Four Options for Saving Medicare from Collapsing under its Own Weight

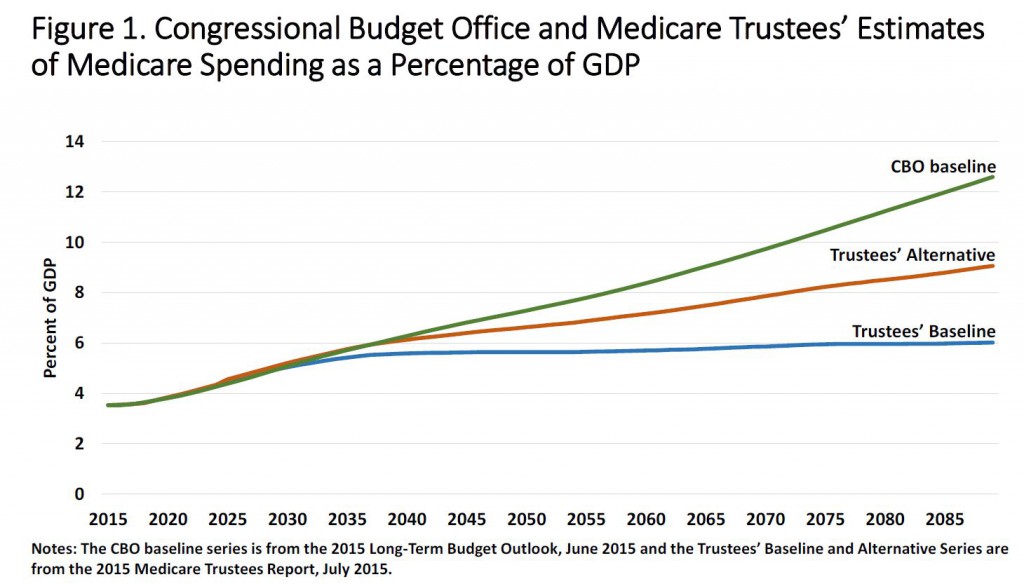

The 50-year old Medicare program is showing its age. Medicare accounts for about one-fifth of medical spending, or about 3.5 percent of gross domestic product (GDP). Over the years Medicare spending per capita has exceeded income growth in the economy. Over the next 75 years the Medicare Trustees estimate Medicare spending as a percentage of GDP will rise anywhere from about 6 percent to just above 9 percent. The Congressional Budget Office baseline put the estimate even higher — about 12.5 percent.

Medicare is not unlike a Ponzy scheme with each generation getting more back than it put in — the balance of which is partly paid by borrowing and higher taxes on succeeding generations of taxpayers. How can the continuous rise in the taxes needed to pay for Medicare be remedied? Researchers Andrew Rettenmaier and Thomas Saving at the Private Enterprise Research Center at Texas A&M University Have basically identified four options.

Option 1) Raising premiums through a means-tested program. This would offset the cost raising taxes, but it would not fundamentally change the program except to raise premiums on the wealthiest beneficiaries. Means-testing for Medicare Part B and Part D already exists. However, the thresholds where higher premiums take effect would have to be much lower and all phases of the program would have to be have premiums hiked on most beneficiaries.

Option 2) Higher deductibles and co-pays and maximum dollar expenditures across all beneficiaries. This would fundamentally change the program. Cost-sharing and incentives created through deductibles would harness seniors to be better, more prudent consumers of medical care. Seniors would probably need to contribute to a type of Medicare HSA in order to fund deductibles and co-pays. There are many unanswered questions. For instance, the HSAs could either be tax preferred or taxable. Deductibles and co-pays could vary with lifetime earnings.

Option 3) Reference pricing and balance billing. These tools would allow seniors to choose their providers and presumably pick ones they preferred and are willing to pay additional fees for their services. One obstacle is that if costs continue to grow over time, so could seniors’ share of the cost.

Providers would not be forced to offer services for the reference price. Because since seniors would be responsible for all charged above the reference price they would be more price-sensitive. Price sensitivity would result in the providers of medical services competing on price to some extent.

Potential pitfalls include seniors who lack sufficient income to pay their share of the costs. That could be solved through a type of means-tested health stamp, akin to food stamps. Sudden onset of disease could also prove very costly. Seniors might be able to purchase an insurance product that could spread health risks from year-to-year or maybe a type of risk-adjusted stop-loss reinsurance.

Option 4) Premium support adjusted for GPD. This option would allow seniors to purchase a Medicare health plan of their choosing. Although private Medicare Advantage plans are currently available to seniors, under option 4 there might evolve greater choice in plan design to meet seniors’ unique needs. The premium credits would be adjusted for health status. All plans would be required to offer catastrophic coverage and the premium support payment (or tax credit) could not be cashed out. The current system of Medicare price controls, list of reimbursable procedures and traditional Medicare reimbursements would no longer be necessary.

Conclusion. What’s the best option? Probably a combination of all the above. Raising premiums to ensure the standards of living for future generations is not eroded is not a bad idea. Forcing future taxpayers to bear the cost of today’s retirees’ vacation homes and RVs is not fair. Higher deductibles and co-pays is the gold standard that employers and commercial insurers have used for years. Reference pricing is a great idea and allowing some fully disclosed balanced billing would not offend me since doctors and hospitals would have to compete for seniors business. A risk adjusted credit to buy a private Medicare plan would also give seniors more options.

Senator Patrick Moynihan (D-NY) correctly observed that it is impossible to predict future Medicare costs because we cannot predict new medical treatments. Social Security is a numbers game but Medicare is a different deal. The CBO’s projection of 12.5% of GDP doesn’t include Medicaid’s exploding costs for people over 65-years-old.

Health care is too complicated for the government to insist on a one-size-fits-all solution. Personal choice must be part of the solution along with means testing including total assets and not just Adjusted Gross Income. Old people should be able to make tax-free HSA deposits and switch taxable IRA withdrawals into HSAs – tax-free.

Younger Americans require the ability to purchase low-cost medically underwritten Individual Medical so they can save for retirement health care expenses with a tax-free HSA.

“The single most exciting thing you encounter in government is competence, because it’s so rare.” — Patrick Moynihan

Do you predict the healthcare industry itself shrinking as a result?

Randi Rabideau

RC Method

Yes Randi, only a fool would get into health care now.

You have very good questions.

While all four options probably have some merit, I have a lot of questions about the long term projections for Medicare spending as a percentage of GDP. If GDP grows 5% per year on average for the next 70 years consisting of 3% real growth plus 2% for inflation as measured by the Consumer Price Index, GDP in 2085 would be $547 trillion as compared to $18 trillion today. That means each one percentage point of GDP variance between estimated Medicare spending and actual spending in 2085 would equal $5.47 trillion. That’s real money.

From 1970-2015, per capita Medicare spending grew at 7.8% per year on average. From 2005, the year before Part D was implemented, to 2015, it grew 3.7% per year. From 2006, the year of Part D implementation, to 2015, it grew 3.0% per year. From 2009, the year following the financial crisis, to 2015, it grew 0.8% per year. So, to quote from the 1960’s rock band, Buffalo Springfield, “There’s something happening here. What it is ain’t exactly clear.”

Maybe the baby boomers aging into Medicare in the last several years are significantly healthier on average than their predecessors. Far fewer people smoke now as a percentage of the population. There is a long term secular trend away from hospital inpatient care. Prescription drugs are able to keep chronic conditions like diabetes, asthma, and heart disease among others in check for a longer period of time.

Imagine if drug innovation found a cure for Alzheimer’s or at least the ability to push off its worst effects for years. Even as the elderly population increases as a percentage of the total population, it wouldn’t surprise me if Medicare spending never exceeds 4% of GDP or maybe 5% at most while spending on younger people could shrink as medical innovation keeps us all healthier for longer. While I have no expertise in medicine, I think there is plenty of reason for optimism.

Per capita growth rate numbers in my prior comment reflect gross Medicare spending, not net spending after beneficiary premiums, IRMAA surcharges and other offsetting receipts.

Several years back we had Milliman model a Medicare reform proposal. Traditional Medicare was replaced by high-deductible plans with cost-control built into the plan design. Workers and their employers would deposit four percent of payroll into an account to fund cost-sharing and expenditures below the deductible. It would save substantial amount of money by mid-century. Although that proposal is not identical to any of these four proposals, it is consistent with and includes elements of several options.

Barry, you say”…it wouldn’t surprise me if Medicare spending never exceeds 4% of GDP.” With tens of millions of Baby Boomers aging into Medicare you don’t think expenses will increase. You are the only one in America that thinks this way.

Also, you say, “Far fewer people smoke now as a percentage of the population.” When smokers die that stops Medicare from further payments. If we keep smokers alive another 7 years, after 65-years-old, that increases Medicare liabilities.

Then you say, “While I have no expertise in medicine, I think there is plenty of reason for optimism.” YOU are the only one Barry. Socialism always ends terribly.

I’ve taken numerous contrarian stances over the course of my career and been proven right on many of them. While the consensus view is often correct, it’s wrong more frequently than you might think. Go back and look at CBO’s 2009 forecast for Medicare spending in 2015. It turned out to be about $125 billion too high.

You selectively have picked out 1 year out of decades. Why not use the same parameters for the CBO’s forecast over a period of 20 years? When you do that I will give more weight to what you just said. Until then I can only say that you provide very selective data in an attempt to prove yourself right.

You also say that you have been right more than wrong. You have been terribly wrong with regard to the ACA as a whole and when divided into each of its component parts. The ACA is a very large mistake.

I think where this discussion is concerned you have been counting your chickens before they hatch.

I also looked at rolling five year growth rates for per capita Medicare spending. That is, 1967-1972, 1968-1973, 1969-1974, etc. Altogether, there are 43 rolling five year growth rate observations for periods ending from 1972 to 2015. Of the 43 observations, 10 had average annual growth rates of 10.0% or more, 24 had growth rates of 5.0%-9.9% per year; and 9 had growth rates of less than 5.0% per year. Of the nine slowest growth rate periods, six saw growth of 3.0% per year or less. Four of those six were the four most recent observations – 2007-2012, 2008-2013, 2009-2014 and 2010-2015. The other two were 1995-2000 and 1997-2002. I also note that all four of the most recent periods are post-Part D implementation.

Inflection points in a trend are hard to identify in real time as there are often other plausible explanations and that could be the case here. Medicare spending could reaccelerate. At the very least, however, the recent slowdown in per capita Medicare spending growth is a hopeful sign that bears watching.

Ron may be interested to know that some of Medicare’s most expensive beneficiaries are under 65 years old. These are folks who qualify for social security disability and are eligible for Medicare two years later. Their per capita spending not only exceeds that of the 65-74 age group but the 75-84 age group as well. Growth in the disabled population has slowed over the last several years which a relative who works for the Social Security Administration tells me is pretty typical when the economy strengthens following a recession.

Also, over half the people on dialysis, which Medicare pays for regardless of age, are younger than 65 as well. Kidney dialysis alone accounts for 5% of Medicare spending.

“some of Medicare’s most expensive beneficiaries are under 65 years old”

Barry I think that’s true.

Yet it may or may not be true that overall Medicare spending always increases with age. It’s well-established that a large fraction of Medicare cost is incurred in the last 12 months of life. But what is the distribution by age of death?

A number of years ago when I was chief underwriter for one of the largest Blue Cross plans – which was also one of the largest Medicare intermediaries – I took part in an examination of our cost data for people over 60. We looked at total submitted expenses for covered treatment – i.e., unreduced by Medicare benefits.

As I recall, we found generally higher overall cost between ages 60 to 65, vs. between 65 to 70. We also observed generally lower overall cost in each subsequent 5-year age group above age 70. This was not what we expected to find.

In fact, up to about age 85, we found annual overall cost to be very roughly in inverse proportion to age. (After age 85, overall costs rose.)

Unfortunately we were unable to determine the reasons for this relativity from cost and utilization data alone.

It’s true that chronic conditions generally correlate with age. At the same time, many chronic conditions adversely affect life expectancy, and often force individuals to retire early i.e. before age 65 – or even 60. We speculated that the result we observed reflected a “weeding out” that affected the infirm elderly at younger ages, leaving a greater proportion of the relatively healthier elderly in the population as it aged.

I retired myself not long after this initial result was obtained. I don’t know if the company ever did pin down the reason for this unexpected finding. The test of any such study is whether its findings can be replicated – but I’ve never read about a similar study or corresponding data that either supported or contradicted our findings.

You may have taken other things into account, but you are still using selection to prop up your optimism rather than focussing in on the problem of Medicare costs. Remember even if Medicare costs per capita fall total costs rise because when people stay alive longer they add considerably to the bill.

The big question is whether medical advancements will make costs fall or rise. The best guess would be rise because individualized medical care is entering the market. (Look at the costs incurred by Steve Jobs) That is one reason why some of the pharmaceuticals are so expensive.

Additionally this individualization of care will result in more chronic disease which we know to be very expensive along with keeping people alive longer. These things I believe will boost the costs at which time after you have had your way and we taxed the young more, raised premiums for the rich and added many more layers of government control severe rationing will enter the picture and that will be done by people far away in Washington based on a one shoe fits all approach. The average man will be rationed, but excuses will be found not to ration those in power along with their family, friends and financial supporters. Government rationing sucks.

In a perfect world, virtually all healthcare costs would occur at or near the end of life except for labor and delivery, vaccinations, preventive screening and the like. If people remained healthy until their bodies wore out at the end of life, their healthcare costs would be minimal until just before the end. As people with chronic disease can be managed better for longer periods of time with the combination of inexpensive generic drugs and positive changes in behavior like controlling weight, getting more exercise and not smoking or drinking to excess, there is lots of potential for healthcare cost growth to slow as health spans, as opposed to life spans, continue to increase. In the meantime, even in a far less than perfect world, healthcare costs for younger people, meaning those below 65 years old, could stabilize or even shrink as a percentage of GDP.

The issue for Medicare, Medicaid and healthcare costs for the rest of the population as well is not whether they increase or not but how fast they grow relative to GDP which is how we look at long term affordability and the extent to which excessive cost growth can crowd out other important and worthwhile priorities both public and private.

Barry, I don’t know what this latest response has to do with your contention that Medicare spending will remain stable “I think there is plenty of reason for optimism.” You start off with selective data and end with what appears to be a non response talking about a perfect world

Allan — I’m talking about Medicare spending possibly remaining stable as a percentage of GDP or, at worst, increasing very slowly. I’m not talking about stability in nominal dollars.

Total healthcare spending in 2014 was within 20 basis points as a percentage of GDP (17.5%) as compared to where it was in 2009 (17.3%). Prior to that, since 1960, healthcare spending grew by one percentage point of GDP or a bit more on average every five years except for a brief period of stability in the mid-1990’s during the HMO heyday.

Maybe your libertarian philosophy blinds you the possibility that some good things could be happening on the healthcare cost front DESPITE the ACA and other government policy.

Yes, I know what you are talking about: “it wouldn’t surprise me if Medicare spending never exceeds 4% of GDP or maybe 5% at most” and I saw how you used arguments of selection to prove your case. Anything is possible, but your optimism to me seems widely deviant from reality, but that seems to occur anytime you wish to prove government actions in the healthcare sector have been justified.

That type of optimism is dangerous because with it one can dig holes that are impossible to get out of.

As far as your reiteration of your selective numbers, I get it, you are reluctant to note that the ACA was a bad idea.

My libertarian philosophy made me hope the ACA would bring good news and that Obama would unify the nation. I don’t however use that unlikely optimistic result to gamble on the future of this nation, my children or my grandchildren something you seem to do all the time.

“you are still using selection to prop up your optimism”

Explain please,

Barry, not only does Social Security and Medicare discriminate against black males because the die young but are required to pay pay payroll tax on every dollar earned but the poor are also discriminated against because they die younger.

–The difference in life expectancy between the poorest and richest is a full 15 years for men and 10 years for women.–

http://www.motherjones.com/kevin-drum/2016/04/chart-day-rich-live-lot-longer-poor

As I approach 50 years of age this July, I have had a first hand peak at the medical expenses Medicare pays for my parents, both of whom are typical for people their ages (67 and 71 this year). The program is literally unsustainable given the increases in beneficiaries from just the Baby Boomers. It isn’t even a close call in my mind.

If the law were changed to allow or better encourage Medicare (and Obamacare) dollars to be spent in Cuba, Mexico or dozens of other countries, NONE of those 4 distasteful measures proposed would be at all necessary or desirable.

How expensive would cars and electronics be if we had to buy them from domestic producers dominated by gummint regulations and price controls? Forcing us to buy insurance to purchase cars, electronics and food is no way to lower their prices, of course. Amerikans are hanging themselves from by their own petard when it comes to health care.

As a current Medicare beneficiary living in a retirement community and as a former officer in a company selling MA, the one issue that needs to be recognized is that seniors don’t like having to make difficult decisions about healthcare and don’t really understand how Medicare works. They just want the bills paid and have choice in providers.

It would be easier if we established relationships with insurers and types of plans as younger folks and were able to carry them into old age. Many years of brand loyalty and experience with consumer driven health care would make some of these schemes more palatable. Old folks vote.

Medicare of course depends mainly on the payroll and income taxes paid by younger workers. If the American future is one where average workers are impoverished — whether through automation, offshoring, whatever– then any program that depends on their taxes is in trouble.

(this is not a hard prediction, I am not wise enough for that, but it is my caution.)

Medicare even now depends on the ability of Washington to run deficits. The payroll tax does not cover all of Part A costs. The income taxes that flow into Part B are indirectly causing deficits.

If America ever had to really balance its budget, Medicare would also be in trouble.

Amidst all our comments, I should mention that Devon deserves extra credit for raising some worthwhile ideas.

1. Extra premiums for seniors

I believe that higher premiums for Plan B start at $170,000 of joint income.

How timid can you get? A senior couple with an income of $70,000 is above average comfortable in any city outside of NY and San Fran. They could easily pay more than $240 a month (2 persons) for a Part B policy with a market value of about $12,000 a year (2 persons).

2. Reference pricing and balance billing

How you do this will take some artful regulations. Seniors trust their doctor, which is not a bad thing, but if their doctor books them into a hospital which leaves them with debt, that will cause massive complaints and disruptions.

Go careful on this one, but do it.

3. Premium support for Medicare Advantage plans.

I confess my ignorance about this one. A senior today can buy a Med Advantage plan from Humana for $0 a month. The plan has some $30 copays, some deductibles, $225 charge per hospital days 1-7, and an out of pocket limit of about $6000.

Why does anyone need premium support to pay $0 a month?

I know I am missing something.

I assume that the only reason Humana can sell this is that regular Medicare is pumping $12,000 a year into Humana for the base cost of this plan. So Devon might be wrong when he says that we can abandon regular Medicare.

By the way, while I have the floor, let me drag out an old prejudice of mine.

I am disgusted that a 65 year old can buy the Humana plan for $0 plus his $120 a month Part B premium…..while his neighbor age 64 has to pay at least $700 a month in most states for a silver plan comparable to Medicare.

I am on Medicare and doing fine despite treatable cancer.

My neighbor age 63 is nearly bankrupt after a knee replacement and a fall.

This is not right. Either expand Medicare to younger ages, or make the ACA subsidies much more generous.

Bob – The extra Medicare premium, called the IRMAA surcharge for Income Related Monthly Adjustment Amount, applies to Medicare eligible single filers with modified adjusted gross income (MAGI) of $85K and above and joint filers with MAGI of $170K and above. There are four surcharge tiers altogether with the top tier applying to single filers with income above $214K and joint filers with income above $428K. Those thresholds are frozen through 2019. Only about 2%-3% of seniors currently have sufficient income to be subject to the IRMAA surcharge but more will be in the future unless the thresholds are increased in line with inflation.

Reference pricing is fine where it makes sense such as for imaging and discrete procedures like hip and knee replacement. It would be considerably more useful if hospitals offered prices for, say, a day in a regular inpatient bed, an hour of surgical suite operating room time, an hourly or daily rate for monitoring time, antibiotics and pain medication if needed, etc.

Medicare Advantage plans bid against a benchmark in each county where the plan chooses to do business. If its bid is above the CMS’ benchmark for that county, it’s paid the benchmark and has to make up the difference with a premium charged to the beneficiary. There are also risk adjustment payments. Premium support would replace that approach with a voucher that the individual beneficiary would use to buy an insurance policy. Risk adjustment payments would presumably have to come into play there too. One important concern is whether or not the value of the voucher would keep pace with the cost of buying insurance as medical costs rise.

For the under 65 population, I’ve said numerous times that the ACA should have capped the cost of insurance at 9.5% of income with no income eligibility ceiling to qualify for a subsidy instead of capping it at 400% of the FPL income which was done, of course, to meet a budget constraint as scored by the CBO.

At the same time, I’ve read that 40% of the people who bought exchange plans are 50-64 years old whereas that age group only accounted for 20% of the pre-ACA uninsured population so the law is apparently serving quite a few of these folks but obviously not all who probably need a subsidy to afford coverage.

“I am on Medicare and doing fine”

C’mon Bob. You are on Medicare Advantage. You have Medicare benefits PLUS the extra benefits of MA.

Not everyone is so fortunate as you – although about 33% of Medicare-eligible seniors have enrolled in Medicare Advantage, as you have.

Please stop saying you are “on Medicare”. You are on Medicare Advantage.

Reference pricing would have to come with transparency and full disclosure. It could potentially be limited to selected procedures like hip replacement or cataract removal. Failure to disclose in a manner deemed appropriate might result in having to accept the reference price and not bill additional fees. I don’t believe Andrew Rettenmaier and Thomas Saving got this far into the mechanics, but I’d require the transparency mentioned in past posts. I’d go farther for Medicare since there is the potential for cognitive decline.

I agree that a $250 or $500 monthly contribution would not disadvantage many couples. In fact a few years ago we had Tom and Andy model a proposal with a high-deductible plan and a savings component.

We hear a lot of discussion about how much a given individual paid in the Medicare portion of payroll taxes, including the employer matching contribution, during his or her working life and how much current beneficiaries pay in Medicare premiums relative to the cost of the program. What we don’t hear about is how much people paid in income taxes. Last year, for example, gross Medicare spending, before subtracting beneficiary premiums, the IRMAA surcharge and state payments on behalf of the dual-eligibles came to 17.4% of federal spending. Not federal revenue but federal spending.

So, to fairly calculate any given person’s contribution toward the Medicare program, you would have to count 17.4% of the amount paid in federal income taxes plus the Medicare portion of the payroll tax including the employer’s share for those still in the workforce and 17.4% of federal income taxes plus the Medicare premium and IRMAA surcharge, if applicable for Medicare beneficiaries no longer in the workforce. Looked at this way, you will find that most people are paying significantly more to support the Medicare program than the popular press would have us believe.

The bottom half of the income distribution, however, which pays little or nothing in income taxes and may even benefit from the Earned Income Tax Credit (EITC) is indeed getting a lot more out of the program than they are paying into it once they are eligible for benefits.

The rule of thumb is that seniors alive today who have been on the program for a decade or two will get back $3 for every $1 they paid in. For people who won’t become eligible for 20 or 30 years, the likelihood (due to higher premiums) is that their return on investment will not be a good.

Devon — I think the $3 in benefits vs. $1 paid in is based on Medicare payroll taxes only and I’m not sure if it even includes the employer’s share. I don’t think it includes a pro rata share of income taxes paid that arealso used to support the Medicare program and I don’t know if it includes beneficiary premiums and IRMAA surcharges, if any, once the person is eligible for Medicare.

It’s like the NY Times raised the white flag today on Obamacare.

Obamacare’s death is happening fast.

The health care exchanges will foster competition among insurance companies and it will drive costs low. Blah, blah, blah.

Barry, you say, ” you will find that most people are paying significantly more to support the Medicare program than the popular press would have us believe.” Correct, the media is propaganda, distortions and lies to support socialism. Finally, you are figuring it out.

Barry, in Florida we have a guy running for Senate to replace Marco Rubio who is supporting term health insurance, just like life insurance. With life insurance with a 20 year term consumers can get ROP – “Return of Premium”

My 1st 10 million of premium in my career I was selling health insurance with ROP, I kid you not. Every dollar paid in premium is returned at the end of the term less claims. This changed incentives. If a procedure was $50,000 and 7 minutes away VS only $35,000 30 minutes away with ROP the consumer cares. Today the consumer would pick the expensive closer procedure because they are going to pay their max out-of-pocket regardless.

ROP is a simple insurance deal that works great for health insurance. In the 90’s the consumer used to get interest on their savings at the bank but those days are gone so ROP would be much more attractive today.

Devon is always trying to get the consumer to want to lower expenses so he should consider ROP for health insurance.

His name is David Jolly:

I support the idea of a term health insurance modeled after term life insurance. This coverage would lower costs on younger demographics by reducing regulation and allowing health insurance to be bought in 5-10-20-30 year terms.

http://www.davidjolly.com/issues/health-care/

David Jolly should say – Americans deserve more options, more choices, more FREEDOM!

Ron — I presume the insurer expects to make money by investing the premiums before it has to return them. In health insurance, though, 80%-85% of premiums are used to pay medical claims in the year the premium is collected so how can there be any premium to return, especially in a low or zero interest rate environment?

In life insurance, by contrast, nothing is paid out until the beneficiary dies. How does the health insurer cover the costs of those with large claims if it’s returning premiums to healthy people? In short, how the heck does it make any money?

First of all, Barry, you are correct about the tex burden of Medicare.

Let’s say that Medicare Part B costs $500 billion in a typical year.

The premiums paid by seniors might total $80 billion in that year.

The other $420 billion comes from taxpayers…where else?

Now let me move to Medicare Advantage. In 2003 I paId little attention to this so I am ignorant.

But Paul Ryan relies on this in a big way, so this is important.

Are you suggesting that carriers will come up with their own premiums, and insureds must rely on subsidies? The CMS guideline would disappear.

Boy this sounds lile the worst features of the ACA,

without risk adjustment, this would all collapse I think.

If you have a moment, enlighten me.

Bob – I happen to have a detailed breakdown of Medicare spending for 2013 in my files so I’ll use that to answer your question though I think it would be essentially the same for 2014 and 2015. Specifically, total Medicare spending in 2013 before deducting beneficiary premiums, IRMAA surcharges, and state payments was approximately $576 billion excluding $16 billion of administrative costs. Including Medicare Advantage, the allocation to Part A, Part B and Part D was as follows: $251.1 billion (43.6%) for Part A; $255.0 billion (44.3%) for Part B and $69.7 billion (12.1%) for Part D.

The revenue sources consisted of general federal revenue, 41%; payroll taxes, 38%; beneficiary premiums, 13%; state payments, 2%; taxation of Social Security benefits, 2%; and interest on the Part A trust fund balance + other, 3%.

One other interesting piece of information I thought I would add is that in 2005 the Medicare Part A Trust Fund Trustees projected that the fund would run out of money by 2020. In 2009, that was moved up to 2017. One year later in 2010, it was moved back to 2029. In 2011 and 2012, it was revised to 2024. In 2013, it was 2026 and in 2014, it was 2030. These estimates all need to be taken with a large grain of salt, in my opinion.

I’m not sure how Paul Ryan’s voucher proposal would work in practice. We know that per capita Medicare spending is slightly less than $12,000 today. CMS also calculates a risk score for each individual beneficiary but it’s strongly influenced by medical claims so it can take high claims in a particular year from 18-24 months to be incorporated into that person’s updated risk score. Due to that lag effect, CMS has relatively little to work with to formulate a risk score when people first age into the program.

I don’t know if the value of a voucher given to a specific person would relate to age, risk score or both. I also don’t what happens when people find an insurance plan that costs less than the value of the voucher. Do they get to deposit the difference in a Health Savings Account or just forfeit it? Conversely, if the value of the voucher is insufficient to buy even a high deductible plan in an expensive county like Miami-Dade, FL, that person presumably must add his own funds to pay the premium. I also have no idea how beneficiaries eligible for both Medicare and Medicaid (dual-eligibles) would be handled.

Perhaps Devon could share more light on how Ryan’s premium support / voucher approach would work.

Also note that there are a number of drugs that are covered under Medicare Part B as explained in the link below.

https://www.medicare.gov/coverage/prescription-drugs-outpatient.html

I have no idea how much of Part B spending is accounted for by these drugs.

I am actually sympathetic in a general sense to what Paul Ryan is trying to do.

He is trying to make Medicare a budget item, rather than a devouring entitlement.

The total amount of vouchers is at least in theory under Congressional control; he would make Medicare into more of a defined contribution plan, less of a defined benefit plan.

At first blush, though, I do not know how you get a private insurer to cover anyone over age 85 without lavish government guarantees…..and then have you made any real progress?