Milliman: “No New Hope” for Obamacare’s Risk Corridors

Actuaries at Milliman have published a new report on the consequences of the CROmnibus preventing health insurers from dipping into taxpayers’ funds to finance Obamacare’s risk corridors. The entire seven pages is well worth reading.

NCPA’s research on the open-ended liability presented to taxpayers by the risk corridors was a factor in the lame-duck Congress’ decision to limit the potential payouts to insurers with unexpected losses to (no greater than) the amount collected from insurers with unexpectedly high profits ― so-called “budget neutrality”.

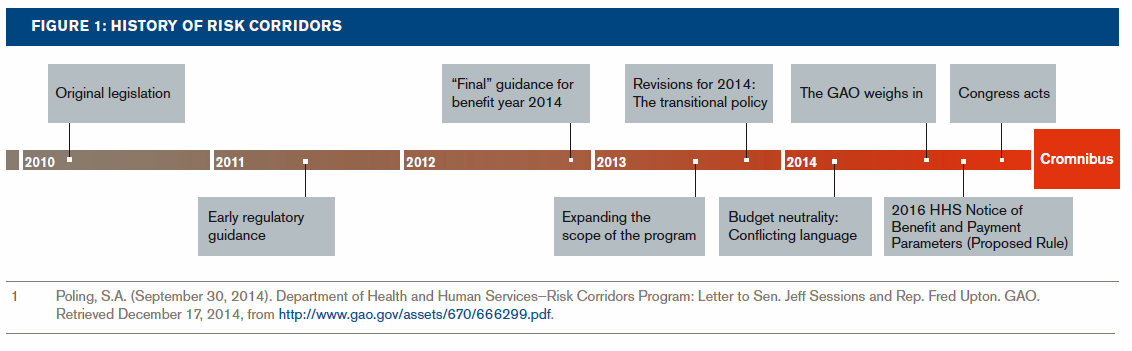

Although giving their report the title “No New Hope”, Milliman’s actuaries are not entirely pessimistic about insurers’ ability to get taxpayers’ funds out of the risk corridors. Indeed, they note that the CROmnibus comprises only one piece of an increasingly complicated legislative and regulatory trail.

With 2016 plan pricing already under way, now will carriers react to the new information available? Some insurers have already assumed that risk corridors would not be fully funded when setting rates last spring, which could serve to increase 2015 premiums and dampen any 2016 impact to some degree. To the extent that the current uncertainties are not resolved early in 2015, it may be too late for insurers to change course in time for 2016 pricing.

At this point, the language behind (and funding of) the risk corridor program is shrouded in politics and controversy. Will the next installment give underpriced carriers new hope?

At NCPA, we think that health insurers which continue to cling bitterly to Obamacare’s promise that taxpayers would bear their business risk are less likely to be prepared to adapt their business models to the health reform that replaces Obamacare shortly after a new President takes office.

I wouldn’t want to be stuck in one of these plans when the ship hits the sand.

The 3 Rs (Reinsurance, Risk Corridors and Risk Adjustment) are intended to: 1) mitigate the pricing uncertainty of insurers in the first three years; and 2) discourage cherry picking by insurers trying to get favorable risks.

The first two Rs (Reinsurance, Risk Corridors) are temporary, ending in 2016. One problem with the whole risk-spreading agenda that proponents of the 3Rs cannot understand is that forcing bad risks on insurers cannot be remediated without huge sums of money. That is why we are having these debates.

I’m not 100% sure anyone can trust Milliman’s perspective. They appear to be pretty self serving rather than agnostic.

Thank you. I trust them. They have clients all over the country. They can’t mislead them!