How Community Rating Hurts Those it is Designed to Help

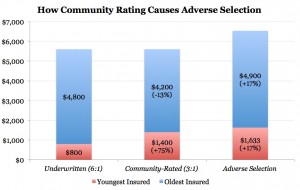

This illustration comes from Avik Roy:

In the first bar, there is a classically underwritten distribution of insurance costs: the 18-year-old pays $800 in premiums, and the 64-year-old pays $4,800: six times as much. Then, in the second bar, 3-to-1 community rating is imposed, which redistributes the cost of premiums. Now, 18-year-olds must pay $1,400 for insurance—a 75 percent increase—so that 64-year-olds can pay 13 percent less… after adverse selection, the oldest policyholder ends up paying more than he would have under free-market underwriting: $4,900 instead of $4,800. A government policy aimed at forcing young people to subsidize premiums for the elderly ends up driving up costs for everybody.

As the article indicates, this result would occur because young people faced with higher premiums drop out of the insurance pool.

Joe:

You are correct, assuming one looks at insurance like yearly renewable term life – on a year-by-year basis.

Working with Milliman, our objective is to encourage people to see insurance as a 2-4 year program, in which the healthy will get substantial benefits for “overpaying.”

After 2-4 years, for a maximumm of $400 per month, a family has the opportunity to accrue a $25,000-$50,000 paid-up policy, with premiums reduced for the catastrophic coverage by 60-80%.

Why do the healthy overpay and the unhealthy underpay?

The unhealthy will be paying fully-community rated premiums for coverage above the underlying paid-up policy, up to $25,000. If claims exhaust their paid-up coverage, they are left with communnity-rated premiums, which should be lower than experience-rated due to their large claims history.

The healthy? They overpay on the community-rated portion, but less and less each month as the paid-up coverage builds. Eventually, they do not overpay at all, as their underlying paid-up policy builds $25,000-$50,000 of coverage. Then the healthy pay the same community-rated premiums above $25,000 and $50,000 as the unhealthy.

In my opinion, it is a relatively small sacrifice for the healthy, for a huge savings, in order for the unhealthy to have more affordable premiums.

Don Levit

Good point. It needs to be made more often.

The government is imposing an arbitrary, costly and unconstitutional burden on the young.

Surely, someone must have presented these facts to Congress during testimony before Obamacare was passed.

All good points. The reason that Medicare is so popular is that once this older insured gets to be age 65, they are massively subsidized by taxes that the young cannot drop out of.

65 year olds pay nothing for Part A, (which has a real cost of about $500 a month) and they pay $100 a month for Part B, which also has a real cost of $500 a month, and most seniors pay about $35 a month for Part D, with another major subsidy.

If all we did was to lower the age of Medicare to 60, the near elderly would benefit greatly, and the young would barely notice if the Medicare payroll tax went from 2.9 per cent to 3.5 per cent or so.

I have real questions of how to pay for Medicare in the long term………….

but all I am saying is that if our short term goal is help the 60 year olds, we should quit trying to regulate and mandate the private insurance market.

Instead we should forget about private coverage and just expand public coverage.

Why didn’t Obama do something this simple? Obama would say that Republicans would never have let him expand Medicare. He might be right.