HSA Enrollment Keeps Growing

AHIP’s latest census of HSA-qualifying insurance coverage contains some fascinating information. Keep in mind these numbers are for HSA-qualifying coverage only. It does not include HRA plans or stand-alone high deductibles.

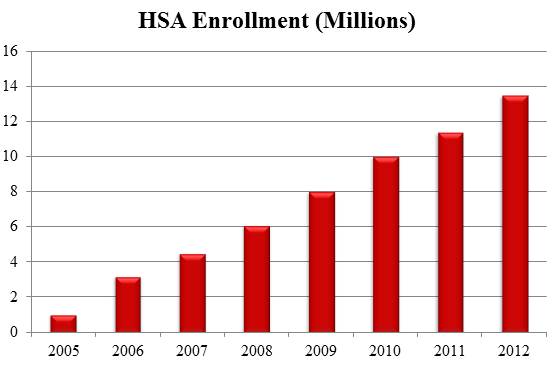

The finding reported in most of the news stories is that enrollment in these plans grew from 11.4 million in January 2011 to 13.5 million in January 2012, an increase on 18% in one year.

This continues the steady growth documented by AHIP’s annual surveys. The trend line is unmistakable –

The vast majority of this enrollment surge is in the large group category, which suggests that large employers are not waiting around to see what happens with the Affordable Care Act. They are moving ahead to increase consumerism with or without ObamaCare.

AHIP also provides state-by-state enrollment information, which may be surprising. The assumption has usually been that HSAs are the darling of conservative Republicans and despised by liberal Democrats, but that idea is belied by the states that have embraced or rejected these plans. The top five states in terms of market penetration are –

Vermont (19.9%)

Minnesota (14.3%)

Montana (12.1%)

Utah (11.5%)

Connecticut (10.6%)

The bottom five states are –

Hawaii (0.3%)

Alabama (1.3%)

Mississippi (1.6%)

West Virginia (1.8%)

New Mexico (2.0%)

Also fascinating are the average premiums for these plans on a state-by-state basis. AHIP’s calculation averages premiums for all markets — individual, small group, and large group. Below are the average monthly premiums for single (not family) coverage in the most and least expensive five states –

High Cost

New Hampshire $ 467

Massachusetts $ 453

Rhode Island $ 432

Connecticut $ 424

California $ 422

Low Cost

South Dakota $ 206

Iowa $ 235

Maryland $ 241

Minnesota $ 264

Michigan $ 277

Interesting that there doesn’t appear to be any correlation between cost and market penetration. Minnesota is one of the low-cost states and has high enrollment, but Connecticut is one of the high-cost states and also has high enrollment.

All very interesting information.

There is an alternative to Obamacare.

Impressive.

Not nearly complicated enough to be an alternative to Obamacare.

In general for every HSA there is an HRA. So there are probably 27 million total accounts.

I don’t wish to rain on this parade, but I would point out that perhaps not everyone that has a qualifying HDHP from an employer sponsored plan is enamored of same.

People that purchase individual HSA qualifying plans are very likely to appreciate and enjoy the overall concept of consumer driven healthcare.

I know from experience that many employees view CDHC as a real negative – in particular if it is the only plan offered by the employer, and often times if they feel it is the only “affordable” option (if they have to pay a premium share for a traditional type of plan). All of this is especially true if the HDHP or employer subsidy is changing from a traditional “pay for everything” type program.

My caution goes to celebrating the increase in qualifying HDHPs. We might want to be a bit careful of this and be on the alert for those that detest this very idea to hold up employees that are in these types of plans because they are “forced” to be.

Dick,

I think we need something more than that if the comment is going to be helpful. We have all met people who hate their HSAs, but also their HMOs, their PPOs, in fact any insurance plan. No doubt a lot of folks would rather have their employer provide everything at no cost. If not their employer, then the government. And, no doubt people should always have a choice of plan.

But that has a lot more to do with our employer-based system than with any particular problem with HSAs.

Sorry Greg – it just seems to me that these types of announcements are CELEBRATING the addition of plans we like.

My caution is that while we may be celebrating, many people with these plans are NOT. Unless people voluntarily move to HDHP programs of their own volition, I think a certain caution on the growth of said plans is in order.

HDHPs are great for those looking to have low monthly premiums but still want the catastrophic coverage. Check out http://bit.ly/Pm2pfl for information on why non-grandfathered HDHPs will be in danger come 2014.

Given the market environment we have now as a result of the ACA, it is amazing that there is any growth at all in HSAs. If we don’t get this mess repealed early next year HSAs will be only a memory in a few years.

In today’s debt driven economy it will be cost that ultimately matters. Like Dick, my perception is that most employees, currently used to getting day-to-day health care paid for, don’t really like the CDHC trend. Unfortunately, this status quo is what must be changed if we are to right-size health care expenditures without moving to a single-payer socialized medicine approach (ACA) that will impose price controls and determine what services are available to whom (ration health care)! Intellectually, both of the approaches make sense, even though are ideologically repugnant to many.

With respect to health insurance, if somebody else is paying, employees want the “best”. Only when it is their money do they make the hard choices. That’s just as true for health insurance as it is for health care services, and the insurers know that!

The pernicious small print of the ACA does represent an existential threat to HSAs. The political process may mitigate that threat, but until we have an insurance environment that actually prices HDHPs at rates that reflect the true actuarial savings (as opposed to selling HDHPs at nearly the same price as 1st dollar coverage), consumer will rightly remain unhappy saving less with increased out-of-pocket risk.