Health Insurance Monopoly

The single most important feature of the Affordable Care Act (ObamaCare) is the establishment of a health insurance exchange where people will be required to buy health insurance if they are not insured by their employer or a government plan. As envisioned by Stanford professor Alain Enthoven, an early proponent of the idea, the exchange will be a model of competition… well…make that managed competition. (More on the “managed” part in a future Alert).

But rather than move toward a competitive world, we seem to be moving toward the opposite extreme: monopoly. Major consolidation is underway both on the provider and insurer sides of the market. And while this trend was already underway before Barack Obama became president, without doubt it is accelerating because of ObamaCare.

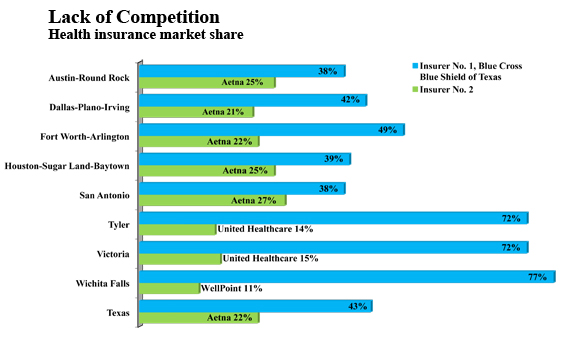

The graph below shows what things look like in the market for commercial insurance in major Texas cities:

- Blue Cross already has 70% of the market in three of the nine largest metropolitan areas.

- In all of them, and for the state as a whole, more than 60% of all customers buy from only two insurers.

Since the passage of the health reform bill, Harvard Pilgrim has announced its departure from the Medicare Advantage market (leaving 22,000 enrollees to search for coverage elsewhere) and the Principal Financial Group has left the health insurance market altogether (leaving 725,000 people behind). Many other small- and medium-sized insurers are struggling to hold on.

What is causing the immediate problem? One big problem is a federally required medical loss ratio (MLR), a term of industry argot that means the percent of premium spent on health care, as opposed to administrative expenses. Before getting into the weeds on this let’s consider the same issue in two related fields: education and private charity.

In almost every state, rarely does a session of the legislature adjourn before someone files a bill to require the public schools to spend a certain percent of their income “in the classroom.” How well does this work? Here is Michael Barba’s description in a forthcoming NCPA Brief Analysis:

Nationwide, schools spend an average of about $10,000 per student each year. On average, 60 percent of this is instructional, according to the National Center for Education Statistics (NCES). Instructional spending includes such things as teacher and staff salaries, extracurricular activities such as sports or academic clubs, and classroom supplies. However, each state can define instructional spending as it chooses, and expenses labeled as instructional are often not exclusively classroom expenses. In Texas, for example, the upkeep of vehicles, equipment and computers, as well as food service, travel, property insurance and refreshments for meetings are all considered instructional…

There is a…mandate in California that 85 percent of total school spending must be devoted to instruction, but the mandate is so riddled with exceptions that it allows funds to be diverted to nearly any program district officials see fit.

With respect to private charities, an often used rule-of-thumb is that 85% should be spent on programs and 15% on “fundraising” and “administration.” My advice: Forget the formal accounting and ask: Does the organization own its own airplane? Does the CEO have his own car and driver? Is there an executive dining room? Do they do a lot of direct mail? These questions are far more important than whether the organization is clever enough to classify the expenses as “program” or “marketing” or “human relations.”

With respect to health care, the same problems arise. There is no hard and fast definition of what is “administration.” And in competitive markets, none of us have reason to care. Do you care how much McDonald’s spends on “administration”? I don’t. But when the federal government told McDonald’s it could spend no more than 15% of health insurance premiums on “administration,” the company threatened to cut its “mini-med” insurance for 30,000 workers. Overall:

- The administration has granted 2.7 million workers waivers, so they could avert the loss of their health insurance — in part because of the MLR regulation.

- Maine has received a waiverto allow a 65% MLR, rather than the 80% or 85% called for in the new law — to keep all its commercial insurers from leaving the state.

- Three other states (Kentucky, New Hampshire and Nevada) have filed similar waiver requests, and an additional 11 states are reportedly preparing to file them.

But waivers make the problem go away only temporarily. What’s really at issue is a difference of vision about how the health insurance market should be organized.

As Scott Gottlieb has pointed out (in a study we covered here), MLR regulations stifle innovation and competition. They are part of a regulatory approach in which health insurance companies are turned into public utilities. On this view, it doesn’t matter that only one or two competitors are left standing.

Regulation, not competition, is what ObamaCare officials are counting on to make health reform work.

Maybe this is why the White House won’t release the info on who it met with while they were devising the whole thing.

Whoever said Obama believes in competition. I don’t think he even understands the concept.

“Regulation, not competition, is what ObamaCare officials are counting on to make health reform work.”

Agree totally.

Another problem with the 80% – 85% MLR regulation is these rules favor comprehensive plans. It is easier to spend 85% of premiums on medical claims when people are essentially pre-paying for medical care they expect to receive. But what if people prefer to own a high-deductible plan that protects them in the event of a major illness? This could be a plan they don’t expect to ever file a claim against (say, a $5,000 deductible plan). The MLR rules make it impossible to sell these plans.

“The administration has granted 2.7 million workers waivers, so they could avert the loss of their health insurance”

Increased regulation will have higher administrative costs. I believe the IRS is slated to increase their workforce by 16,000 to audit the health care compliance. 2.7 million (waivers and growing) is a dose of reality for the plan.

The graph is worrisome.

Devon – The loss ratio requirement shouldn’t be any more of a problem for “normal” high deductible plans than for comprehensive ones, as long as the pool of covered persons is large enough. Actually, the administrative cost to handle lots of small claims is higher than that to handle the more occasional catastrophic level claim. Especially in an environment where there isn’t any underwriting cost up front (as is anticipated), the high deductible plans (as long as we are not talking deductibles over, say, $15,000) shouldn’t present that much of a problem. There are plenty of people who exceed $5,000 in expenses in a year to spread expenses across expected claims.

The bigger problem in general is the power currently granted the jumbo players to control the prices of their inputs – that is, the disruption caused to the market of the essential stratified price fixing that is present with network discounting from the unrealistic bill master of providers. By moving to an enforced all payer system (example – Maryland hospital system, or at least a variation on same), you take away the (in my view) illegitimate advantage granted to the BUCAHs in their ability to coerce providers into discounts that creates cost shifting and excessive administrative costs to maintain multiple bill schedules, and create a playing field where new entrants can bring innovation and creativity back to the market. Of course, that market should also be the arbiter of the percentage of premium that ends up as claims through open transparency, not an arbitrary government regulation that says it must be 80-85%.

Contrast this with car insurance, where I have a range of companies to choose from. They even run commercials on TV competing for my business.

Is managed competition like controlled excitement?

John,

Re: the McD’s analogy. I seem to remember that Starbucks says it spends more on health insurance than coffee. The CEO recently said that he changed his mind and now thinks Obama Care will hurt small business. A good analogy would be to require Starbucks to pay no more than 15% in administration when it buys coffee! This would be a big problem for them because they have programs to make sure the harvest is sustainable and the workers are paid fairly and more. All of these other objectives cause the administrative costs to go up.

-Gerry

If competition means what it says, competition, then what is this fetish among economists to hang onto competition in word only by renaming it managed competition? Why didn’t they choose the words managed control?

John,

McDonalds was given a waiver because they only offer mini-med plans that had capped/limited services which cannot occur under PPACA. You discussed this right here on this blog. Why are you saying it was because of MLR now?

John,

Since the passage of healthcare reform, 3 prominent medical insurance carriers have gone out of the small group health insurance business. More to come, I’m afraid.

-Stuart Prescott

Erik – I am not positive but I believe the McDonald’s waiver is a bit of both – yes, they offer a mini-med plan, and needed a waiver due to max benefits, etc. However, it also is usually the case that mini-med plans just also happen to operate with a much higher expense to benefit ratio precisely because the benefits are so low. It still costs more or less the same amount of money to set up the certificates, do the paperwork, set up the claims files, etc., and it is also true that mini-med plans often come with a sales/service “fee” that is paid to get people enrolled. The result is that these types of plans often run loss ratios anywhere from 50-65%, depending on volume. (The lower end loss ratios are often voluntary work-site type products with relatively high sales commissions. Personally and professionally, I find such products indefensible as providing an acceptable value proposition, as they can be provided for far less administrative and sales cost if structured with better design, but no one has cared to do it right because the motivation wasn’t there.) Hence, the McDonald’s plan most likely required a waiver for both reasons.

Competition > regulation, any day. Nice analysis, Dr. Goodman.

John –

Another excellent analysis. The problems with Obamacare are vast, but at the top of the list is the MLR requirement. It’s insanity.

Well, the thing is: Groups’ behavior in the market for health insurance tells us that they do not care what the MLR is. I wrote about this back when Gov. Schwarzenegger was trying to impose this in California: http://tinyurl.com/6xbks2p (p. 24). If they do care, then they can choose not to pay premiums to carriers with low MLRs and go to those with high MLRs instead. But they do not.

I own life insurance, auto insurance, and tenants’ insurance. I haven’t the slightest idea what the loss ratios are for those carriers.

@ Devon Herrick and HD Carroll

I agree with HD in response to Devon. High deductible plans should have lower administrative costs. The reason: the plan doesn’t have to monitor and manage small claims that are more appropriately monitored and managed by individual patients.

@ Simon

The 16,000 IRS auditors was a Republican estimate that the IRS doesn’t agree to. More importantly, the Republicans may succeed in defunding any IRS spending for this purpose. But if the IRS were going to do it right, they probably would need 16,000 new people.

@ AI

Agree that we should call the exchange “managed control” rather than “managed competition.” Good point.

@ Erik and HD Carroll

Agree with HD’s response to Erik. McDonald’s has been mum about all this, so it’s hard to know for sure.

@ Gerry Musgrave

More CEOs will be changing their minds before it’s over.

@ John Graham

Agree with you totally. In a functional (as opposed to dysfunctional) market no one has any reason to care what the MLR is.

When Small Group Reform was enacted years back, the objective was to reduce competition because “fewer companies are easier to manage”. With this round of reform, the MLR mandate means that only Blue Cross, United, Cigna, Aetna, and Humana can meet that level, so all others will be eliminated, then there are only 5 companies to oversea.

In some environments, this would be considered fascism. But, I guess “managed competition” has similar connotations.

Fascism? I think you hit the nail on the head, Ralph.

http://online.wsj.com/article/SB10001424052748704461304576216872954763388.html?mod=WSJ_Opinion_AboveLEFTTop

Interesting potential application of this ruling, last week in DC District Court to older Americans who wish to waive Medicare Part A so that they can participate in a Health Savings Account offered by their employer. If affirmed on appeal, it may mean that you have to not only forego Medicare Part A coverage but also Social Security benefits.

Talk about monopoly?!

Jack, see Wall Street Journal editorial on this today.

Ralph,

Thought you should know that the Utah Portal was designed to “increase competition and offer choice.” There are only 4 carriers participating. There are many more carriers and plans available in the private marketplace….so far.

To meet the MLR ration carriers have cut agent commisssions by 35%-50%, laid off employees, and closed some regional offices. They have eliminated some less popular plans for ease of administration. Large carriers are swallowing up smaller carriers. For example, Coventry bought Preferred Health in KS and Mercy Health in MO. And so it goes.

Beverly

“…the Utah Portal was designed to “increase competition and offer choice.”

Large carriers are swallowing up smaller carriers. For example, Coventry bought Preferred Health in KS and Mercy Health in MO. And so it goes.”

Seems their “design” isn’t working that well

Wow…that’s SO cool…sure.

The only alternative is to have a plan that pays medicare plus 30%