Is the Income Tax System Fair?

No one in the health policy community has been more critical of the unfair way the tax code treats health expenses and no one has been more diligent in suggesting alternatives to it than yours truly. Also, no think tank has been more aggressive in promoting fairer, more progressive alternatives to the current tax system than the NCPA. (See the John Goodman/Larry Kotlikoff “progressive flat tax” proposal, for example.)

That said, Barack Obama’s critique of the income tax system is way off the mark. Since the days of Ronald Reagan, says the president, Republicans have been protecting the rich at every opportunity — shielding them from the obligation to pay their fair share. Yet here are some facts about U.S. income taxes that most people don’t know:

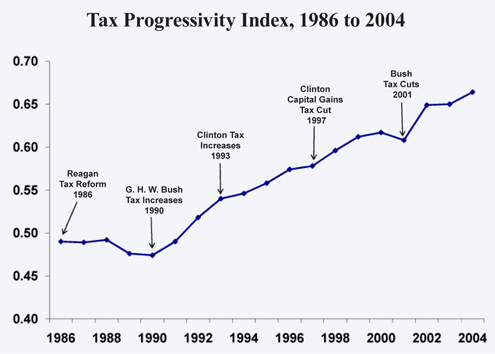

- Over the past quarter century, our income tax system has become increasingly progressive — with the tax burden almost continuously shifting through time from the bottom half to the top half of the income distribution. (See the graph below.)

- As a result of this seismic shift in the tax burden, more than half of U.S. households (taxpayer units”) pay no income tax at all and 30% of all households actually make money off the income tax system (pay “negative taxes”) through the Earned Income Tax Credit.

- More than one-third of all income taxes are now paid by the top 1 percent and almost three-fourths of all income taxes are paid by the top 10%.

- According to an OECD report, the U.S. currently has the most progressive tax system among all developed countries.

- Although it’s hard to assign responsibility to the two political parties, Republicans are probably responsible for 80 percent of the increase in progressivity.

If you find any of this surprising, the obvious question is: why? If the president wants to have a national discussion about the distribution of the tax burden, why are the American people not better informed? There are three reasons: Republicans, Democrats and the news media.

The most important reason for the increasing progressivity of income taxes is that virtually every Republican tax bill over the past 25 years has taken more and more people off the tax rolls. Democratic opponents inevitably point to the lowering of the highest tax rates as a “giveaway to the rich.” They conveniently ignore the fact that in lowering the rates, these same tax bills also widened the base. By allowing fewer deductions, exemptions and loop holes, the bills exposed more income to taxation. More importantly, if people at the bottom of the income ladder are completely taken off the tax rolls, the burden of the tax system will shift to those at the top, no matter what rates they pay or what deductions they take.

The problem with Republicans is that it is not in their nature to promote redistribution from rich to poor. It’s as though they are too embarrassed to say, “Look what we did.” If you made a gift to the needy or engaged in some other charitable act, would you go around and brag about it? Of course not. Well, that’s the way a typical Republican politician feels about Republican tax policies. I honestly can’t remember the last time I heard a Republican boast about the fact that Republican tax bills have liberated half the population from the burden of the income tax.

Let me tell you how it will be,

There’s one for you and nineteen for me,

Cause I’m the taxman.

Democrats, by contrast, tend to be redistributionists by nature. They have no reluctance to talk about taking from the rich and giving to the non-rich, whether through tax policy or any other means. And if Republicans choose to say nothing, few Democrats are going to gratuitously compliment them for engaging in more redistribution than even Democratic politicians were willing to enact. Instead, the natural tendency for everyone in public office is self-serving spin. The Democratic line, therefore, has been: Republican tax policy is benefitting the rich. It has been a distortion that Republicans have been unwilling to challenge.

The news media tends to be basically lazy. They don’t dig much deeper that the latest press release. So if Democrats claim that Republican tax policies favor the rich and the Republicans don’t deny it, don’t expect to read anything different in tomorrow’s newspaper.

Now for the facts of the matter. We don’t need to dwell on anecdotes about Warren Buffett’s tax return versus his secretary’s. We know, very broadly, who earns what and who pays what because the IRS keeps track of it. Here, courtesy of the Tax policy Center are the effective tax rates by income level.

Looking at changes over time, Michael Stroup, an economist at Stephen F. Austin State University, has taken the IRS data and constructed a “progressivity index.” It’s a sophisticated way of measuring how even or uneven is the tax burden as a whole. Here’s what it looks like:

In 1986, Reagan era tax reform brought the highest tax rate down from 50% to 28% and at the same time removed millions of people from the tax rolls. Stroup finds that the overall effect was no change in progressivity in the short run. But after a dip in the index (which is natural in recessions), these changes over time led to a tax burden that increasingly shifted to above-average-income earners. A Republican capital gains tax cut signed by President Clinton accelerated the trend (Yes, lower tax rates really did produce higher capital gains revenues.)

Tax changes under George W. Bush moved essentially in the same direction: lower taxes — especially on dividends and capital gains — combined with provisions that let millions of additional families escape taxes altogether. The net effect was to even more dramatically shift the burden of taxation to higher income earners. In fact, Stroup finds that the increase in progressivity was greater under Bush than at any time in the previous twenty years. He concludes:

Since the 2001 and 2003 Bush tax reforms, the share of total income received by the wealthy has increased; however, their share of the total tax burden has increased even more than their income share… Bush’s reforms have helped mitigate the income gap between rich and poor by increasing the progressivity of the income tax system.

So what is the Obama Administration proposing? They claim to be proposing a “Buffett rule,” under which the wealthy would pay at least the same tax rate as middle-class taxpayers. But, as Megan McArdle points out:

[T]he Obama Administration itself has not outlined anything of the sort. At least in the White House document that I read, I saw no proposal to set some sort of AMT on millionaires. Instead, it [is] rehashing a bunch of things that the administration has long proposed: allowing the Bush tax cuts to expire for those making more than $250,000; changing the treatment of carried interest income accrued from capital gains; and altering the treatment of deductions for very high earners. If all of these things were passed, guess who would still pay a lower effective tax rate than his secretary? Hint: his initials are WB, and he lives in Omaha, Nebraska.

In case you don’t keep up with these things, most of Warren Buffett’s “income” is in the form of unrealized capital gains. That means during the tax year the value of his stocks and bonds and other unsold assets rises.

Under the current system, and under the new Obama tax regime, the tax rate on unrealized capital gains is …. you guessed it …. exactly zero.

See David Henderson and Alan Reynolds on these issues as well.

Good analysis. Great chart.

Great Beatles song. Good pairing,

Also, Medicare and Social Security taxes and benefits as a system are highly progressive. The rich get much less out than they put in. I’d like to see a detailed analysis of this, to include the taxation of SS benefits.

Also, of course, Medicaid is extremely progressive, as is all welfare.

The President noted the Buffet rule is all about math. Is that math for reelection or to solve the fiscal issues? Individuals that make over a million a year represent less than 1% of the population. Also, rate changes on that end of the progressive curve have a greater increase in the burden. What math is he talking about, and what is the “fair share”?

I wonder why we have a cap on how much a person can put in an IRA. Why not tax income when it comes out of the IRA to be consumed, rather than when it is earned.

Also it would seem to me simpler and better to tax a husband and wife’s income separately and let them divide the exemptions optimally.

http://un-thought.blogspot.com/2011/09/warren-buffetts-article-on-taxation-has.html

John,

Interesting that Financial Times came out for the Buffet Rule today!

Stan

This is fantastic! Very succinct.

Great article. I would love if it could be paired with a rebuttal to the common Democratic talking points that insist that the “rich” get away with paying nothing, or GE pays zero taxes, etc. and could explain how that fits in.

It is a flawed premise that government should take resources from the people and use the funds to provide services they otherwise might not pay for. Before long, politicians realize they can make promises to potential voters that future politicians and society is forced to keep. This has been the case in all the advanced countries. Maybe the less developed countries will avoid some of these pitfalls by witnessing the result firsthand. If so, it will be a good example of how countries progress and fall behind in their wealth and development.

Good post. Very interesting.

Whenever I hear whining about how “unfair” life is, I think of a Drill Instructor from a long time ago (the sixties).

“FAIR?” he roared when a rash recruit protested having to do pushups because the other squad f*ed up.

“FAIR is where you eat COTTON CANDY and step in MONKEY S*T!!!!”

This reality goes a long way towards explaining the enigma that Dr. Goodman has identified with respect to government provision of medical care. It is a characteristic of any democracy.

However, only a small proportion of the population experiences high medical costs at a given time. So, it would seem impossible for political factions in a democracy to buy votes by promising “free” medical care. And yet, they all do it, and the voters clearly demand it.

The answer must lie within the progressivity of the tax burden. If I am not paying most of the taxes that are being recycled into government-run health care, I will be satisfied with it, despite its inefficiencies.

So, which is the chicken and which is the egg? That is: Does ultra-progressive income tax lead to government-provided health care, or vice versa? The graph suggests that the health benefits (i.e. Medicare) come first.

You are leaving out a big part of the story to say the least:

The top 1% earn 25% of the nation’s income

The top 1% own 50% of all stocks, bonds, and mutual fund assets

The top 10% own 90% of all stocks, bonds, and mutual fund assets

The bottom 50% own 0.5% of all stocks, bonds, and mutual fund assets

I have to wonder how concentrated America’s income and wealth will have to become before you will acknowledge that there is a problem?

Great analysis and thought John. I am forwarding on to others who are leftist in their thinking so they can wake up and smell the truth! BTW, the comment from Plac ebo about the rich owning most of the assets has absolutely nothing to do with the article. However, I find it quite unfair that the top 1% pay 33% of the nations taxes and only earn 25% of its income…

See David Friedman on this issue here: http://daviddfriedman.blogspot.com/2011/09/d-friedman-vs-d-brin.html

I had no idea that the Republican legacy was an increasingly progressive tax system. I’m not sure that Republicans do it out of the kindness of their hearts. I think there are enough loopholes that their buddies get tax breaks, but not enough so that the aggregate millionaire is paying less than the middle class. But, I’m not a tax expert.

@Plac Ebo

When J. K. Rowling became the richest woman in the world by writing Harry Potter books, she made you better off not worse off. She didn’t take anything away from you or anyone else. She didn’t take wealth away from you or others, she created wealth. What is it about wealth creation that you don’t understand?

The unequal distribution of wealth is a complex problem. Some people believe the solution is to tax away some of the income/wealth of the rich and redistribute it to the poor. But isn’t the problem primarily one of the poor not investing enough in themselves (and saving the returns) rather than the rich investing too much?

The lower-income quintile of earners are not investing enough in human capital or taking advantage of educational opportunities. As a result, they are not earning. This is why their share of the income and wealth is low. On the other hand, the top quintile of earners takes risks, invests in the economy, creates wealth and saves the vast majority of their income in the form of productive assets that benefit society. That is why they earn and control a large portion of wealth. Taxing capital formation makes society worse off since capital is what create jobs. A better solution would be to boost the productivity in the lower ranks of the population and encourage the middle-class to save more. But those goals are difficult to achieve.

@ John Goodman

Do you think J. K. Rowling’s wealth was created in a vacuum? Had she been born and lived her life on a desert island do you think she would be the world’s richest woman? We are all products of the times, culture, and economy we live in. And, don’t forget to throw in the effects of connections, opportunity and luck.

J. K. Rowling should enjoy sizable rewards for her works. However, it is not good for the long term health of a society when its wealth and incomes are terribly skewed such as ours has become.

I’m sure that we can agree of the need to weed out corruption and waste in government. Where I’m sure we differ is the role of government and who should shoulder the tax burden in making this a better country for all of its citizens.

Doesn’t anyone understand this? and if the tax breaks favor the wealthy, that too should be looked at seriously. The flat tax rate could work if the populace is honest with their filing, and this albatross can be shed off our backs. The rich want to get richer and they have the money to find ways to avoid taxes, and the poor complain cause they don’t want to pay either. Do you think that there is enough honesty in this country of ours to make it work? I doubt it since every business entity is full of corruption

Tax Assessment is a crucial yardstick that helps create the transparent platform to judge the system. I hope the government is listening!