Flash GDP: Health Services Over One Third of GDP Growth

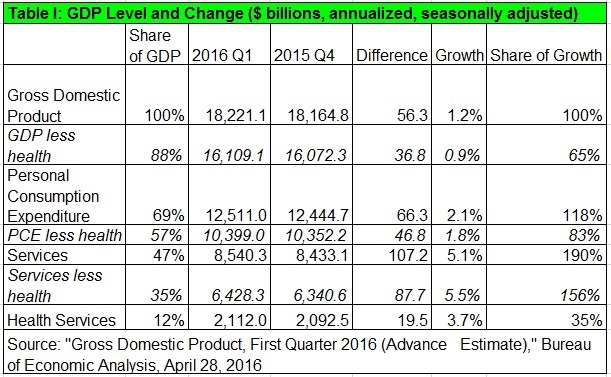

This morning’s advance (flash) estimate of GDP for the first quarter (usually subject to significant future revision) showed very weak growth dominated by spending on health services. Health services spending of $19.5 billion (annualized) comprised over one third of GDP growth. However, there was shrinkage in personal consumption expenditures on goods, private domestic investment, and exports. This meant personal expenditures on services grew almost twice as much as GDP growth. Growth in spending on health services amounted to a little less than one fifth of growth in services spending. Nevertheless, the quarterly growth in spending on health services indicates health services continues to consume a disproportionate share of (low) growth (Table I).

This morning’s advance (flash) estimate of GDP for the first quarter (usually subject to significant future revision) showed very weak growth dominated by spending on health services. Health services spending of $19.5 billion (annualized) comprised over one third of GDP growth. However, there was shrinkage in personal consumption expenditures on goods, private domestic investment, and exports. This meant personal expenditures on services grew almost twice as much as GDP growth. Growth in spending on health services amounted to a little less than one fifth of growth in services spending. Nevertheless, the quarterly growth in spending on health services indicates health services continues to consume a disproportionate share of (low) growth (Table I).

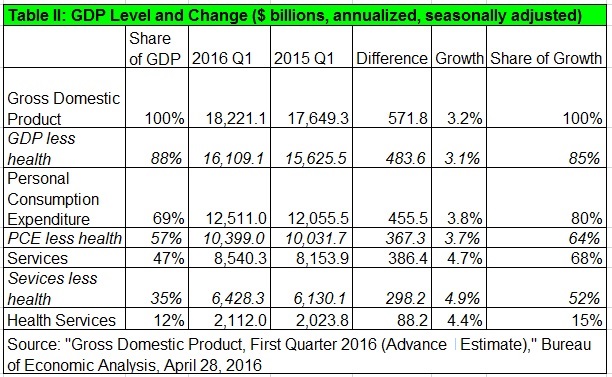

The figures for 2015 Q1 to 2016 Q1 show growth in spending on health services accounted for only 15 percent of GDP growth. Nevertheless, this spending grew 4.4 percent versus only 3.1 percent for non-health GDP. Growth in health spending accounted for over one fifth of growth in services spending (Table II).

Although health services spending accounts for just 12 percent of GDP, these estimates continue to indicate it will grow faster than GDP. There is no slowdown in health services spending.

Technical note: When I discuss health services in these quarterly GDP releases, I mean only health services. I do not include purchases of medical equipment, or facilities construction. While I include Medicare and Medicaid, I do not include Veterans Health Administration or other government benefits. So, these dollar figures undercount the amount of our economy consumed by the government-health complex.

(See: Measuring the Economy: A Primer on the GDP and the National Income and Product Accounts, Bureau of Economic Analysis, October 2014, pages 5-2 and 5-3; Micah B. Hartman, et al., “A Reconciliation of Health Care Expenditures in the National Health Expenditures Accounts and in Gross Domestic Product,” Research Spotlight, Survey of Current Business, September 2010, pages 42-52.)