Health Plan Deductibles Grew Seven Times Faster Than Wages

The Kaiser Family Foundation has just released its 2015 Employer Benefits Survey:

Single and family premiums for employer-sponsored health insurance rose an average of 4 percent this year, continuing a decade-long period of moderate growth, according to the Kaiser Family Foundation/Health Research & Educational Trust (HRET) 2015 Employer Health Benefits Survey released today. Since 2005, premiums have grown an average of 5 percent each year, compared to 11 percent annually between 1999 and 2005.

The average annual premium for single coverage is $6,251, of which workers on average pay $1,071. The average family premium is $17,545, with workers on average contributing $4,955.

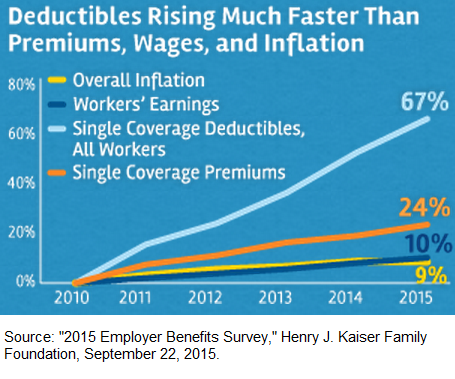

Since 2010, both the share of workers with deductibles and the size of those deductibles have increased sharply. These two trends together result in a 67 percent increase in deductibles since 2010, much faster than the rise in single premiums (24%) and about seven times the rise in workers’ wages (10%) and general inflation (9%).

“With deductibles rising so much faster than premiums and wages, it’s no surprise that consumers have not felt the slowdown in health spending,” Foundation President and CEO Drew Altman said.

I would state that a little differently: It is consumers who are causing some of the slowdown, because they are increasingly sensitive to health spending. So, NCPA would tend to characterize the movement to faster growing deductibles and slower growing premiums as a good thing.

However, I have to qualify that remark: There is still too much price-fixing conducted between health insurers and providers, and not enough price formation by consumers and providers directly.

I would also quibble with the way the lead author describes the effect of the Cadillac tax, a punitive excise tax Obamacare will begin to levy on employers with health plans valued above a threshold in 2018:

“Our survey finds most large employers are already planning for the Cadillac tax, with some already taking steps to minimize its impact in 2018,” said study lead author Gary Claxton, a Foundation vice president and director of the Health Care Marketplace Project. “Those changes likely will shift costs to workers, but exactly how and how much will vary for individual workers.”

Like premiums, the Cadillac tax will be entirely borne by workers. Whether it is passed on as a hike in premium or a reduction in wage growth is a secondary matter.

The Employer Benefits Survey, which the KFF has sponsored for many years, continues to be an important and excellent resource. The whole survey is worth reading.

This deductible information is really making Hillary sweat and she is proposing new fixes in IOWA. Employees are in a bad habit of only caring about the size of the deductible because the employers were paying the premium. Employees never cared about the premium because somebody else was paying that. Obamacare is changing that. Now employees are paying $1,000 a month to add the family on their employer-based plans. Hillary knows these employees don’t qualify for one thin dime of federal tax credits, she calls this problem the Family Glitch.

Self employed people have always been much smarter and they realized that when you raise the deductible the premium goes down. Women employees really hate deductibles. We can call Obamacare’s $6,850 2016 deductibles the Democrat WAR on women.

I bet it has happened a thousand times to me talking to employees on COBRA paying $1,200 a month that they can save $800 a month if they go to a $6,000 deductible. Then these uninformed employees say, “I can’t afford a $6,000 deductible.” Then I say, “Are you saying that if you had a $6,000 deductible today you would pay $9,600 more to lower your deductible $5,000?” That usually works.

When you save more in premium than the size of the deductible you can’t lose. Math is hard for some people, like Hillary, poor thing.

I believe the $6,850 would be the Out of Pocket Maximum not the deductible.

It does not make sense to pay $4,000 a year in premium only to turn around and pay $6,000 in deductible.

Might as well get a LLyods reimbursement Policy, much cheaper in premium.

Erik, there are $6,600 deductibles that pay 100% in 2015 and this grows by the CPI. Are you sure I’m wrong?

The average premium in 2015 for single coverage is $6251 with a $1,500 average annual deductible. Of course this report doesn’t list average out-of-pocket expense which is much higher than $1,500 because employees don’t have 100% coverage after the deductible. In my county the county employees now have a $6,250 out-of-pocket. This report would have been much more accurate if they used out-of-pocket instead of deductibles.

Also, you wrote, “It does not make sense to pay $4,000 a year in premium only to turn around and pay $6,000 in deductible.” You would be correct if you don’t get sick. Because if you don’t get sick you are just wasting that health insurance money. My son’s RX is $6,000 a month so $10,000 in deductible and premiums is much better than flying naked without insurance for him.

What are the premiums on your LLyods reimbursement Policy?

When the price of something grows seven times faster than wages, I would assume people would buy less of it. Except in this case, the government forces you to buy it.

For every 100,000 young healthy people who think they don’t need any health insurance beyond a mini-med plan, I wonder how many in any given year are badly hurt in a car or motorcycle accident or a sports injury or get a cancer diagnosis. If they consciously decide to spend their money on other things rather than buy at least high deductible health insurance and then find that they need the coverage but don’t have it, they should suffer the consequences. This is why mandates to purchase and guaranteed issue have to go together. Otherwise you get adverse selection on steroids. If the individual mandate goes away, guaranteed issue has to go with it.

I suppose, in this case, your “I wonder” constitutes an “argument”.

I don’t believe “mandate to purchase” is necessarily required. A “tax incentive to purchase” has worked fairly well in the employer market which continues to survive despite restrictions on underwriting. I’ve been arguing that the tax exclusion effectively reimburses healthy employees for the additional premium cost beyond that of an equivalent underwritten policy.

Of course employer coverage comes with some built-in restrictions that also help to limit anti-selection. A non-employer-based plan supported by tax credits would need equivalent restrictions.

My understanding is that if you don’t sign up for an employer plan when you first become eligible, you will be subject to medical underwriting if you want it later. The exception is if you have a life changing event like losing coverage under a spouse’s plan.

Employer plans are also priced on a community rated basis which makes them a better deal for older employees than for younger folks.

I don’t see how private market plans can work without a mandate to purchase but with guaranteed issue remaining in place. It just invites adverse selection.

My experience has been that if you don’t sign up during the window or after a qualifying event, it’s not offered period.

Small companies I’ve worked for (in California) had age banding and were not self-insured. I don’t suppose this is the case for all states, but this is closer to what I had in mind.

As I mentioned earlier, the term “guaranteed issue” would have to be subject to some restrictions, including prior creditable coverage and an enrollment window or waiting period. Medicare has a draconian lifetime penalty for failure to enroll on time.

The same restrictions would have to be a requirement for upgrading to a more expensive plan.

Anyway, I don’t see how guaranteed issue could work in the strictest sense even with a mandate to purchase, unless ‘mandate’ means ‘forced purchase’.

Barry, the individual mandate means nothing for most people. In New Orleans a 64-year-old couple finds the lowest priced HMO plan $1,000 a month which means there is no penalty for the couple if they have Modified Adjusted Gross Income (MAGI) of $150,000 or less annually because of the IRS’s affordability rule of 8% of income.

I know CPAs were making everybody pay the fine if they didn’t have health insurance but these so-called advisers were just plain wrong.

So the fine on the mandate goes to America’s youngest citizens because their premium is the lowest, figures.

Next year the premium will go up and so will the amount of income required to pay the fine on the Individual Mandate.

Ron — I get the affordability issue, especially for older people. I’m just saying that we can’t have guaranteed issue without a mandate. Otherwise people could just wait until they get sick to buy health insurance. Sometimes they could even buy it and then drop it again after they get their care such as having a baby or an operation they know they need like hip or knee replacement. That happened a fair amount in Massachusetts during the early days of Romneycare.

Ron makes some good points, but I want to expand on two of them.

1. If women hate deductibles more, partly this is because they see doctors more often, and thus a high deductible will hit them financially every single year. Men tend to think of health care in terms of a car crash or massive heart attack,

maybe twice in their life, so a high deductible is more palatable to them. (I first encountered this idea from an article by Malcolm Gladwell.)

2. The Hillary plan that I read about is actually pretty interesting. I believe it would pay up to $5000 to an insured person if their out of pocket payments in a given year exceeded 5% of their income.

In other words, (I think), if a person making $40,000 had a bronze plan with an out of pocket limit of $12,000, then after a big claim the government would give the person $10,000. ($12,000 less 5% of income)

How she pays for this and administers this is fuzzy, but the concept seems OK to me. The conservative Martin Feldstein suggested something like this 20 years ago.

That 5 percent threshold comes out of the notion of “under insurance” promoted by Commonwealth Fund. What about people with volatile incomes? Suppose you have an income of $150,000 in 2015, $50,000 in 2016, and $150,000 in 2017? You save a lot of your money in fat years. Should you get the payout if you exceed the 5 percent threshold in 2016?

Ron makes some good points, but I want to expand on two of them.

1. If women hate deductibles more, partly this is because they see doctors more often, and thus a high deductible will hit them financially every single year. Men tend to think of health care in terms of a car crash or massive heart attack,

maybe twice in their life, so a high deductible is more palatable to them. (I first encountered this idea from an article by Malcolm Gladwell.)

2. The Hillary plan that I read about is actually pretty interesting. I believe it would pay up to $5000 to an insured person if their out of pocket payments in a given year exceeded 5% of their income.

In other words, (I think), if a person making $40,000 had a bronze plan with an out of pocket limit of $12,000, then after a big claim the government would give the person $10,000. ($12,000 less 5% of income)

How she pays for this and administers this is fuzzy, but the concept seems OK to me. The conservative Martin Feldstein suggested something like this 20 years ago.

whoops. The example in my second to last paragraph would have the government giving the person $5000 not $10,000.

Couple of comments on deductibles:

First, the nominal increase in deductibles is misleading – in that many increases are part of a conversion to personal account/consumer driven health plans (Health Savings Accounts, Health Reimbursement Accounts). In fact, HSA-qualifying High Deductible Health Plans (which only became available in 2004-2005) represent 25% of enrollments. So, the deductible information does not incorporate employer-funded contributions to HSA’s and HRAs.

Second, please read Devon Herrick’s Policy Report #372 on Medicare Reform, and take note of Figure VI. It confirms that, despite all the bluster about higher deductibles, the percentage of health care spending paid by individuals has dramatically declined from almost 50% in the 1960’s to just over 10% (measured as recently as 2012). So, all the deductible increases have failed to keep pace with medical inflation – meaning that even after the increases, employer plans still bear an increasingly larger share of funding the cost of medical services.

So, a little perspective is needed here when discussing the size of a deductible. I would note that I am in the same plan that I had in 1984 – which had a $200 deductible at that time. Had the deductible kept pace with inflation, measured using the cost of my plan, the deductible would now be > $3,000 a year (it is half that amount in 2015, or $1,500).

With regard to the comments above about restrictions on enrollment, note that HIPAA has prohibited medical underwriting in group health plans since its passage in 1996. It also limited the application of pre-existing condition exclusions. Pre-ex was eliminated by Health Reform for employer-sponsored group health plans.

So, late entry restrictions are for those employer plans without an annual enrollment, where those who waive coverage at hire can only enroll should there be a HIPAA-qualifying special enrollment event.

That said, Health Reform also confirms that for the employer to avoid paying the $3,000/year employer shared responsibility penalty tax, all full time employees must have an annual opportunity to enroll in qualifying health coverage – so, while the employer need not open up to annual enrollment all coverage offerings, to avoid the penalty tax, they must make available at least one qualifying coverage offer (“affordable”, “minimum essential coverage” of “minimum value”) at least once a year.

Very, very well put. Thank you.

BenefitsJack, only employers with 50 or more full time employees are required to offer insurance or pay federal fines in the land of the free.

The average price for family insurance is $17,500 and the employer is paying $12,500 and the employee is paying $5,000. In Houston a 50-year-old couple earning $65,000/year with 2 children can purchase a Blue Cross HSA Bronze plan for $3,576 a year after tax credits. The employee saves $1,500 a year and the employer saves $12,500. Even if the employer has over 50 full time employees and pays the federal fine of $3,000 the employer still saves $9,500 a year.

The total annual premium for this Blue Cross plan is $8,688 a year. So why are employers paying double for employer based health insurance? These large insurance companies hope the brainwashed Americans never figure out that they are being scammed to the max with employer-based health insurance because the insurance company’s stock are going to the moon. In 2009 Humana’s stock was $19 a share and now it’s $181!

In 1972 the Mayo Clinic charged $50 a day in the hospital. When you had your $200 deductible you probably had 80 – 20 co-insurance to $5,000 and everything was less than $5,000 so people payed 20% of their medical bills.

Agreed with respect to the 50 employee threshold, but it is 50 counted uniquely as only Health Reform and the IRS can – full time employees, and full time employee equivalents, measured based on averages in the preceding calendar year.

Health Reform was structured so that employers who already offered health coverage could make modest changes and maintain their existing offerings. The whole structure was designed to avoid giving employers who already offered coverage an excuse to drop coverage.

That is, while Health Reform now offers an alternative to employer sponsored coverage (public exchange options), employers who had decided in the past to voluntarily offer coverage without the employer mandate had no reason to change their prior decision – other than the potential for savings (where your analysis needs to be adjusted for the loss of tax preferences, less of an issue for non-profits and governments).

Note Mr. Graham’s comments from above: “Like premiums, the Cadillac tax will be entirely borne by workers. Whether it is passed on as a hike in premium or a reduction in wage growth is a secondary matter.”

That is what is happening for employers today … the after-tax cost of providing tax preferred health coverage is incorporated in the budget as part of total rewards spending. So, maintaining coverage means maintain a prior decision to offer coverage that was made at a time when there was no mandate. So, Health Reform introduced no burning platform to stop doing what they had previously voluntarily decided to do.

Most employers who were not offering any coverage probably still don’t offer any coverage – opting instead, as your numbers suggest, to pay the penalty tax. Other employers who were not offering coverage, or who were only offering coverage to a subset of all full time employees (such as a staffing agency, fast food enterprise, etc.), may have opted to provide the bare minimum (a single coverage option that barely meets all the minimum requirements, but where the cost to the participant is so significant, in terms of the employees’ contribution AND their out of pocket expense maximum) that no one enrolls – yet the employer avoids the employer shared responsibility penalty tax.

Once the Cadillac Tax kicks in, expect to see employers become very savvy and hyper critical about their health coverage spending – with an eye on managing costs to remain below the arbitrary dollar thresholds. As was the case in the past, look for new trends to start with not-Medicare-eligible retirees, then migrate to apply to active employees.

Further, and importantly, look for many employers to create structures designed to encourage those with the highest anticipated claims experience/medical services utilization to waive employer sponsored coverage and migrate to a public exchange option.

That is, averages, and particularly average medical costs are very deceiving. Remember what we call the Pareto principle – 80+% of costs are incurred by < 20% of the employee population. So, look for designs and structures to emerge that encourage those with significant expense to waive employer-sponsored coverage and migrate to the public exchange, particularly where the structure enables the individual to qualify for taxpayer financial support.

Keep in mind, there is no Cadillac Tax on public exchange coverage.

Ron’s discussion about how employers could save money by sending their employees to the exchanges is of interest.

John Goodman and Douglas Eakin said about the same thing 6 years ago.

So an observer might ask why this massive savings opportunity has largely been ignored, especially by larger employers who have in almost no cases dropped health insurance.

Here are a few possible reasons that I see:

a. For older employees, the exchanges can be much worse than their workplace plans. This includes top management at many firms.

b. Some firms could keep their pre-ACA plans through grandfathering rules.

c. Companies hate to pay IRS fines for anything.

Employers have in fact been changing their medical coverage to take advantage of ACA and save money. Keep in mind that large employer strategies generally differ from small employer strategies so one cannot expect all employers to be doing the same things, or even at the same pace. Most of this information is available on the web.

For one thing many large employers have stopped, or plan to stop, contributing toward the premiums for their retirees’ medical coverage. Instead these employers offer what is called “access-only” coverage for retirees. Retirees still have access to employer-sponsored medical coverage – provided the retirees pay the full [group] rate. This is a savings for the employer.

The absence of employer premium contributions is incentive for individuals to find other coverage e.g., thru a spouse. When individuals drop coverage, that’s additional savings to the employer.

Further, retirees not yet eligible for Medicare usually comprise the most costly population to the employer, Large employers have begun to terminate early retiree coverage entirely. That yields even more savings to the employers. (Employers who terminate early retiree medical coverage often permit such retirees & their dependents to elect retiree medical coverage when they become Medicare eligible – without any employer premium subsidy).

These strategies are practical because (1) the employers have ceased premium contributions, (2) ACA insurance is guaranteed-issue, and (3) ACA provides subsidies based on income for policies purchased on an exchange.

My former employer allowed non-union retirees to buy in to the company’s health insurance coverage with their own money at group rates for years but eliminated even that option about four or five years ago. For unionized employees, the cost of health insurance for both retirees and the active workforce is a hugely contentious issue in the current labor negotiation with the United Steelworkers Union for a new contract to replace the prior contract that expired on September 1st. Since fewer and fewer private sector retirees have health insurance that former employers help pay for, I can also understand why there is increasing resentment among taxpayers toward public sector retirees who continue to receive generous health insurance coverage in retirement paid for largely or fully by the employer (taxpayer in this case).

Since many retirees and their spouses have combined incomes well below 400% of the FPL, they should be eligible for significant subsidies with their out-of-pocket cost of insurance limited to 9.5% of pretax income for the 2nd cheapest Silver level plan in the market. For most employees outside of low wage industries like restaurants and bars, retail trade and hospitality, employers have chosen to sustain employer provided health insurance though more and more gravitated toward high deductible plans and, in a few cases, private exchanges coupled with a defined contribution toward the cost of insurance. They see it as a competitive issue to help attract and hold good employees. In a few well publicized cases of employers with lower paid workers including Starbuck’s, Whole Foods and Costco, these solidly profitable companies can afford to offer health insurance to a workforce that is largely young and healthy.

Good points. I have worked in and sold insurance to small businesses nearly all my adult life. These businesses tend not to have any retirees under the age of 65, much less retirees who are on their health plans.

The exception would be school districts. The longest teacher’s strike in MN history occurred when a district tried to force early retirees off the health plan.

The attitude in small business is that if the employer is going to help pay for Medicare during an employee’s entire tenure, then that is all that is owed. Small businesses tend to look on 56 year old retirees as rather privileged characters, who should fend for themselves.

Assuming Health Reform is ultimately implemented as it was written (after all the delays, and administrative adjustments end), you’ll see employers react to the “new normal” – the post-PPACA world. If you are looking for precedent, look at the impact on defined benefit pension plans after Congress got active – ERISA (1974), ERTA (1981), TEFRA (1982), DEFRA (1984), REACT (1984), TRA (1986), SBJPA (1996), PPA (2006), and minor changes in almost every year after 1986. Or, as I mentioned above, look at the change in retiree medical coverage – and particularly the changes once uniform accounting rules became a reality (FAS 106, and later FAS 158) in 1994.

For retirees, there have been reasonable alternatives for Medicare-eligible retirees in place for almost a decade, and a significant minority of employers who offer retiree medical coverage have now opted for EGWP’s and Medicare private/public exchanges. Only now are we starting to see the changes in coverage for non-Medicare eligible retirees (because the public exchange options re now in place) – but expect that to increase significantly once the Cadillac Tax is implemented in 2018.

Where active employee medical is already present, it is part of the total rewards package. So, a change requires a change in rewards strategy. Most current employee benefits professionals have NEVER had to justify the offer of health coverage at their employer, they inherited someone else’s decision. I can confirm, in my 35 years of corporate employee benefits planning at five different Fortune 500 employers, that I never had to justify why we offered health coverage as part of the total rewards package. Simply, there were no viable alternatives. So, my charge was to find a way to manage the spend and maximize the return on the investment (in terms of tax preferences, value to participants, etc.)

As with almost every other strategic change, there will be winners and losers – when changing the status quo. So, as long as the status quo is sustainable (not necessarily the most profitable), large organizations tend to avoid creating the conflict of “winners and losers”. Some organizations overcome this resistance by implementing changes that include transition provisions that “top up” – so that there are no losers in the short term, but the longer term solution is ultimately realized.

So, the structure I expect to see deployed, over time, once Health Reform is fully implemented (but not at ALL employers) is one where the employer either offers coverage that, either:

– Does not meet the “minimum value” requirements, but is of value to employees.

– Does not meet the “affordability” requirements for those employees who might otherwise be eligible for taxpayer financial support (< 400% of FPL).

In the first alternative, the employer would leave out certain very expensive treatments from their self insured plan. So, overall employer spend will be relatively unchanged for most employees. However, those who anticipate significant medical expense (well in excess of the "premium", the average cost of health coverage), will recognize the much higher costs they would bear. In turn, they can waive the employer-sponsored plan because it does not meet their needs as well as options available in the public exchange. Because the plan does not meet the minimum value requirements, the individual can then opt for public exchange coverage AND qualify for taxpayer financial support where their household income is < 400% of FPL. But, the majority of employees, those who do not expect significant medical expense, those for whom the plan is still of value and convenient, would likely remain in the employer-sponsored plan. Similarly, by eliminating employer financial support for dependent coverage, the employee can easily identify the option that will be the best for her family members.

In the second option, as in the first option, the employer will provide a notice confirming that the individual now has access to both the employer sponsored plan and the public exchange options – and, where household income is < 400% of FPL, she can qualify for taxpayer financial support upon enrolling in public exchange coverage. So, again, the individual has clear, identifiable financial incentives to take advantage of taxpayer subsidies – reducing her costs and those of her employer as well.

One casualty of both options will be employer financial support for any dependent coverage, and, for many employers, eliminating the spouse as eligible for coverage.

In both alternatives, the employer might provide additional compensation (wages) while, at the same time dramatically raising the deductible to match the maximum out of pocket limit. In both alternatives, the employer would provide a personalized notice to the individual that they now have access to both the employer sponsored plan and public exchange options. They actually already have access to both today – so, this would highlight that fact. Added decision-making assistance would also be provided in the form of counseling. In both alternatives, where the household income is < 400% of FPL, taxpayer financial subsidies for public exchange coverage are available. So, the employer will benefit from a structure where, while continuing to make employer-sponsored coverage available, they will inform the employee that the public exchange option may be the better choice FOR THE EMPLOYEE – and, where the employee takes action, the employer reduces their cost. Finally, while I expect employers to make such changes over a period of years, I also expect many will change the "default" on their annual enrollment, to "no coverage" – so, employees need to affirmatively elect the coverage that they want.

There will be other changes in employer's self-insured health plans with an eye on those individuals who would enroll one or more family members in both the employer-sponsored plan and a public exchange option.

These are major, massive changes that won't be undertaken until there is a burning platform – generally, unsustainable cost and/or implementation of the Cadillac Tax.

The survey data noted above confirms employers, at least today, are willing to spend those significant amounts. Apparently, at those spend levels, some employers have decided that the cost of coverage is sustainable. If it was only about money, cost and expense, if it was only about gaining a competitive cost advantage, employers could have dropped coverage in favor of the public exchange options two years ago. Obviously, it is solely about cost, money and expense.

Nicely said, BenefitJack. (I think you left out a “not” in your last sentence, but your meaning is clear nevertheless).

BenefitJack, here is an example of your new normal. My county in Florida, Pasco County, is charging teachers $14,012.60 per year for family Blue Cross PPO health insurance. The COBRA cost is $19,255.08 per year so the school district is only paying about $5,000 per year per employee for the insurance.

This post is saying exactly the opposite that the employers are paying more than the employee. In the real world these 10,000 employees are being scammed by the insurance industry and the NCPA is cherry picking data to report that doesn’t really tell the whole story.

http://www.pasco.k12.fl.us/library/ebarm/cobra/dsbpc_cobrarates

Charging employees (teachers) $700.63 every 2 weeks for family coverage ($1,401.26 per month)

http://www.pasco.k12.fl.us/library/ebarm/dsbpc_retireerates16.pdf

A 35-year-old teacher with a husband and child could have her husband and child go to the exchange and get Blue Cross for $373 per month (save over $1,000 a month) but it’s not Open Enrollment – is it?

You have to admit that the public is being scammed by employer-based health insurance. It’s like the Mafia.

It sounds like premiums for exchange plans will increase faster than general inflation as employers gradually transition their most expensive to cover employees to the public exchanges. Also, as more employers end coverage for retirees, especially retirees not yet eligible for Medicare, that will further skew the exchange pools toward older and sicker people.

Recall the tax credits adjust with inflation too (because they are based on the Federal Poverty Level), so Obamacare beneficiaries will face higher costs each year. (Well, maybe not this year, as there is no inflation!)

Not much of an adjustment – Required contribution percentage based on income that is a function of the federal poverty level, relatively unchanged from 2014 $11,670 (lower 48 states) to $11,770 in 2015:

< 133% 2.00% to 2.01% (2015)

133% – 149% 3% to 4.00% to 4.02%

150% – 199% 4% to 6.3% to 6.34%

200% – 249% 6.3% to 8.05% to 8.10%

250% – 299% 8.05% – 9.5% to 9.56%

300% – 400% 9.5% to 9.56%

So, even if the premiums go up dramatically for public exchange options, so long as the worker's income doesn't increase substantially, they will be mostly insulated from health care cost inflation in terms of their premium payments – the added cost will be shoved onto the backs of taxpayers.

This is true for those that qualify for the tax credits. If the employer is charging $1401 a month to add the family onto insurance and they go to the exchange and get coverage for $900 a month with no tax credits they will feel the pinch of inflation on the exchange. United Healthcare’s rates just came out for Florida and it’s a 20% increase. So if the 2015 Exchange cost is $900 a 20% increase will make the premium rise to $1,080 a month in 2016 and they still don’t qualify for tax credits.

If the consumer is getting tax credits now they probably won’t feel the increase but the taxpayer will. On this we can all agree.

Thanks Jack for summary. You do suggest a way to get around the ‘family glitch’ in the current ACA, where a spouse is not eligible for subsidies if the plan for the employee is considered ‘affordable’.

I lost you on one point though. You suggest that an employer remove expensive treatments from their self insured plan, and then employees who anticipate such care will migrate to the exchanges.

But what if the expensive treatment is unexpected? this has happened twice in my own life. Medical records are chock full of people who found they had prostate cancer after a routine blood test, etc etc. This could be an ugly situation for the employer.

With respect to family coverage in the Florida county, many employers (but not a majority) pay little or nothing towards the cost of family coverage. Expect that trend to increase, not decline – now that all employers (including the spouse’s employer) are supposed to offer coverage.

For expensive treatments, the goal is to ensure people make informed enrollment decisions. Any firm aggressive enough to take this action will likely not bat an eye when it occurs unexpectedly.

A middle ground would be to treat as out of network expense.

As costs become unsustainable, expect various responses up to and including abrupt plan termination to stop the bleeding.

Less than 30% of small employers offer coverage in Florida. So it’s common that those that do have a spouse that is not covered with employer-based coverage.

This Pasco County employer-group coverage for teachers took a 24 percent increase for employees. This is a group of 10,000 employees. So saying group coverage is increasing only 4% in 2016 is wrong big time with this group.

We won’t find the truth with the media.

“saying group coverage is increasing only 4% in 2016 is wrong big time with this group”.

Well, yeah; but Ron, who is saying group coverage is increasing only 4% in 2016?

John Graham quoted a Kaiser/HRET study which found that “Single and family premiums for employer-sponsored health insurance rose an average of 4 percent this year.”

This year, not next year.

The average increase Kaiser/HRET found for 2015, and the specific increase you mention for 2016, can both be true. Just as it is true that on average Americans have one testicle and one ovary. That sounds funny, but it’s arithmetically true because, in any average, every value is not equal to the mean value. So even if the predicted average cost increase for 2016 were 4% (I think it’s actually somewhat higher than that) there will be outliers both above and below the predicted average.