Obamacare’s Effect on Employers’ Health Costs

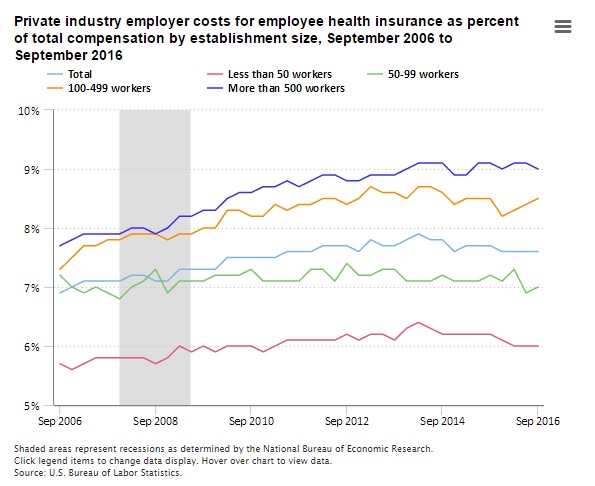

The Bureau of Labor Statistics has published a chart showing how health benefit costs among private employers have increased over the past decade. The chart shows health benefits increased from 6.9 percent of total compensation in September 2006 to 7.6 percent last September. The 0.7 percentage point absolute increase is a relative increase of ten percent.

The chart shades the period of the Great Recession, (December 2007 through June 2009), after which health benefits as a share of total compensation really jumps. This is counter-intuitive, because health benefits are stickier than wages, so would normally have shrunk as a share of total compensation as wages caught up.

President Obama signed the Affordable Care Act in March 2010. It is hard to determine the ACA’s effect at any single point after that, because its regulations dripped out over the years. The exchanges, which heavily subsidized individual health insurance, began providing coverage in January 2014. The establishment of exchanges would have encouraged employers to “dump” their employees into them.

The law inhibited this through a mandate on employers of 50 or more workers to offer “affordable” health coverage. However, the Administration delayed enforcement of this mandate until 2015 for employers with 100 or more workers and until 2016 for those employing 50 to 99 workers. Employers of fewer than 50 workers do not bear the mandate.

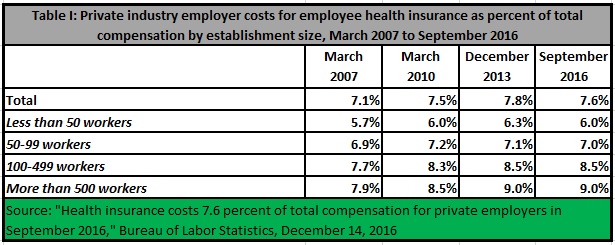

Table I breaks down health benefits as a share of total compensation among employers of various sizes, at certain inflection points: A baseline measurement exactly four years before Obamacare was signed, the month Obamacare was signed, the month before exchange coverage began, and the latest measurement.

For small businesses which do not bear the employer mandate, health benefits as a share of total compensation climbed at a steady rate until the exchanges opened for business. Then they dropped from 6.3 percent to 6.0 percent, a relative decline of almost five percent. This suggests small businesses have had some success in socializing their employees’ health costs by sending them to the exchanges for subsidized coverage.

Overall, Obamacare appears to have increased employers’ costs, but not catastrophically. The report notes: “Private industry employer costs for health insurance have not been lower than the current 7.6 percent of total compensation since March 2011, having reached a peak of 7.9 percent of total compensation in March 2014.”

However, other sources note total health costs have increased even more, because employers have shifted a greater share of premium to employees. According to the Kaiser Family Foundation (which includes government and private employers in its survey), premiums have increased 58 percent from 2006 to 2016. Workers’ share increased 78 percent, which employers’ share increased just 51 percent.

In itself, this is not a problem, because it is a myth that employers bear any share of employees’ wages. Employees bear all the cost of their employers’ share of health benefits through foregone wages. Nevertheless, Obamacare’s failure to achieve its goal of reducing health costs is increasingly obvious from the Administration’s own agencies’ data.

Do you believe these numbers?

Obamacare Propaganda Alert: MIAMI (AP) – “most consumers can find plans for less than $75 a month.”

http://www.fox35orlando.com/news/224661608-story

(In Tampa a 55-year-old woman and child is $728/month for the cheapest HMO with a $7,000 deductible. $75 a month is a LIE!)

Which government numbers are we to believe?

Ron — I assume the feds mean $75 per month to be paid by the insured member with the rest covered by federal subsidies. With the subsidies based on the cost of the second cheapest silver plan in the market, the bronze plans with their much higher deductibles are presumably considerably cheaper. It’s conceivable that the $75 per month number is in the ballpark for single coverage assuming the purchase of a bronze level plan. No?

Barry ,

It’s a lie period. Subsidies do not change the cost of the insurance. The cost is s fixed price. The government is using missleading sales tactics that agents would loose there license if they did it. The price of the product does not change the only thing that changed is how much the tax payers are fleeced for an insurance plan. If you can call it insurance.

Lee,

What counts to the individual is the amount they are paying out of pocket for the insurance plan. They don’t care how much is paid in subsidies by someone else on their behalf. How much more they could have paid themselves is an open question. However, it’s quite likely that if they had to pay the full cost, they couldn’t afford to and would have been or remained uninsured. So, the issue becomes how do we cover people who can’t afford the premium on their own even if they can pass underwriting. The other issue is how do we pay for high risk pools to subsidize people who can’t pass underwriting. Or should we just let them remain uninsured and rely on private charity if they can find it? I would like to see everyone covered one way or another except for illegal immigrants.

Barry,

Ron said the gov was lying because most people can find a health plan for less than about $75 a month premium. That is a lie. The premium is much more.

As far as everyone covered. Where do you stop. Why dosent everyone have a home? Electricity, hot running water, milk , soda, beer, whisky,cigarette, cell phone,cable tv? Health care is a service. If one service is subsidized then why aren’t all services subsidized?

I would say subsidies increase the cost of the insurance, because they relieve consumers of some of the cost. Vendors take that into account when pricing.

I thnk the general taxpayer subsidizes Part D to a tune of 74% plus an additional 11% from the states leaving only 15% of the costs for those receiving the benefit. Knowing per capita seniors purchase more pharmaceuticals than any other group, wouldn’t that add up to a tremendous increase in price?

Barry,

The politicians are still trying to fix this mess good luck.

Here are the high risk pools you are wanting..

to bad no companies will be in the market by 2018 and the costs will skyrocket but better late than never I guess:)

Proposed HHS Notice of Benefit and Payment Parameters for 2018

The proposed HHS Notice of Benefit and Payment Parameters for 2018 released today proposes standards for issuers and each Health Insurance MarketplaceSM[1], generally for plan years that begin on or after January 1, 2018. The Marketplace continues to play an important role in fulfilling one of the Affordable Care Act’s core goals: reducing the number of uninsured Americans by providing access to affordable, quality health insurance. As of the end of March 2016, about 11.1 million people had health insurance coverage through a Marketplace, almost a million more than at that point in time the previous year.

The proposals in this proposed rule include improvements to the risk adjustment program that will strengthen its ability to protect consumers’ access to high-quality, affordable options in the individual and small group markets, as well as other changes that will streamline the Marketplace consumer experience and the individual and small group markets as a whole. The actions in this proposed rule build on other actions CMS has taken to strengthen the Marketplace in recent months, including a recent request for information (RFI) seeking public comment on concerns that some health care providers and provider-affiliated organizations may be steering Medicare or Medicaid enrolled or eligible people into a Marketplace qualified health plan (QHP) to obtain higher reimbursement rates[2]; the announcement of a new outreach strategy targeting young adults[3]; and beginning implementation of the special enrollment confirmation process to ensure eligible individuals have access to coverage while preventing misuse of the system[4].

This fact sheet highlights certain elements of the proposed rule. In addition to the elements described below, we also seek comment on other ideas to improve the risk pool, such as clarified coordination of benefits rules, grace period policy, specifying a certain amount or percent of user fee revenue for education and outreach, and whether and how to further support the transition of former Pre-Existing Condition Insurance Plan (PCIP) Program enrollees into the Marketplace to ensure that they do not experience a lapse in coverage.

Risk Adjustment Model Recalibration

Accounting for Partial Year Enrollment: We are proposing to incorporate partial year adjustment factors in the adult risk adjustment model to address feedback that the existing model underpredicts claims costs for enrollees who are enrolled for only part of the year. We are proposing to incorporate the partial year adjustment factors in the adult 2017 and 2018 benefit year risk adjustment models, as we previously indicated in guidance.[5]

Incorporating Prescription Drug Utilization: We propose to use prescription drug utilization data to improve the predictive ability of our risk adjustment models beginning for the 2018 benefit year. By using prescription drugs to impute missing diagnoses and to indicate the level of severity of a health condition, we will better account for the health risk associated with insuring individuals with certain serious health conditions.

High-Cost Risk Pool: We propose to modify the treatment of high-cost enrollees in the model to improve the model’s ability to better predict risk for issuers who enroll sicker-than-average enrollees, better protecting access to high-quality, affordable coverage and improving protection for issuers with enrollees that have unpredictably high costs. Specifically, we propose to create a pool of high-cost enrollees where an adjustment to issuers’ transfers would fund 60 percent of costs where individual costs are above $2 million.

Publication of Final Coefficients: We propose to issue final 2018 benefit year coefficients prior to the 2018 benefit year risk adjustment calculations using the most recently available MarketScan® data, likely in the early spring of 2019. We would continue to finalize the underlying risk adjustment methodology used to arrive at the final coefficients in the final Payment Notice. Publishing the final coefficients closer to the calculation of risk adjustment for the 2018 benefit year would provide for risk adjustment coefficients that reflect the most current data available for the applicable benefit year.

Future Recalibration: We propose to use data from external data gathering environment (EDGE) servers, the systems issuers use to submit data for the risk adjustment and reinsurance programs, to recalibrate the risk adjustment models beginning for the 2019 benefit year, which would improve model accuracy. We would use a masked enrollee-level dataset from the EDGE server to recalibrate the risk adjustment models and inform development of the Actuarial Value Calculator and risk adjustment methodology, which HHS releases annually. The dataset would use masked enrollee IDs, and would not include the identity of the geographic rating area, state, plan, issuer, or the EDGE server. We believe this dataset would also be a valuable tool for deepening understanding of the evolving Marketplace and driving innovation.

Risk Adjustment Data Validation: We also propose several amendments to the risk adjustment data validation process, including proposals related to the review of prescription drug data, random sampling for issuers below a certain size, and the establishment of a discrepancy and administrative appeals process.

Payment Parameters

FFM User Fee for 2018: We propose to charge a Federally-facilitated Marketplaces (FFM) user fee rate of 3.5% of premium for the 2018 benefit year. This user fee rate is the same as the rate for each year from 2014 through 2017 benefit years. We propose to charge issuers operating in a State-based Marketplace on the Federal platform (SBM-FP) a user fee rate of 3% of premium for the 2018 benefit year. We also seek comment on how much user fee funding to devote to outreach and education to help ensure robust enrollment in the Marketplace.

Premium Adjustment Percentage: This percentage generally measures the average health insurance premium increase since 2013, based on the most recent National Health Expenditures Accounts projection of per enrollee employer-sponsored insurance premiums. The premium adjustment percentage is used to set the rate of increase for three key parameters: the maximum annual limitation on cost sharing, the required contribution percentage for eligibility for a certain exemptions under section 5000A of the Code, and the affordability percentage for calculation of assessable payment amounts under section 4980H(a) and (b) of the Code. For 2018, we are proposing a premium adjustment percentage of approximately 16.17%, reflecting an increase of 2.6% from 2017.

Annual Limitation on Cost Sharing: The maximum annual limitation on cost sharing is the product of the dollar limit for calendar year 2014 ($6,350 for self-only coverage) and the premium adjustment percentage for 2018, rounded down to the next lower $50. We are proposing a maximum annual limitation on cost sharing for 2018 of $7,350 for individual coverage and $14,700 for family coverage.

Stand-alone dental plans (SADPs) related to the annual limitation on cost sharing: Under our rules, the annual limitation on cost sharing is established for plan years through 2018, and then indexed to the consumer price index (CPI) for dental services thereafter. Therefore, this rule proposes maintaining the dental annual limitation on cost sharing at $350 for one child and $700 for one or more children.

Plan Benefits

Bronze Plans: To permit greater flexibility in benefit design and to accommodate potential future updates to the Actuarial Value Calculator, we propose to permit a broader de minimis range for the actuarial value of bronze plans when the plan covers services before application of the deductible.

Standardized Options (Simple Choice plans): In the 2017 Payment Notice, we finalized six standardized options (also now referred to as Simple Choice plans) for 2017, one at each of the bronze, silver, silver cost-sharing reduction variation, and gold levels of coverage based on analysis of 2015 enrollment-weighted FFM qualified health plan (QHP) data. For 2018, we propose updated standardized options, based on a similar analysis of enrollment-weighted 2016 individual market FFM QHP and also SBM-FP QHP data. Additionally, recognizing that issuers in some states were unable to offer standardized options due to the requirements of certain state laws on cost sharing, we propose a larger number of standardized options, with the intent that at least one standardized option in each level of coverage will comply with State requirements. Each State would still only have one standardized option at each level of coverage. We also propose a standardized health savings account-eligible bronze high-deductible health plan option that would comply with IRS Health Savings Account rules.

Network Breadth: In the 2017 Payment Notice, HHS finalized a policy to provide information about QHP network breadth on HealthCare.gov, in order to assist consumers with plan selection. For the 2017 benefit year, we intend to pilot a network breadth indicator in a number of States on HealthCare.gov to denote a QHP’s relative network coverage. For the 2018 plan year, we are proposing to incorporate more specificity into these indicators by identifying for consumers whether a particular plan is offered as part of an integrated provider delivery system. We also seek comment on whether there are additional steps we can take to limit surprise bills for consumers building on the requirements set forth in the Notice of Benefit and Payment Parameters for 2017.

Eligibility, Enrollment, and Benefits

Special Enrollment Periods: We propose to codify several special enrollment periods that are already available to consumers in order to ensure the rules are clear and to limit abuse. We also seek comment on policy or outreach steps we could take related to special enrollment periods that would help strengthen Marketplace risk pools by helping more eligible individuals enroll and preventing abuse by ineligible individuals.

Direct Enrollment: We propose a number of consumer protections around the direct enrollment channel, though which web-brokers and issuers may enroll consumers directly. For instance, we propose that these direct enrollment entities must demonstrate operational readiness and compliance with certain requirements prior to their Web sites being used to complete QHP selection, and provide differential display of standardized options. We propose that web-brokers must display certain information relating to advance payments of the premium tax credits prominently, and permit enrollees to select a particular APTC level, requirements that already apply to QHP issuers engaged in direct enrollment. We also propose that web-brokers engage in certain post-enrollment assistance activities. In addition, we propose to allow third parties to perform monitoring and oversight over web-brokers, to ensure compliance with our direct enrollment requirements.

Binder Payments: We propose to give Marketplaces the discretion to allow issuers to implement a reasonable extension of the binder payment deadlines when an issuer is experiencing billing or enrollment problems due to high volume or technical errors.

Market Reforms

Child Age Rating: We propose updates to the child age rating structure to better reflect the health risk of children and to provide a more gradual transition when individuals move from age 20 to 21. Specifically, we propose one age band for individuals age 0 through 14, and then single-year age bands for individuals age 15 through 20, effective for plan years or policy years beginning on or after January 1, 2018. We also propose child rating factors that, overall, are higher than the current child factor and more accurately reflect health care costs for children.

Reassessment of the 5-Year Ban on Market Reentry upon Withdrawal from a Market: We propose several changes to our guaranteed renewability regulations that would address instances where issuers may inadvertently trigger a market withdrawal and 5-year ban on market reentry. In these select instances, we believe is it appropriate to allow issuers to remain in the applicable market, and believe allowing so will improve the choice of plans available to consumers. We propose that, for purposes of guaranteed renewability, a non-grandfathered product may be considered the same product when offered by a different issuer within an issuer’s controlled group, provided it otherwise meets the standards for uniform modification of coverage. We also propose that an issuer may replace all of its existing products with new products without triggering a market withdrawal, as long as the issuer matches new products with existing products for purposes of rate review.

MLR Rebate Impact on New and Growing Issuers: We propose to expand the medical loss ratio (MLR) provision allowing issuers to defer reporting of policies newly issued with a full 12 months of experience (rather than policies newly issued and with less than 12 months of experience) in that MLR reporting year, and to limit the total rebate liability payable with respect to a given calendar year in certain situations.

Goodman weasel alert: Dr. John Goodman, a conservative health policy expert who leads the Dallas-based Goodman Institute for Public Policy Research, doesn’t have high hopes that Republicans advocating for a “repeal and delay” approach will ultimately deliver needed change.

He also noted Republican plan to essentially defund Obamacare using a tool called budget reconciliation, which requires only a simple majority and allows them to skirt around passing actual replacement legislation.

“It’s not that I’m critical of the repeal. I’m suspicious of the delay,” said Goodman, who is an advocate of the Sessions-Cassidy proposal. “I’m afraid ‘delay’ is a weasel word and we may never get the repeal.”

Lee, thanks for posting the latest bulletin from the Titanic, i.e. the CMS tinkering with the drowning ship of the ACA.

I note that the health care exchanges continue to be awarded 3.5% of all premiums.

That is a hell of a lot of money. And yet, there is poor service in some areas, and in MN the exchanges are very late in advancing tax credit money to insurers.

My office has frequent contacts with our state exchange, and I certainly see no one getting rich over there. Where is the money going?

Also, a brief note — this announcement does not really create a high risk pool for the public. It references some sort of reinsurance for claims over $2 million, that is all.

Bob — I’m wondering if you or Ron or Lee know how many claims above $2 million there are for the commercially insured population nationwide and what percentage of total medical claims those ultra high cost cases account for.

I also wonder what those statistics look like for the Medicare and Medicaid populations but at least for those populations, there is little or no effect on what those folks are asked to pay in premiums of their own pockets except for Medicare Part B and Part D premiums (25% of program costs for most beneficiaries and considerably more for those subject to the IRMAA surcharge).