Means Testing Medicare Premiums

Soon after House Speaker John Boehner and Minority Leader Nancy Pelosi surprised the House of Representatives with a so-called Medicare “doc fix” that would cement important Obamacare gains, NCPA sprang into action and proposed an alternative.

Since March 25, this blog has been heavily loaded with articles addressing the topic. Unfortunately, we were not able to overcome the Obamacare coalition this time, and the legislation passed without amendments.

Many readers have asked why I did not address means-testing Medicare premiums, which account for about $34 billion of the revenue raised in the bill. The answer is that Part B (physician) and Part D (prescription drug) premiums have been means tested for years. The “doc fix” does not include a change in principle in this regard. Also, increased means testing has long been proposed by most Republicans and conservatives, so that measure did not constitute a broken promise like the rest of the bill did.

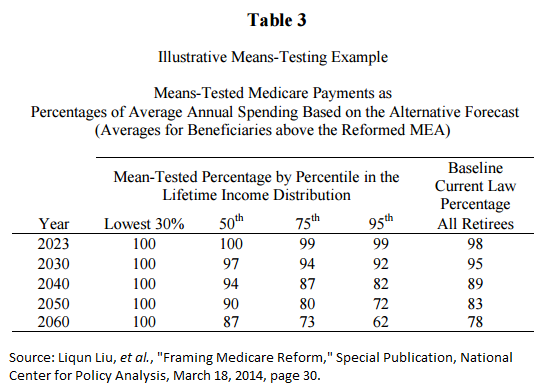

NCPA has also published research that proposes means testing Medicare premiums. Most recently, Liqun Lu, Andrew J. Rettenmaier, Thomas R. Saving, and Zijun Wang modeled a reform with such significant means testing that the highest income seniors would only get 62 percent of the actuarial value of their Medicare benefits once the reform had been fully implemented (Table 3). The means testing in the “doc fix” bill appears to be much more modest than Lu, et al., project are required to make a serious dent in Medicare’s unfunded liability.

Means testing Medicare premiums goes far beyond making the rich “pay their fair share.” Recall that premiums pay only one quarter of Part B’s costs and one eighth of Part D’s. Three quarters of Part B’s costs and seven eighths of Part D’s costs are paid by the federal government’s general account – which is largely funded by personal income taxes.

And those taxes are paid by higher income households: The top one percent of tax filers account for one quarter of tax revenue, while the top ten percent account for over half.

So, when we ask higher earners to pay higher Medicare premiums, as well, we really are asking them to pay twice for their Medicare benefits.

While the current standard Medicare Part B premium of $104.90 per month covers 25% of the cost of Part B services, there are four levels of IRMAA surcharges above that starting with incomes above $85K for a single person and $170K for a couple. The 4th (top) tier applies to single beneficiaries with a modified adjusted gross income (MAGI) above $214,000 and couples with MAGI above $428,000. The standard premium plus the surcharge for the 4th level totals 80% of the actuarial value of Part B services. The maximum amount was deliberately capped at 80% to ensure that even the wealthiest beneficiaries would receive at least some benefit for all the Medicare taxes they paid over their working lives.

As I understand it, the increase in the Part B premium legislated as part of the “Doc Fix” bill will bring that maximum premium to 100% of Part B costs. While it affects only a small percentage of beneficiaries, the principle of requiring those with income above a certain level to pay for 100% of the actuarial value of Part B benefits despite paying possibly hundreds of thousands of dollars of Medicare taxes during their careers, risks turning Medicare into a means tested welfare program which, in turn, could erode political support for it over time.

I think this is an unfortunate and dangerous approach. It would have been better to just pass the doc fix with no budget offsets since healthcare spending was coming in below expectations for quite some time now and is likely to continue to.

Thank you. With respect to the new means testing, you are not quite right. There will still be four levels of high income premium participation: 35%, 50%, 65%, and 80%. The change is the threshold income. Interestingly, the first threshold actually increases.

That is, for a single person today, $80,000 is the income threshold at which your net premium will jump from 25% to 35% of total premium. Under H.R. 2, that will jump up to $85,000. So, those people “win.”

However, the highest participation rate, 80% kicks in today at $200,000 (for a single). That threshold will drop to $160,000.

These changes happen in 2018.