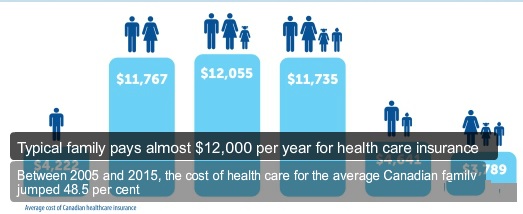

“Free” Canadian Health Care At $12,000 Per Family

The Fraser Institute has released a study estimating the costs of Canada’s government monopoly, a.k.a. single-payer health system. A typical Canadian family of four will pay $11,735 for public health care insurance in 2015. The study also tracks the cost of health care insurance over time: Between 2005 and 2015, the cost of health care for the average Canadian family (all family types) increased by 48.5 per cent, dwarfing increases in income (30.8 per cent), shelter (35.9 per cent) and food (18.2 per cent).

Moreover, general government revenue—not a dedicated tax—funds health care, making it difficult for Canadians to decipher how much of their tax dollars actually go towards health insurance.

The study finds the average Canadian family with two parents and two children earning $119,082 will pay $11,735 for public health care insurance in 2015. A single individual earning $42,244 can expect to pay $4,222.

For American readers, I should note that the single-payer system does not include dental care or prescription drugs for working people in most provinces. And to get in front of the comments: Yes, when you add your taxes for Medicare and Medicaid plus premiums for employer-based health benefits, you are paying more than your neighbors to the North.

The average family in Canada earns $119,082!?!?! I’m moving there!

That does sound high. But I’ve also heard Canadians reach the 50% marginal tax rate at something like $35,000 in annual income.

The average family with “two parents and two children” is almost certainly an upper middle-income family. The single-parent households are what drag the overall average down.

Statistics Canada has the median family income (of all family types) for 2013 at 76,000 dollars (I assume those are Canadian dollars since the data come from the Canadian government). For couple families (those families with 2 adults living together), the number is 84,000. Lone parent families is 40,000. (data from http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/famil108a-eng.htm) (For those who want to know: Purchasing Power Parity exchange rate is about 1 Canadian dollar to 85 US cents.) So no matter how you slice the data, the numbers used in the report do not represent a typical Canadian household in any category of family size. Also, it is a bit strange to talk about the cost of health care for a particular type of family (especially changes in the cost) when the cost comes out of the government fisc. If the government is making the purchase, it only makes sense (to the taxpayer) to talk about whether taxes go up or down, not (for example) whether the cost of roads goes up or down for a particular household.

Given the amount of taxes that Canadians pay, I would think most of them would say that the healthcare is not free but that it is something they have already paid for.

Thank you for that. That figure rings true and it is Canadian dollars, so CN$76,000 is about US$57,000.

“Median” is a precise term, but “typical” is not. However, I understand why the Fraser Institute defined “typical” as two parents and two kids. “Household” is not a standard unit.

Spending about 10% of income for health insurance, whether through taxes or insurance premiums, is pretty standard in most other developed countries. I think that’s why the ACA set the threshold income level that had to be spent for premiums at 9.5% before subsidies kick in for those with income between 300% and 400% of the FPL.

For people with generous employer coverage, especially in the public sector and employees who are members of the old industrial unions like the UAW and USW, the value of the insurance coverage, including the employee contribution if any, can easily exceed 20% of compensation even if you include the employer contribution formally as part of compensation. Any taxes paid to help finance Medicare and Medicaid would be on top of that. Unfortunately, most employees don’t realize this and, if they do, they don’t seem to care. Presumably, that’s because they think any reform plan like some republican proposals to replace the employer tax preference with age-based tax credits would leave them significantly worse off than they are today even assuming employers increased taxable wages by the amount they were previously contributing toward the cost of health insurance.

Are these Canadian dollars? It’s interesting about dental care — I wonder how that affects medical cost inflation vs. covered medical care, and whether Canadians buy dental insurance or pay out of pocket, and whether dentistry is perceived as a more or less desirable occupation than medicine (and what comparable incomes are for dentists and family practitioners).

Canadian dollars. Dental and Rx coverage is a popular employer-based benefit. My old dentist told me that periodically the dentists debate whether they should lobby for coverage but not for many years and they are glad they stayed out.