Health Insurers Just Fine Under Obamacare

New research from the Commonwealth Fund, a pro-Obamacare think tank, shows that health insurers are doing just fine under Obamacare.

Well, the stock market has been telling us that for years. The report’s purpose is to cheer the rebates that insurers which made too much money paid to consumers. Obamacare regulates the Medical Loss Ratio (MLR). If an insurer does not spend enough premium on medical claims, it has to pay a rebate to its beneficiaries.

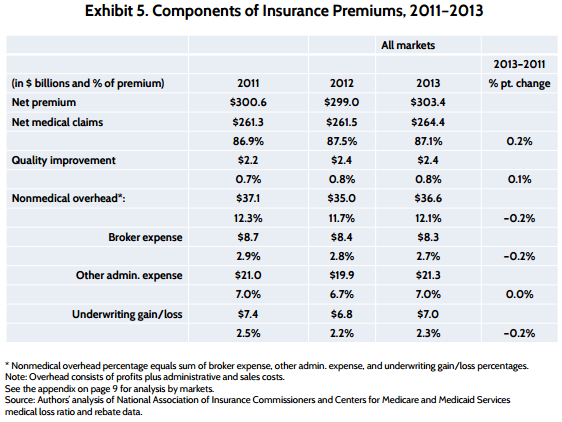

Rebates have collapsed from over $1 billion in 2011 to $325 million in 2013. The report concludes that Obamacare caused insurers to reduce their overhead expenses and profits. Actually, there is less to this story than meets the eye. Exhibit 5 shows that there has been very little change in insurers’ income statements over the three years.

(Source: Michael J. McCue & Michael A. Hall, The Federal Medical Loss Ratio Rule: Implications for Consumers in Year 3, New York, NY: Commonwealth Fund, March 2015, page 6.)

The operating margin (underwriting margin/net premium) declined from 2.5 percent to 2.3 percent. However, what the analysis neglects is that insurers experienced a significant reduction in risk. That is what the stock market has been telling us.

Exhibit 6 shows how badly the individual market has been hit: Administrative expenses increased from $3.4 billion to $4 billion, an increase of 17 percent. Underwriting losses tripled from $400 million to $1.2 billion.

(Source: Michael J. McCue & Michael A. Hall, The Federal Medical Loss Ratio Rule: Implications for Consumers in Year 3, New York, NY: Commonwealth Fund, March 2015, page 7.)

That individual market, of course, was destroyed by Obamacare. The insurers that remain are doing very well.