ObamaCare’s War on Marriage

First marriages are taking place later in life. And, increasingly, couples are opting out of marriage entirely. Living together prior to marriage — or as a substitute for marriage — is about 15 times more common today than it was 50 years ago. About half of all women of childbearing age have lived with a romantic partner prior to marriage. This figure approaches three-quarters of women in their 20s. Social conservatives may dismiss this as a case of waning morality — morally-challenged couples shacking up rather than entering into holy matrimony. Yet the reasons could be partially economic.

The decline of marriage may be partly due to so-called marriage penalties in the federal tax code, and in government welfare programs. You can add another penalty to the list: the ObamaCare exchange marriage penalty.

A centerpiece of ObamaCare is the establishment of health insurance exchanges where qualifying individuals can purchase subsidized, individual health insurance. However, these exchange subsidies — which are based on the federal poverty level (FPL) — are far more generous to cohabitating partners than to married couples.

The reason cohabitating couples fare better than married ones is because the federal poverty level does not rise proportionally with the number of individuals in the family. For example, the poverty level is $11,490 for an individual, but only increases to $15,510 for a married couple — just $4,020 more. Thus, two unmarried individuals living together qualify for larger federal subsidies than they would if they were married.

But you say it’s time

We move in together;

Raise a family of our own,

You and me.

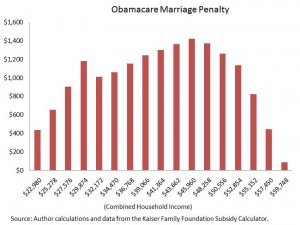

Consider the example of two young lovers moving in together to share expenses, each earning 200 percent of the FPL (about $22,980 annually). This is how cohabitation often starts; it’s a financial marriage of convenience — minus the marriage. If that same couple were to marry, their combined household income of $45,960 would rise as a percent of the poverty level from 200 percent (individually) to 296 percent for a family of two. Tying the knot boosts their family income on paper, but has the opposite effect on their bank account. For example:

- Individually they would each qualify for a subsidy of about $1,087 each, or $2,174 per household.

- If that same couple were to marry, their combined subsidy would fall to $753.

- Thus, getting married would cost them $1,421 annually.

It gets worse. Living together also increases the likelihood of raising children without the security of marriage. Government surveys find that about one-in-five women who begin cohabitating for the first time become pregnant within a year — a figure that doubles for some segments of the population.

Few people would argue that children don’t benefit from the stability that marriage provides a family. Yet if the cohabitating couple mentioned above were to have a child together, the Tax Policy Center estimates they would suffer an additional marriage penalty of $2,672 per year in higher taxes as a result of their decision to get married (although their ObamaCare exchange penalty would fall by $456). If the single mother applies for food stamps reporting only her own income and her and her child as her family size, she would likely qualify for an additional $1,800 in annual food stamp assistance unavailable to her if she was married. It is a reasonable bet that $5,437 (the combined marriage penalty worth about $453 per month) is a large enough financial incentive to make many couples like this hesitate about marriage.

The ObamaCare marriage penalty especially discourages low-to-moderate income cohabitating couples from marriage. National statistics already show cohabitating leads to marriage far less often among low-income couples than wealthier, more highly educated ones. Low-to-moderate-income couples who cohabitate are about twice as likely to forgo marriage as couples with a bachelor’s degree. This may be because the tax penalities take a bigger bite out of lower income couples’ budgets, discouraging a trip down the aisle.

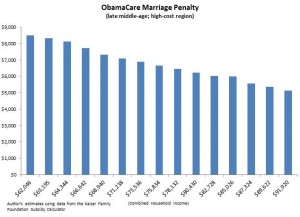

It’s not just young, moderate-income couples who experience ObamaCare marriage penalties; older couples, and those with a middle-income can as well. Exchange subsidies are a function of both income and premiums, which vary by age and region of the country. Thus, married couples whose combined income surpasses 400 percent of poverty will receive no subsidy, when their individual incomes would qualify for a generous subsidy. In some instances where middle-aged couples live in high-cost regions, their marriage penalty can approach $7,000 or more.

Increasingly, many couples may decide a marriage license is a luxury they cannot afford.

Great song pairing.

That’s only one part of the marriage penalty from PPACA.

Take a couple, if they are married, the “affordability” provisions look at “household income”.

And, “affordability”, with respect to employer-sponsored coverage only looks at the cost of coverage for the single tier – such that those offered “qualifying” employer sponsored coverage, generally do not qualify for taxpayer financial support in public exchanges.

I initially focused on moderate-income couples because they is where calculations for the federal poverty level are known to impose high marginal tax rates. Also, that is arguably where a marriage penalty could affect young couples’ behavior at the margin.

However, because the exchange subsidy phases out entirely at 400% of poverty, it appears the biggest losers will be older married couples who reside in high cost areas.

“Social conservatives may dismiss this as a case of waning morality — morally-challenged couples shacking up rather than entering into holy matrimony. Yet the reasons could be partially economic.”

People respond to incentives. I would say that waning morality is much more of a result of changing incentives than a change in people.

True, society doesn’t make women need a man anymore, decreasing the disincentive to what some would call “immoral” behavior.

Now, we have:

“Thus, two unmarried individuals living together qualify for larger federal subsidies than they would if they were married.”

Actually incentivizing change in the social structure. For as much as we can cheer eliminating restrictive social norms we can decry the erection of new ones. If two people make the decision to get married, why would we keep them from it?

An additional burden to taking “the leap”. We are likely to see a marriage become a relic.

Will this lead to change in attitude of The State as your family?

That is interesting question. Although there are too many variables to say for sure, that is a more likely outcome than it was before this.

Now THAT’S a scary thought!!!

I agree, I’m trying to come up with a reason why that wouldn’t be an inevitability given that these trends continue. Aren’t we seeing similar things in Europe where the family structure is more eroded than ours?

With such savings extended over a period of years mom and dad might start including this type of advice to their children being sent off to school.

If things like this continue, I would expect to see social norms change.

Yes, I can almost imagine my mother saying this now.

“Sally, when you go off to college and meet a nice young man, and decide you want to spend your life with him, don’t feel like you have to save yourself for marriage.

Just live together until the novelty of domestic life wears off. That way, you won’t suffer a marriage penalty — or have to bother with divorce!

Just think of your first cohabitation like a starter marriage that will end quickly once you’re away from college.

But as with all temporary living arrangements, be careful not to take on any long term commitments, like debts, mortgages, a dog or children”

That seems to be the direction the state is pushing us towards. The state finds both religion and marriage to be unnecessary competition. The state wishes the religious or matrimonial bond to be only a monogamous bond with the state until death do YOU part.

Devon,

According to the Nations Vital Statistics System:

http://www.cdc.gov/nchs/nvss/marriage_divorce_tables.htm

Notwithstanding that our legislation and the tax codes must be fair and equitable, and that our legislators continue to have the authority to alter said law, upon consensus, … you are correct, the annual ratio of U.S. marriages has decreased by 4% over the last 10 years; however, the ratio of U.S. divorces has decreased by 10% over the same period.

Are you as eager to draw a casual conclusion that ‘ObamaCare Reduces Divorces’ as you have by implying that ‘ObamaCare Decreases Marriages?

After reviewing the data, a more reasonable statement might be to say that the incidence of marriage contracts is proportional to economic conditions.