Issue Settled: The Young Are Worse Off Under ObamaCare Pricing

This is from Chris Conover:

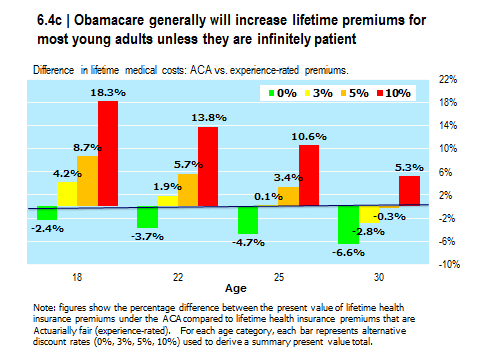

Thus, from the standpoint of the average young adult adversely affected by ObamaCare, I would argue that the figures using a 10% discount rate come much closer to the truth than do the figures using a 3% rate. And you can see from the chart that using that 10% rate, ObamaCare is not a good lifetime deal even for people as old as 30 [and if I had used a much higher discount rate of say, 17%, ObamaCare would turn out to be an even worse deal for young people]. For 18 year olds, ObamaCare essentially is imposing a tax of 18.3% on the premiums they would otherwise pay under the more market-oriented reforms favored by many conservatives and Republicans.

“Thus, from the standpoint of the average young adult adversely affected by ObamaCare, I would argue that the figures using a 10% discount rate come much closer to the truth than do the figures using a 3% rate. And you can see from the chart that using that 10% rate, ObamaCare is not a good lifetime deal even for people as old as 30”

If this is not good for the young, who make up the economy of tomorrow, why are we doing this?

Because the Obama admin believes that the elderly’s health care is more important than the welfare of young people.

Universal Healthcare programs force governments to make those kind of utilitarian value judgments.

“For 18 year olds, ObamaCare essentially is imposing a tax of 18.3% on the premiums they would otherwise pay under the more market-oriented reforms favored by many conservatives and Republicans.”

So they are universally considered an adult, and because of that they are given an extra 18.3% tax on their life style, this is legalized theft.

“Many economists think U.S. society has a long-run discount rate (i.e., social rate of time preference) of 3% since that figure is comparable to the inflation-adjusted rate of return on long-term U.S. Treasury bills. But individual rates of time preference typically are much higher than societal rates, with double-digit rates not being at all uncommon in the vast literature that has sought to estimate their size.”

Why are they much higher than 3%? Typically 3% is the norm, this is the first I have heard different.

“About 3.7 million of those ages 18-34 will be at least $500 better off if they forgo insurance and pay the penalty.”

Wow, that is a substantial amount of people. There is no way those people are going to pay the full insurance premiums. ObamaCare will just push this nation into more debt.

Yes, and that causes the U.S. to increase inflation, which harms the economy over the long-run.

Also, it could decrease the U.S. credit rating over the long term.

That decreases the U.S.’ national security, because there has never been a war throughout history that hasn’t force the the U.S. federal government to take out loans and go into debt, so we won’t have the money in a war to win.

Do you really think that the government would allow it to go that far?

They might, they did it last year. This is a serious concern that shouldn’t be taken lightly.

The Society of Actuaries also made this prediction.

And that same 18 y/o could not get insurance at all under the GOP plan if they had asthma.