Federal Medicare, Medicaid, Obamacare Subsidies to Increase 85 Percent in Ten Years

On Wednesday, the Congressional Budget Office (CBO) released its Update to the Budget and Economic Outlook: 2014 to 2024

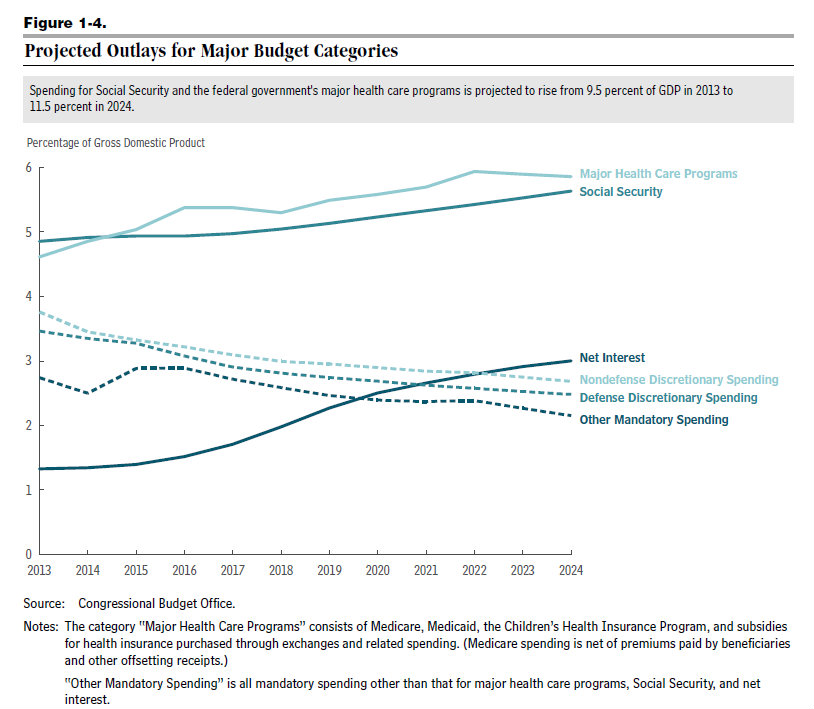

Annual net outlays for the government’s major health care programs (Medicare, Medicaid, the Children’s Health Insurance Program, and subsidies for health insurance purchased through exchanges) are projected to rise by more than 85 percent. Outlays for those programs would grow from 4.9 percent of GDP to 5.9 percent, CBO anticipates.

Spending for Medicare’s payments to physicians is constrained by a rate-setting system called the sustainable growth rate. If the system is allowed to operate as currently structured, the fees that physicians receive for their services will be reduced by about 24 percent in April 2015…If, instead, lawmakers overrode those scheduled reductions — as they have every year since 2003 — spending on Medicare would be greater than the amounts projected in CBO’s baseline. For example, holding payment rates through 2024 at current levels would raise outlays for Medicare (net of premiums paid by beneficiaries) by $131 billion (or about two percent) between 2015 and 2024.

As shown in Figure 1-4, this is the year that spending on major health programs (Medicare, Medicaid, and Obamacare subsidies, but not VA or military health care) will be greater than spending on Social Security. Back in 1974, federal spending on its major health programs accounted for 1.0 percent of GDP, while spending on defense (which is actually delegated to the federal government in the Constitution) was 5.4 percent of GDP. In 2024, defense spending will account for only 2.7 percent of GDP — less than half the spending on major health programs.

Defense is not alone in its decline: Health spending, Social Security, and interest payments on the debt will increasingly crowd out all other federal spending, such as infrastructure (also delegated to the federal government by the Constitution, under the term “post roads”).

The Medicare and Social Security trust funds have been spent on general expenses

What remains are treasury bonds which serve as collateral for the original money that was spent

Redeeming the Treasuries is needed when current payments exceed current revenues

The use of the reserve fund requires that additional debt must be issued due to the current budget deficit

Do the additional Treasuries add to the deficit or is it considered an accounting wash?

Don Levit

How many Americans can name the governor of the central (people’s) bank of Chima? Hardly any, yet he is the one who decides whether we can run our healthcare system, by deciding whether to buy our debt or not.

Don’t worry! Taxpayers will pay for all illnesscare costs in a decade, unless…?