Latest IRS Rule Outlaws Decades-Old Benefits, But Will Not Stop Employers Dumping Workers into ObamaCare’s Broken Exchanges

The New York Times‘ Robert Pear has covered an IRS rule that he interprets as barring employers from dumping workers into ObamaCare health insurance exchanges. Although this is the goal of the IRS rule, it is unlikely to have a significant effect on employers’ executing such changes.

Pear’s article covers a Q&A just released by the IRS that summarizes a decision it made back in September (Notice 2013-54). That notice laid down rules for Health Reimbursement Accounts (HRAs), Flexible Spending Accounts (FSAs), and Employer Payment Plans (EPPs). Employers have made pre-tax contributions to these plans for many years.

The notice clarifies that HRAs and FSAs must be “integrated” with employers’ group health plans to count towards ObamaCare’s minimum essential coverage. EPPs are a little known method for employers to contribute non-taxable dollars to workers’ premiums for individual insurance, and were defined by the IRS way back in 1961. Unfortunately, I can find no estimate of how many workers have such arrangements, although one expert source suggests they are “not as common” as HRAs and FSAs. My contacts confirm that benefits advisors have also proposed to employers that they fund HRAs and FSAs for workers, as long as those workers have individual policies. The contributions don’t necessarily fund premiums directly, but the money is considered fungible by workers who pay premiums out of their wages.

These arrangements are now outlawed. According to one lawyer in Pear’s article: “For decades,” Mr. Biebl said, “employers have been assisting employees by reimbursing them for health insurance premiums and out-of-pocket costs. The new federal ruling eliminates many of those arrangements by imposing an unusually punitive penalty.” Another expert source confirms that “Employer Payment Plans are not viable for plan years on or after Jan. 1, 2014“. Any employer who continues such an arrangement will be subject to fines of $100 per worker, per day, up to $36,500 per year.

So, notwithstanding its effect on participation in ObamaCare’s exchanges, the rule has destroyed arrangements that some employers and workers have had “for decades”. However, employers’ motives to dump workers into ObamaCare exchanges is not primarily driven by the ability to bribe workers with pre-tax dollars to do so. ObamaCare is so good at socializing benefits costs that post-tax dollars work just fine.

NCPA has just published a series of booklets on living with ObamaCare, available to members. In the booklet for employees, we give an example of how an employer could decide to drop health benefits and dump employees into ObamaCare exchanges. It has nothing to do with HRAs, FSAs, or EPPs:

Half of all employees work for an employer who is self-insured. This means the company pays the medical bills and hires an insurance company to administer the plan. A self-insured company can avoid the $2,000 fine per full-time employee with a health plan that only covers the cost of preventive care, with no annual or lifetime limit. But since this insurance will not satisfy the full requirements of the new law, you may go to the exchange and get subsidized insurance. If you do, your employer will be liable for a $3,000 fine per employee. Your employer could avoid that fine by offering to “top up” the limited benefits by requiring you to pay up to 9.5 percent of your annual wage in premiums, and the full cost for your spouse and children.

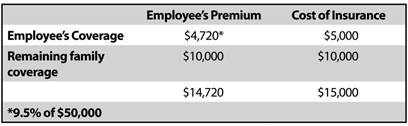

The table (“Calculating Affordable Coverage”) shows an example of a $50,000-a-year employee who is asked to pay 9.5 percent of his or her annual gross wage for individual coverage ($4,720) and the full cost of coverage for the family ($10,000). Under the law, this is deemed “affordable,” and satisfies the employer mandate, even though few workers would willingly spend nearly half of their take-home pay on health insurance — unless they expect some whopping medical bills. If the family turns down this offer, and signs up for coverage through a health insurance exchange, they will not be entitled to subsidies for the policy they purchase.

There are much less catastrophic possibilities, including offering small taxable wage increases to employees whose household incomes make them eligible for subsidies in ObamaCare’s exchanges. For high-income employees, the tax exclusion of health benefits may be worth 50 percent of the benefit, so they would demand a huge hike in salary in exchange for being dumped in the exchange without subsidies. However, for low-income employees, the tax exclusion may be worth little or nothing, especially when compared to tax credits available in exchanges. Even after paying fines, many employers will conclude that this is a good decision.

“…barring employers from dumping workers into ObamaCare health insurance exchanges.”

If they aren’t small businesses, then isn’t that the point of the employer mandate, to not dump employees into the exchanges?

The idea is dumping low income earners off, since they would likely get subsidies for coverage anyways. If you dump high income employees, they would need to pay up more wages to compensate for the loss of their benefit.

In the near future we will all be dumped off coverage and the employer mandate will be a thing of the past. America will have universal health care. Wait times will be 3 times what they are now.

“…an example of a $50,000-a-year employee who is asked to pay 9.5 percent of his or her annual gross wage for individual coverage ($4,720) and the full cost of coverage for the family ($10,000). Under the law, this is deemed “affordable,”

There are many loopholes that firms will be able to get around with the employer mandate.

One of the many issues with ObamaCare mandates are the fact that they are mandating people to have health insurance or be fined, and that many parties face perverse incentives which make individuals worse off.

While the article discusses the potential impact on the public exchanges, what about the private exchanges

If these policies are individual and not part of an employer sponsored plan, are they subject to not only income and social security taxes but also the $36,500 excise tax per employee per year

Don Levit

The IRS may try to prevent employers from dumping workers in the exchange, but there’s really no way around it. Firms that predominantly hire workers with incomes too high for subsidies will always offer coverage. However, small firms that hire moderate-income workers will shed job-based health plans simply because the exchange subsidy is too great not to take advantage of it. That is why NCPA has always said that the PPACA will fragment the labor market into high wage and low wage firms; and into big and small firms.

Devon:

I can see the rationale for what you are suggesting but not the legality.

Lower wage workers cannot be discrimimated against for health insurance coverage, although higher wage employees can.

Even the creative accountants may not be able to do an end run around this.

Don Levit

“employers’ motives to dump workers into ObamaCare exchanges is not primarily driven by the ability to bribe workers with pre-tax dollars to do so. ObamaCare is so good at socializing benefits costs that post-tax dollars work just fine.”

This is another example of the unintended (or intended) consequences of the ACA – providing perverse incentives for employers to drop employee health insurance. Such consequences are unavoidable with such a bureaucratic mess as Obamacare.

It sounds like this is just one more way ObamaCare is making it harder for people to get insurance. I thought the whole point of the legislation was to make it easier and more affordable.

This is what happens when the government makes people’s important life decisions for them. Resources get wasted for little benefit.

Not to mention the strain it will put on the people who have been using EPPs for decades!

I’ve always liked the “if it ain’t broke, don’t fix it” mantra. I think the government could learn from it.

“Even after paying fines, many employers will conclude that this is a good decision.”

If even after paying fines keeping things the same is still cheaper for employers something is probably wrong with the system.

Right? If it’s better for companies to just eat a $36,000 loss, something has to be off.

Isnt companies no longer offering health insurance benefits the same thing as dumping employees into obamacare exchanges?