How to Commit Fraud

Chris Conover explains it all, using by way of illustration mistreated Mike, desperate Dan and Puzzled Pete. The whole piece is worth reading. He avers:

Let me reiterate my sincere hope that not a single Mike, Dan, or Pete commits fraud to get on the ObamaCare exchanges.

Got it, Chris. Thanks for the tips anyway.

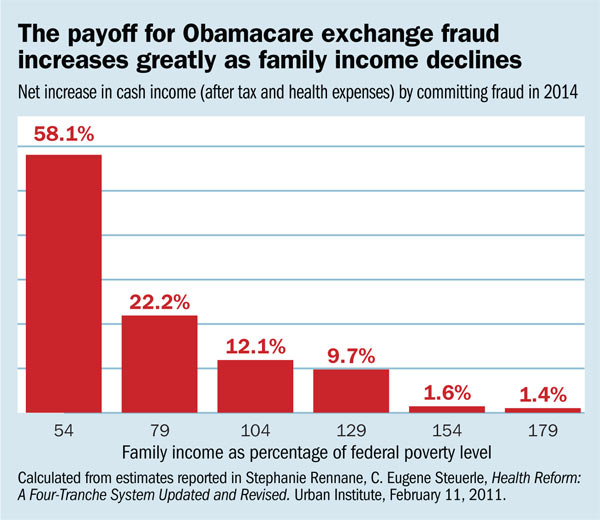

I wonder if there will be any policing of this fraud.

There probably will be, but not for awhile, because the government has no idea how big of a problem this is going to be…

I say this a lot, but I just can’t imagine that they are that incompetent… How can they not know?

Well the amount of issue they have to deal with on a daily basis makes it hard for them to focus in on one issue and prognosticate future happening with the program, which is why they hire people to do that…but the people that are hired now are on the Obama payroll, so it’s very unlikely the congressmen are not being told at all.

Yeah, there is going to be a substantial amount of fraud and evasion. I just don’t understand how they aren’t foreseeing this…

I think they are…

I think that they will probably have to create a new executive branch agency, kind of like the IRS, that keeps track of healthcare claims and monitors for fraud.

Yeah, I have a proposed 10 more agencies we could use, which would then create the need for more, and so on

Why would a federal government interested in maximizing enrollment have any incentive to do so?

“As it turns out, Dan also has a twin brother who (I know this is incredible) works as a grounds-keeper at the very same large firm as Mike’s brother! He too gets paid an extra $8,000 a year for essentially the identical job since his employer has decided to drop health benefits. What’s truly incredible, however, is that while Dan’s brother obviously ends up paying higher payroll taxes than Dan—after all, his income is higher—he actually gets a bigger EITC check ($1,768 larger).”

This.

It goes without saying that the Administration is more concerned with enrollment than accuracy of subsidies.

Surely, even the most liberal observer realizes that it is unjust to treat people with the same income differently because of the way in which they earn their income (as long as it is legal).

How much simpler it would be if everyone got a tax credit for health insurance! How much fairer! And how much administratively easier!

(Also, proposed in this blog again and again and again.)