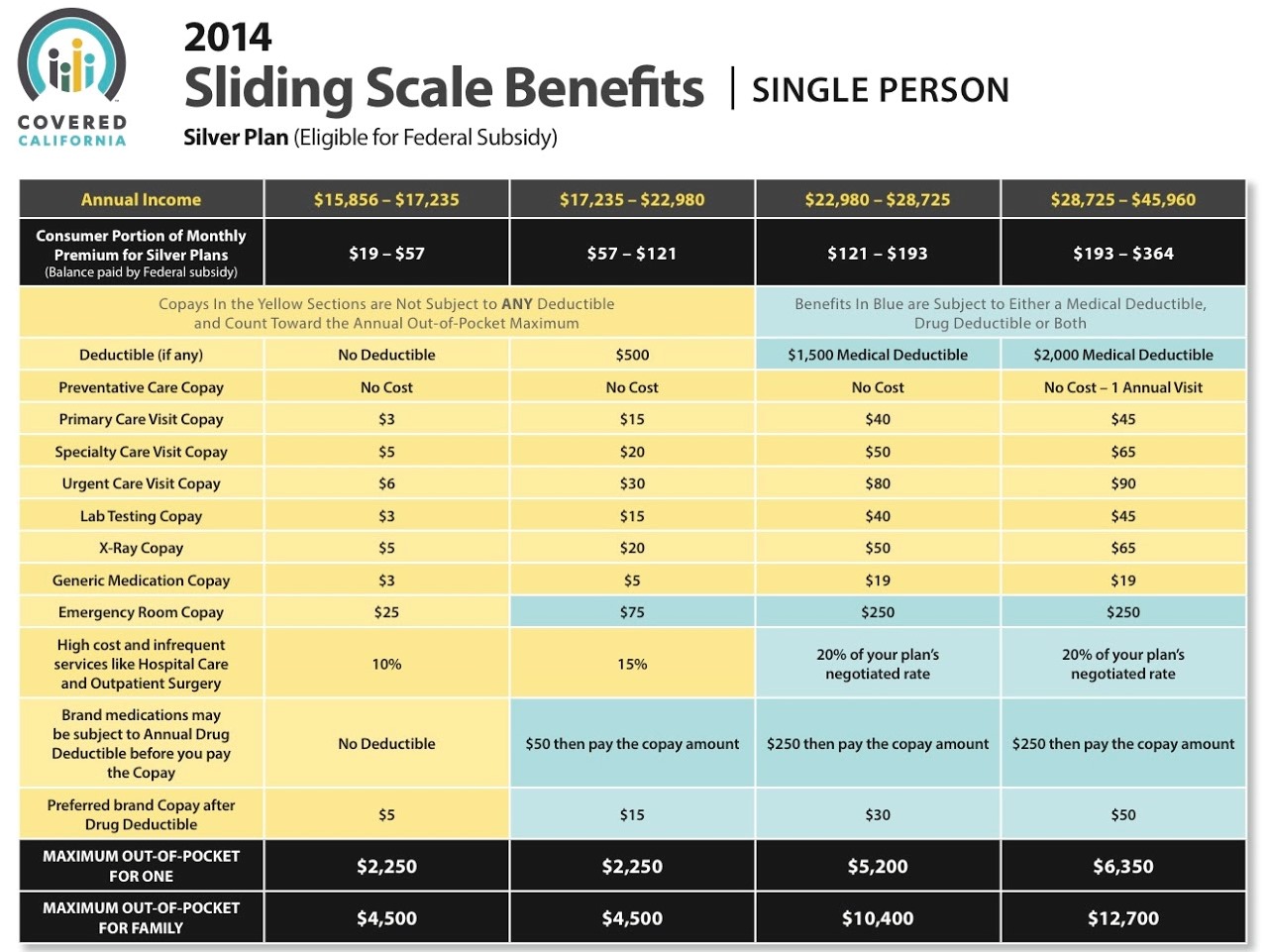

Take a look at the chart above. It was prepared by Covered California, the state-run California exchange and comes to us courtesy of Robert Laszewski. It reflects a pattern I’ve noticed that is common in the small employer market and that I wrote about in Priceless.

Traditional insurance theory holds that patients should pay out of pocket for expenses that are small and over which they have a great deal of discretion. Insurance, on the other hand, should pay for expenses that are large and over which patients don’t have a lot of discretion. The insurance above turns that theory on its head.

Patients who choose this “Silver Plan” will make only nominal copayments when they see a doctor, get a blood test or an X-ray exam ― activities that are usually discretionary and the source of a great deal of unnecessary care. But if they go into a hospital (where patients have almost no control over what is done or what anything costs) they will be charged from 10% to 20% of the total bill. For an individual earning only a few thousand dollars above the poverty level, a hospital visit will cost $2,500. For a lower-middle income patient, the charge will be $6,350. A moderate income family can end up paying hospital expenses of $12, 500 ― every year!

Clearly this plan will be attractive to people who don’t plan to enter a hospital (the healthy) and unattractive to people for whom a hospital stay is likely (the sick). It is consistent with our long-held prediction: In an insurance exchange (or in any managed competition setting), insurers will try to attract the healthy and avoid the sick. And after enrollment, they will subsidize the healthy at the expense of the sick.

Very interesting…

This is yet another piece of evidence – in a long line – that demonstrates that the community rating in Obamacare is not overcome by the risk corridors and re-insurance that are supposed to mitigate adverse selection

I have received e-mail invitations to webinars from vendors who think I am a health-insurance executive or broker, and are selling data-analysis software to really dig in to patient profiles. I suspect that many vendors have developed sophisticated analytic packages designed to help insurers weed out the sick and likely to be sick.

I think the plan would also be attractive to young people, for whom a hospital visit is only a catastrophic event.

Hopefully its only a catastrophic event, but some young people I know have a tendency to make catastrophes routine.

Which is why I don’t feel bad about them paying what they will under ACA. When they do get hurt it will be big, so might as well pay it off beforehand.

It hardly seems fair to tax someone for the possibility of using a benefit.

We do it with police and fire services, why not healthcare?

I just want to point out that things like this place further disincentives on earning a higher income.

As if you need an incentive for a higher income besides the income itself…

Its a curve, dontcha know?

As aggregate marginal income tax rates rise, the tax rate on your last dollar of earned income the reward for working is decreased, and more importantly the opportunity cost of not working is also decreased. People have less incentive to work more, harder, or faster, and so they don’t.

Lessening the productivity of any worker, be he making $30k or $300k, is not good for the economy.

But Obamacare actually makes things worse than all that. Due do the complicated system of subsidies and phaseouts, at certain places called notches, the marginal tax rate can exceed 100%, which is a tremendous disincentive to work. You may think this hits the 1%ers and it is not a big deal, but actually it hits people of relatively modest income. People earning 20 or $30k a year, depending on their family type and collection of federal benefits, can end up with marginal tax rates in excess of 100%. That certainly is a tremendous disincentive to work.

I thought the point of this was the use the healthy to help the sick, not the other way around?

How often does the government achieve what it sets out to do in legislation?

Traditional insurance theory holds that patients should pay out of pocket for expenses that are small and over which they have a great deal of discretion. Insurance, on the other hand, should pay for expenses that are large and over which patients don’t have a lot of discretion. The insurance above turns that theory on its head.

Yes, but insurance theory also assumes that insurers can charge premiums that are adjusted for risk. In the California exchange insurers cannot charge risk-rated premiums.

Maybe a way to discourage sick people is to make them afraid they will be out thousands of dollars. Conversely, a way to encourage healthy people is to offer them amenities like doctor visits for free.

First dollar coverage appears to be predicated on the assumption that preventive care will reduce health care costs. But avoidable, unnecessary doctor visits account for quite a bit of rising health care costs.

Rationing and reduced access is the only way to make that kind of system work.

Wait a minute. This is madness. A doctor will need to know what your income is in order to know how much of a copay to charge?!?! How the hell is that going to work?

I thought the metal plans were all imposed by ACA, not designed by insurance companies. While I don’t disagree that any rational insurer will design plans to avoid anti-selection, does it apply in this situation?

I found a great book that covers the strategies and details of the health care law in a question and answer format – The Best ObamaCare Guide.

Do people really believe that if a family either chooses not to purchase health insurance or cannot afford the premiums, that outstanding hospital and doctor bills will actually be paid? Therefore, the doctors and hospitals remain at risk for losing more money.

Hmm it seems like your blog ate my first

comment (it was extremely long) so I guess I’ll just sum it up what I

submitted and say, I’m thoroughly enjoying your blog. I as well am an aspiring blog blogger but I’m still new

to the whole thing. Do you have any helpful hints for

inexperienced blog writers? I’d genuinely appreciate it.

Also visit my blog post shop fitting hertfordshire (Jonas)