Hypocrisy on Medicare Reform

The latest proposal to reform Medicare is a bipartisan gesture, courtesy of Senator Ron Wyden of Oregon, a Democrat with a long record of reaching across the aisle on health care, and Paul Ryan, Republican of Wisconsin and chairman of the House Budget Committee. The basic idea is to give seniors “premium support,” a risk-adjusted voucher that can be applied to the premiums charged by competing private sector health plans. In this version, Medicare would be one of the plans seniors could apply their voucher to.

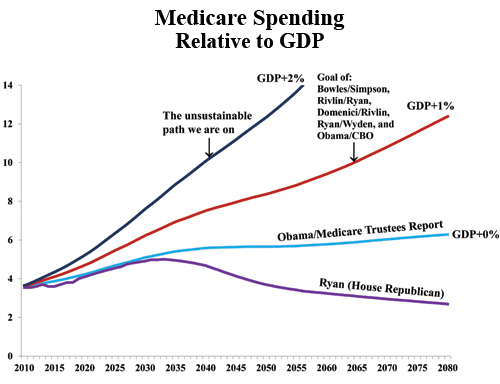

The Ryan/Wyden proposal would cap the rate of growth of premium support at the real rate of growth of per capita GDP plus 1%, even though health care spending overall has been growing at about GDP plus 2% for the past four decades. In this respect, the proposal is similar to the Ryan/Rivlin proposal, the Dominici/Rivlin proposal, and the Bowles/Simpson (Obama debt commission) proposal.

The Ryan/Wyden proposal has been criticized by some on the left, and there is nothing wrong with criticism. There is something wrong when the critics are known supporters of ObamaCare, however.

Writing in The New York Times, former white House health advisor Zeke Emanuel complained that:

Premium support is classic cost shifting, rather than cost cutting. Unless growth in health care costs is low, Medicare beneficiaries will just have to pick up the difference between the voucher’s value and the cost of the health insurance plan they purchase.

A similar complaint was penned by Laura Tyson, former chairwoman of the Council of Economic Advisors under President Clinton, in another New York Times column. Both have been involved with voucher proposals before.

But sleep won’t come, The whole night through,

Your cheatin’ heart, will tell on you…

Emanuel admits that he has previously advocated a voucher plan for all Americans with Stanford University health economist Victor Fuchs — and he still endorses the idea. His main problem with Ryan/Wyden is that the bill segregates the elderly and puts them on a slower growth path than the rest of the country. Tyson was appointed by President Clinton to serve as a member of the National Bipartisan Commission on the Future of Medicare, chaired by Republican Bill Thomas and Democrat John Breaux — a commission that developed a premium support (voucher) proposal for Medicare. Ultimately, she voted against the proposal, however.

Still, my charge of hypocrisy has nothing to do with the past. My problem is that both Emanuel and Tyson support the Affordable Care Act (ObamaCare). As all readers of this blog surely know by now, more than half the costs of insuring young people under ObamaCare is to be paid for by cuts in Medicare spending. As Tom Saving and I explained in The Wall Street Journal, how much Medicare will be cut is a matter of some dispute. The Congressional Budget Office says the act requires Medicare to grow at GDP plus 1%, exactly the same rate of growth as the premium support proposals referred to above. The Medicare Trustees report, however, says the act requires Medicare to grow at GDP plus 0%. And since the Medicare trustees are appointed by the president, we take the trustees’ report as the Obama administration’s view of its own health plan. [See the chart.]

In truth, none of the plans referred to above have any realistic method of slowing the rate of growth of health care costs. So what happens if health costs for the elderly grow at a faster rate than the limits the plans require? Here is Tyson:

The Ryan-Wyden proposal is ambiguous about what would happen if the cap became binding. The proposal says Congress “would be required” to intervene and “could” implement policies to change provider payments and premiums for beneficiaries.

Congressional intervention to control provider payments would shift the burden of higher-than-anticipated costs to providers from the federal government and would effectively signal the end of managed competition as the mechanism to control costs.

But squeezing payments to providers is exactly what is called for under the Affordable Care Act. In fact, under the Medicare Trustees’ version, the ObamaCare cuts will be more severe than the Ryan/Wyden cuts.

Both Emanuel and Tyson seem to be aware they are vulnerable to the charge of hypocrisy. They both mention the ACA, and both make an inadequate effort to explain why they support cutting physicians’ fees under ACA but not under anyone else’s plan.

Tyson goes so far as to claim that Medicare can use it’s monopsony buying power to suppress provider fees better than private insurers and thus can be more successful in restraining costs. She seems to be unaware that in many parts of the country Medicare Advantage (MA) plans pay less than Medicare. Where MA plans pay more, it is often by choice (e.g., to get better service). Emanuel says the only real way to control costs is to change the way we pay for seniors’ health care. He seems to be unaware that all the changes he is calling for are already being implemented by private MA plans, not by Medicare.

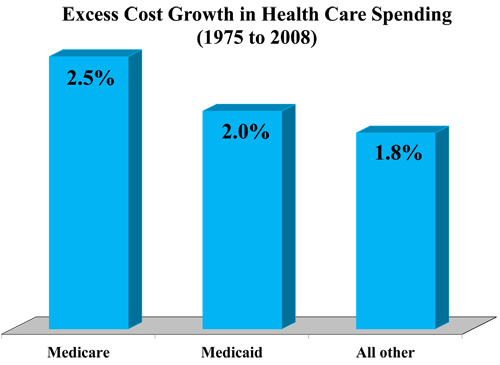

Tyson even presents a chart claiming to show that Medicare costs have been growing more slowly than private sector costs. She seems to be unaware that you cannot compare raw numbers meaningfully without making adjustments for the changing age structure of the two populations, out-out-pocket payments, etc. As Tom Saving and I pointed out at the Health Affairs Blog the other day, the CBO has come closest to making a valid comparison. Here are the results:

Great post. They are hypocrits.

Nice song pairing. I agree that we have two cheating minds. I’m not sure about the hearts.

John, do any of these studies remove the cost shift from Medicare and Medicaid to private coverage? That is, with the introduction of DRG’s, RBRVS, and balance billing limits (and some limitations on Rx pricing in Medicaid and Medicare Part A), provider reimbursements are limited where governments “negotiate” the price. For example, the average annual increase in the Medicare Part A and Part B point of purchase cost sharing over the past 20 years has been about 3.25%.

There are many studies that show providers attempt to recover the cost of treating certain patients at a loss by raising prices for other patients.

I just don’t see how the programs can stay solvent after 2035.

I suggest a two step approach. Step one would be the Ryan-Wyden plan for those over 20 years of age as of Jan. 1, 2012. Those younger and now beginning with birth would accumulate funds yearly in health savings accounts along with high deductable insurance supported by tax credits for those paying income taxes, the earned income tax credit for those that qualify and outright deposits by the federal government for the remaining of our population. This would mean that each generation would accumulate the funds to care for themselves when elderly. It has been amply demonstrated that those with health savings accounts are much more careful as to their spending for health care. This would mean that as a society we would have to consume somewhat less and save more.

The problem with Wyden-Ryan (W-R) is that it appears to be only beefing up of Medicare Advantage (MA) HMO Plans (read the full 40+ page summary for the MA emphasis). MA is popular only because of massive HMO/MCO subsidies costing far more than traditional Medicare (a huge price to pay for better comparative patient benfits and the old MCO game of cherry picking well clients and lemon dropping the frail and sick.) Maybe I missed mention of using the voucher for HSA/HDHP insurance plans in W-R. I did see more of the same give the voucher money to a “competing” HMO/MCO corporation. For decades we have seen a system that gives control of the money to MCO corporations–a system that fails quality measures and cost control in both public and private sectors. Show me where I am wrong, and I may change W-R to R-W. Bob

No commentator seems to recall that the rate of growth in Medicare relative to GDP is a formula of “Increasing numbers of beneficiaries (Boomers); times their needs for services; times the amount of services provided, times the unit costs of those services, plus a factor for profit.”

So far, attention is being paid just to the cost of services, plus an implicit acknowledgment that amounts of services will be cut through various kinds of regulatory controls over providers.

Look more closely at the Boomer generation impact on Medicare costs. Up 45+ over the next 20 years. Unless there is a major disappearance of that group, or more rapid die-off of those already in Medicare, the sheer number of beneficiaries is poised to overwhelm any of these pitifully small tinkerings that politicians want to do.

A minor suggestion: Congress and the President should have a NORAD-style war room loaded with facts and simulation models that can quickly parse policy questions into all their component parts, extrapolate trends and make choices among sets of options, then lay out their externalities, or unplanned effects. Right now, it is painfully obvious that these politicians (lawyers) do not have the smallest grasp of what they are doing. Anytime you see a politician come up with a gimmick, like vouchers, you can bet he does not know what he doth. Never mind that he is apt to be a hypocrite on top of it.

Medicare needs to take a larger view rather than a micro view: to decide how much can be spent from the tax revenue, delegate it to states in the form of block grants, for the states to further delegate to regional healthcare systems, under a repeal of the Stark Acts, where providers are linked together to offer a chronic-disease focused array of related services where the beneficiary, through various incentives, is in a position to control more of his utilization and costs of care. Attempts at micro-management have brought us to this pass. It does not work as a total program solution. Sorry, but that is the case.

To make a major gain in the Medicare program begin now, for the Boomer population between 45 and 65: that is when chronic diseases are most apt to emerge and utilization increase. It is also where the beneficiary is most motivated and capable of managing his own health and health services. Health Savings Accounts are an effective tool that does change economic incentives of the beneficiary.

Aphorism: If you want less money spent, put less money in. Period. But make utilization and price decisions as close to the service as possible, not in Washington.

John and friends: keep up this topic, as no additional law has been drafted as yet that would be a satis-factory replacement for the ACA to make it easier to repeal said Act; one of the most destructive pieces of legislation since Prohibition.

Wanda J. Jones, MPH

President

New Century Healthcare Institute

San Francisco

Professor Tyson’s assertion of the monopsony power of Medicare is too often heard. But this monopsony power has nothing to do with health care per se. The federal government operated a single-payer housing scheme for seniors, HUD would enjoy exactly the same monopsony buying power. Or if the federal government operated a single-payer food scheme for seniors, Department of Agriculture (I suppose) would wield the monopsony power.

Of course the seniors’ choices of groceries and housing would dwindle in the short term, and they would would freeze and starve to death, because the government would fix prices incorrectly and farmers and builders would eventually stop supplying.

However, as Dr. Goodman and Professor Saving point out, Medicare exercises no monopsony power at all. To complement their article, allow me to point to an analysis with similar conclusions by Jeff Anderson (http://tinyurl.com/34s3eo6). Anderson points out that the share of private spending covered by insurance has increased versus out-of-pocket costs over the period from 1970. Once correcting for this, private spending grew slower than Medicare.

Medicare spends $8 Billion annually to support the training of physicians in the various specialties. One of the most reliable predictors of the cost for Complex Health Needs is the number of specialists in a community as opposed to Primary Physicians. No matter how the healthcare dollar is controlled or distributed, we still need to fix its inefficiency. I suggest three first steps: 1) limit green cards for physicians to Primary Physicians, 2) apply a slowly evolving requirement on Medicare training funds to limit their distribution to institutions who train two Primary Physicians for every specialist (by 2020) and 3) amend the Stark regulations to strenghthen the economic limits on physician conflicts of interest. Any Physician equity position in a hospital, outpatient surgical center or diagnostic equipment installation should be an anomaly of the past, soon.

Economic Nobel Prize winner (2009) Elinor Ostrom still is the best source of concepts applicable to any permanently meaningful reform of the healthcare industry. Peter Drucker is a close second.

Dr. Paul

Why not have physicians who have no political connections or ambition, to come up with a reasonable solution based on quality, patient needs, and in doing so will decrease the cost by eliminating the poorly diagnosed, overtreated and overcharged. The readmission rate in less than 30 days is the direct result of poor diagnostic conclusions, based on no time to take a complete and thorough history or to do a complete and thorough physical causing needs to be ignored or overlooked, necessitating readmission. I have always maintained that the best care is least expensive in the long run. “Act in haste, repent in leisure”.

Dr. Bob Kramer

Dr. Bob! Well said. If you wish to be a bit adventurous, one alternative for healthcare reform strategy is described on the wordpress blog site at nationalhealthusa.net

Sorry John, I wouldn’t normally do this. I just couldn’t resist the invitation.

Dr. Paul

The big problem is the lack of jobs. We talk about baby boomers coming along and more and more people on Social Security and Medicare who aren’t working. First, Social Security should be preserved for what it was intended for. Retirement income for the people at the end of their employment years. Social Security Disability should be short term only. I think 90+% of those receiving disability could be retrained to do something. Most can walk, talk, see, hear, read, write, drive a car, etc. The only true totally disabled person is one who has mental problems and cannot do anything for themselves. I propose 12 to 18 months on disability if truly debilitated and this time is to be used to go to school to train in something else to do. At the end of that time, assistance with job placement. Herein lies the problem, lack of jobs. Welfare payments should cease unless that person is underemployed or in training for employment. Unemployment is not an option. Those underemployed would be put in a training position to help them towards proper full employment with placement assistance. Again, problem with there being sufficient jobs. To have an ever-expanding population of non-working persons and the Government expanding welfare programs to cover them has to become a major problem. Obamacare is part of that problem and not a solution. Put people to work and get them off welfare and government expenditures will naturally come down and it will widen the base of tax payers and also those that would be paying into Social Security. We need to quit creating a welfare state and build a nation of workers. In the old days of building this country there was the unwritten law that prevailed. If you don’t work, you don’t eat. We made a stab at it in 1996 with the Welfare to Work program and renamed AFDC program TANF. Temporary Assistance to Needy Families. It was working too but then the Government started backing off and allowing exceptions until we are back where we started and no welfare program is temporary. No public assistance to illegal aliens of any kind except emergency medical attention, would save a ton of money. Government needs to get it’s head out of it’s b— and start running this country like it should be run. Any assistance should be temporary to help you get back on your feet and not a new way of living. I could go on and on but space is limited. Email me with questions and suggestions (other than where I can go.)John J.

Theory is what I am hearing about keeping seniors working. The only place I see seniors working is at Wal-Mart as greeters or people who own their own business. I am sure the greeters at Wal-Mart are making a sustainable living wage and their healthcare package as a part-time employee would more than meet their health needs. LOL. Keeping seniors working may sound all nice and neat, but in reality it ain’t going to happen. Most businesses cannot wait for the old folk to retire and trying to prove discrimination will just make attorneys richer and seniors poorer.

Disability as an option for seniors who can’t find a job? Have you ever looked for employment after 55, let alone 65? Give me a break! All we will see is an increase in government employees to maintain a whole new disability system that will not be successful and stress seniors to death with the delays. Oh, but wait, maybe that is the point– just kill them off faster so they don’t waste all the money they paid in the system while they were working. There would be little if chartable success with this theory. Tax money would just be draining out of another government agency and adding to the problems of accountability of our tax dollar.

And, oh yeah, the volunteer force would shrink greatly should this theory be implemented. Senior time would be better spent volunteering then hunting for employment that is not much of reality. Let this discussion continue, but deal with the realities not political sound bytes and building on an unrealistic solution.

Please also note the Swiss German Israeli and Irish ninaotal healthcare plans.Okay, I’ll note them, john ryan. Below ratings, according to originally released early this year and updated in April.Ireland single payer/two tier system, no government mandate#1 in gross external debt to GDP Switzerland single payer with government mandate#4 in gross external debt to GDPGermany single payer with government mandate#14 in gross external debt to GDPThe US is #20 in gross external debt to GDP. But I’m sure you’ll help us climb that ladder along with your POTUS.INRE Israel, completely different critter. The government mandate came around 1995. Israeli’s have four private insurance providers to choose from. The government collects their taxes, and pays the private insurers. In some ways, not to dissimilar to Medicare. Except that the electronic records are superior, and they don’t have generous malpractice laws. A doctor must be proven negligent. They also have their budget problems, and they too have been busy implementing reforms. Why? Cash problems, of course. They had 23% poverty level, and 7.6 unemployment back then too. Of course, with ours, 7.6 looks downright inviting anymore Guess that re’education campaign is working, and we’re to adjust to a new norm .In public debt (as opposed to total external debt), Israel is 14th per CIA Factbook, with public debt that is 78% of GDP in 2009. In that same year, the US was 47th on that list. In comparison, that was the good ol’ days, pre Obama, but post Comrades Pelosi and Reid since 2007. Coulda been better if no one handed the keys to the nation’s piggy bank to those two, but nooooo. They are #36 on the external debt ladder.I might also add that Israel’s individual income tax rates range from 10-45% of their income (higher than the US), and that doesn’t include their 16% VAT tax. The US is 15-35% (until Obama/Pelosi/Reid are done with us, that is) with no VAT tax (until Obama/Pelosi/Reid are done with us, that is sigh).So what were you all a’glow about, john ryan? See any fiscal wonderful’ness going on with their health systems and debt?Reply

Remarkable issues here. I’m very satisfied to look your post. Thanks a lot and I’m looking forward to contact you. Will you kindly drop me a e-mail?