Myth Busters #15: Easy-to-Understand Health Insurance?

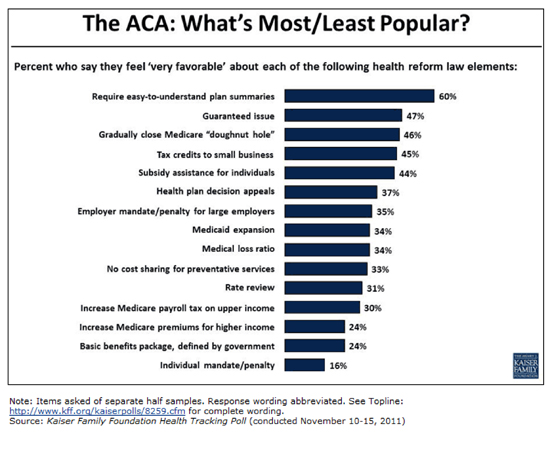

I was hit between the eyes by a recent essay by Drew Altman, president of the Kaiser Family Foundation. This item was the latest in his “Pulling it Together” series, and it looks at the most and least popular provisions of Obama’s health reforms, as measured by the KFF’s monthly tracking poll.

He is surprised (as am I) that far and away the most popular provision was “require easy-to-understand plan summaries.” Sixty percent of respondents were “very favorable” toward this provision, while none of the other elements gained the support of more than half.

The reason this finding hit me is because this is exactly what I was hired to do back in 1979 at Blue Cross Blue Shield of Maine. I didn’t know or care anything about health care until then. I was running the Maine Public Interest Research Group (PIRG) at the time and we were far more focused on housing, transportation, urban renewal, lemon laws and the like.

But the legislature passed a “plain language” law requiring health insurance contracts to be written so an average six grader could understand them as measured by the Flesch Tests. Similar laws were enacted in a whole lot of states. Blue Cross needed someone who could write plainly and still understand the legal requirements of a contract, and I got the job.

That was almost 33 years ago! And we are still wrestling with the same problem today? Are problems ever solved in this business? What is going on here?

Some cynics will say that evil health insurers don’t want people to know what is in their benefits so they purposely make the contracts incomprehensible. But this is just stupid. Medicare has exactly the same problem. California Health Advocates published a chart explaining Medicare benefits as simply as it is possible to do and it is still incomprehensible. Get a copy of the current “Medicare and You” booklet and tell me how easy it is to understand.

The fact is that health insurance is complicated because health care is complicated. Congress may think it can wave a magic wand and declare that it should be simple, but that is like passing a law that declares ice should not be so damned cold.

Suppose you are the insurer and I am the patient. My doctor tells me I need an MRI. You have to pay for it. How much will you pay? I might decide to get it in a hospital, in a doctor’s office, or at a free-standing radiology center. Each may charge a different fee, in part because each has different overhead costs. Will you pay the same amount regardless of the charge, or will you pay the full charge? Will you need some kind of verification that my doctor ordered it, or will you let me go get the test on my own whim? Will you need some proof that the test was actually done, or will you just pay the claim as it comes in? Will you want to know that the MRI provider was qualified to perform the test, or will you pay a claim from any Tom, Dick, or Harry who mails it in?

This is only one test and only one patient. How will you write the contract explaining to me what your policy is? How easy will it be for me to understand what you have written?

The biggest complicating factor is third-party payment. It is incredibly complicated to pay someone else’s bills — for anything. How would you like to be responsible for paying my grocery bills? Or my clothing bills? Or my transportation bills? How would you write the contract for any of that?

It is far easier to make a sum of money available to me and let me go get my own services and pay the bills myself. Now that would be an easy-to-understand contract! It would be one sentence — “Here’s $XXX. Go get your own services.”

If Congress wants health care financing to be “easy to understand,” it should remove the third-party from the mix.

ACA Opinion Poll summary:

Popular: getting stuff.

Unpopular: paying for it.

Excellent subject matter Greg. I have been fighting the same battle since the 70’s. Your conclusion is on the money as well. In the final analysis the primary transaction has to be made between the buyer and seller if there is to be any kind of clarity of what is being billed for and why.

Insurance is a contract, and like most contracts that involve the potential for one party (the insurer) to lose a lot of money, there are a lot of complicated terms. Why anyone thinks that this can be converted into 6th grade language is no more comprehensible than the idea that say, a contract to purchase a home should be reducible to one page of one syllable words.

As for the notion that this is the fault of the insurer as a 3rd party, sure, go ahead and eliminate the risk-taking insurer. A bevy of intermediaries will take their place to assist the patient in making informed choices (or assist the physician with explaining and interpreting the physician’s recommendations, and the alternatives, to the patient).

Ian, you are exactly right. In fact, those intermediaries already exist, and they provide the services you describe at very affordable costs. They have emerged in response to the needs presented by the increasing popularity of HSAs and the like.

The answers are “out there”. All that is needed is the emancipation of the market forces that serve healthcare and healthcare financing needs.

Good article Greg. I think PPACA has hightlighted a need for the sales, distribution system to be improved so that consumers can get information they need. As much as I hate the PPACA Health Exchanges,they have hightlighted a need for a change in the distribution channel. There seems to be a growing development of private exchanges to channel consumers to products, increase their health literacy, and triage them to agents/brokers to assist them with application and post-application questions and needs. If we are ever to increase individual sales over group sales a new distribution portal is needed where customers feel comfortable in connecting to unbiased information from a non sales person. Private exchanges may be that answer. By providing qualified leads with basic choices to an agent, the agent can then work through the selling details and future claim services. Let’s just hope that the SCOTUS gets this case right!

Thanks Ron, but I don’t see how these exchanges will be an improvement on ehealthinsurance.com. The consumer can get a rough idea of the differences between plans and then go to an agent for clarification. Whenever we deal with a complex system — tax code, legal system, etc. — we need the services of an agent. Health care is no different. The authors of PPACA seemed to think they could employ ACORN organizers to do this, Mmm hmmmm.

Great post, Greg.

Greg, as compliocated as we have made it, there is still room for clairity over what currently passes for Schedule of benefits. Move the ball down the field on this and most will be much better consumers.

If all carriers were made to express policy provision in the same manner, this would greatly reduce confusion. Take OPM as an example. Some carriers include the deductible in their Out of Pocket Max while others don’t??? How can you call it a “max” when you leave out the deductible? I believe it can be done in two pages to eliminate 95% of all questions and confusion, the fact that PPACA gives a carrier 4 pages front/back should eliminate 99.9% of all confusion….very doable.

Hey Doug, I think you are right about what you referenced, but the issue goes beyond the summary plan description. It gets into the pricing of services as well as when those services can be performed and who can perform them. It seems the process has to change in order to bring necessary clarity and understanding.

Greg, ehealthinsurance is a good start, but the developing private exchanges will be able to increase transparency and product selection by including network providers (hospital & physicians), loss ration data for those who think that is of value, agency ratings, consumer service ratings,rate increase histories, agent credentials (e.g. CLU, CFA, etc.), high risk pool qualifications, and much more including eligibility for public programs. Many individuals do not get past the agents application at the kitchen table because they are told they can never qualify for insurance.

Tthe health plans Americans buy aren’t just, or even primarily, insurance. They are a network of providers who have agreed to offer services at specified rates and pre-payment for certain of these services. I have absolutely no way to compare networks offered (among carriers or by a single carrier) based on price or any other factor relevant to me. intermediaries (think Castlight) with fancy UI’s won’t help either, so long as applicable law protects the secrecy of private contracts between carriers and providers without recognizing a competing consumer or societal interest in transparency. (Indeed, carriers argue that making network pricing public hurts society by making it harder to price discriminate among providers.).

Imagine the following conversation.

ME: I’d like a policy with a $3000 family deductible and $6.000 out of pocket max please.

CARRIER: Ok, got it right here. With our superstar provider network it’s just $700 a month in premium. Or you could get our Traditional network for $1000.

ME: superstar huh? Interesting.. I just need to know what I will be charged for services under that deductible. I’ve prepared this list of providers and CPT codes….

CARRIER: We can’t give you that kind of information. We do have a web cost estimator…

ME: You don’t know how much you pay Dr X for procedure Y in your networks?

CARRIER: yes we do. We just can’t tell you.

ME: Yes, but how do i know what i am paying for if i cant compare your two networks? And, come to think of it MegaCarrier down the street only wants $600 for the same deductible and oop max….

CARRIER: Well everyone knows our network discounts are better than theirs!

And on it goes. This will only get more convoluted as we enter the era of narrow networks and ACO’s.

There is nothing inherently inscrutable about insurance. Don’t buy the ‘it’s just complicated’ argument. If our congress critters would free the data, insight would follow.

As for PPACA exchanges, sameness isnt simplicity..

You write: “The fact is that health insurance is complicated because health care is complicated.”

It’s true that health care is complicated, but insurance is complicated in the U.S. because we insist on slicing and dicing our coverage in irrational ways. Other industrial democracies, for example, do not make everyone switch to a completely different health coverage system at age 65, so there’s no need for a giant “Medicare & You” handbook. In most countries, your basic coverage stays the same from birth to death. Whether or where you work has little or nothing to do with it.

A couple of years ago I was at a medical conference and fell into a conversation with a woman from Sweden. I asked her what she had to do to receive health care. Although her English was fine, she was baffled by the question. “For instance do you have to have some kind of membership card to obtain care at a doctor’s office or hospital? I asked.

“Oh, no!” she answered. “You just have to make an appointment.”

They DO have health care in Sweden. I’m sure that parts of it are fairly complicated to the people actually in charge of financing, administering, and providing it. But for everyday consumers, it is simplicity itself.

Mr. Kessler, you have identified the problem exactly.

Ms. Metcalf, I think the type of simplification you suggest makes the issue of simplification a minor issue. In other words, the problem of rats in New York City could be eliminated by dropping a bomb on the city. If we are going to solve a problem the cure can’t be worse than the disease.

Mr Timmons

So you are apparentlyl likening the universal health systems of other industrial democracies to smoking ruins? I a pretty sure that their citizens wouuld not agree.

Nancy,

You don’t really think Sweden is representative of anything do you? It’s a fine country (though some of my ancestors were Norwegian), but it has a largely homogenous population of under 10 million.

“So you are apparentlyl likening the universal health systems of other industrial democracies to smoking ruins?”

Ms. Metcalf, no, I am merely trying to illustrate that “universal healthcare” brings with it much more problem baggage than it’s worth if the goal is merely to simplify and make the healthcare delivery process easier to understand.

In addition, what is acceptable in other cultures really doesn’t necessarily carry much weight as being acceptable in our culture. The Swedes probably spend a greater percentage of their public funds on snow handling equipment than we do, and also do not have the chaos we do when we have with the occasional blizzard. Does that mean we should emulate their expenditures in that regard?

I couid substitute almost identical conversations I have had with people from Canada, Germany, France, and the UK

American health care is expensive because for historical reasons (see Paul Starr’s new book) we insist on maintaining the delusion that the free market can provide it efficiently. This has led to thousands of points of friction and complexity, amply documented in the comments on this post, that simply do not exist in other systems.

It is true that if we simply let everyone fend for themselves via health savings accounts, things would be simplified. But given that a large proportion of the population simply cannot afford to fund HSAs at all, let alone to multi-million-dollar level required to fend of financial ruin in the case of serious illness, it is simply not practical and it’s not going to happen.

To the extent our system works at all, it does so because government has interfered in the private market. That is true even for your beloved HSAs, which benefit from a fat tax subsidy.

Ms. Metcalf, you can use any country you choose as an example and the same apples and oranges problem exists.

Most importantly you are completely off base because you are starting with incorrect assumptions. We do not now have a “free market” in any part of the healthcare process. Further, no one has said that “everyone” should have an HSA. And there is no argument that a certain percentage of the population needs some type of financial assistance.

Neither of these presumptions negate the application of true free market reform. Clearly, you do not understand how “third parties” involvement in the process (be it government or commercial) is where the “friction points” you reference originate. If you took the time to read some of Scandlen’s publications you may not be as impressed with Paul Starr’s conclusions. This assumes, of course, that you are looking for logical solutions rather than being ideologically motivated.

Every post on healthcare needn’t devolve into a black and white discussion of socialized medicine vs no government regulation. It’s stale. I’m interested in an intelligent discussion of what we can improve in the American context, particularly from the consumer’s perspective.

@Jon Kessler

No it shouldn’t Jon. However, tweeking the system is a stale exercise as well. This is about starting with a blueprint and building from that. Either the basis is that of a free market system or a government based system. It is much easier to with a free market system (default mechanism) and involve government where appropriate than it is to assume a government based system and tweek in some free market side shows to “compromise” with FM advocates. The latter simply will not work. In fact, the latter approach only encourages conclusions like those expressed by Ms. Metcalf.

No argument here. I look to John’s site as a pace to formulate ideas on a viable ‘conservative’ agenda on healthcare since, for the most part, legislators and their ilk don’t have a clue at this point.

Ok, Mr. Timmins, what’s your proposal for free market reform?

And Mr. Kessler, if you look at the history of American health care you will see that it began with an entirely free market system, which, especially as health technology advance and became more expensive, became increasingly unaffordable for people of modest means. That’s when government started to “tweak it where appropriate,” and here we are with Obamacare.

I accept that American political culture will never accept any form of socialized medicine, even using the slightly incorrect definition that includes single payer-but-private providers a la Canada. But perhaps unlike most readers of this blog, I also don’t think it’s acceptable for our system to leave 50 million people without a reliable or affordable source of coverage. Anything that fixes that is fine with me. I’m all ears.

My original point was that if you start with a fragmented system of private payers and providers, the minute government starts making regulations to correct what the market cannot, you end up with huge complexity that is unbelievably and eternality baffling for consumers.

Ms. Metcalf, there are many options for free market reform that would rid us of most of the third party burden that retards both quality and cost of healthcare.

Some general approaches to start:

– Discourage “first dollar” insurance coverage and cursory copays. Insurance deductibles should be much higher and the costs of same much less, leaving more discretionary dollars in the hands of the individual. “Discourage” does not mean “outlaw”. It means discourage through the use of the tax code.

– Remove the statutory “mandated benefits” from the mix. Encourage individuals to manage their own healthcare needs (be it preventative or elective care). Individuals and their physicians are much better managers of healthcare than bureaucrats (either governmental or commercial).

– Create a competitive marketplace for companies that wish to finance healthcare by removing the now corrupted federal and state barriers to entry. IMO, this would also require the DOJ dealing with the restraint of trade issues associated with the provider contracting practices of BUCA. In the end, preferential pricing for insurance companies should go away, and providers of healthcare services should have published pricing transparency.

There is much much more Ms. Metcalf, but obviously this blog is not here to have posts of great detail. And yes, free market reform applies to Medicare/Medicaid programs as well. See the Coburn bill at

http://coburn.senate.gov/public/index.cfm?FuseAction=HealthCareReform.Home

Job based third party payers began during WWII with income tax incentives and has progressed to our current status. As I see it, the best way to combat this is to repeal the 16th Amendment. No income Tax > no job-based health insurance.

Thanks, Bert