Did NCPA Reform Liberate Older Workers?

This is Timothy Taylor:

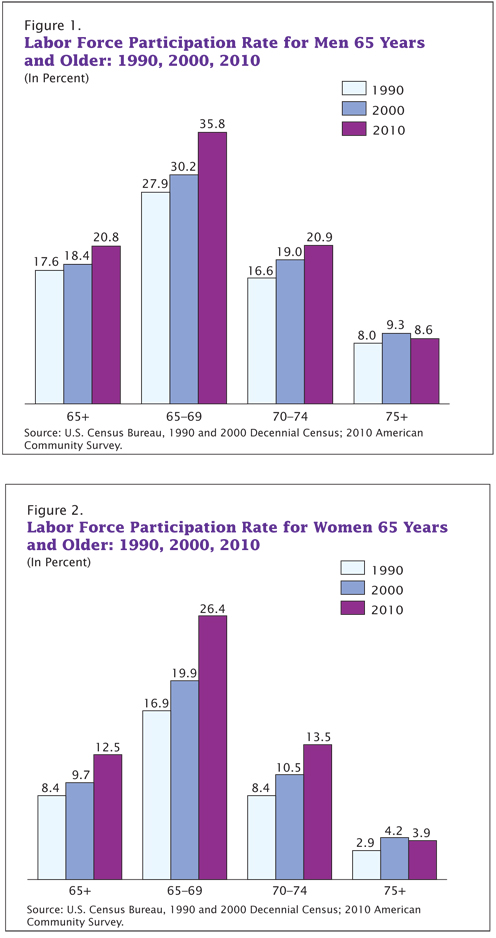

The proportion of U.S. adults who are “in the labor force” — that is, who either have jobs or are unemployed and looking for a job — has been falling for a decade, as I explored in an April 26, 2012, post on “Falling Labor Force Participation.” But for one demographic group, the elderly, labor force participation is rising substantially. [See the charts below.]

An NCPA reform championed in the early 1990s called for allowing seniors to reach the retirement age and keep on working without losing their Social Security benefits. This idea (which received only lukewarm support from AARP) became part of a slew of pro-growth proposals, was one of five NCPA “tax ideas” that formed the core of the Contract With America and eventually became law. The old law took away 33 cents for every dollar of earnings above a threshold.

Source: United States Census Bureau.

People work more when less of their income is taxed. This sounds strange to some people. But when you tax benefits, you make leisure time cheaper.

Go NCPA!

I don’t mean to be the party crasher here, but couldn’t this increased labour participation rate be attributed to the poor economy in 2010?

I’m sure the lower effective tax rates help, but I don’t see this finding as all sunshine and roses.

These are very interesting graphs. Good job NCPA.

FYI, the so-called “full retirement age” is now 66 (and still going up). That’s the age now where the penalty goes away. Unless the Census and whomever can cut the data by “full retirement age” rather than by over/under 65, the “over 65” and “65-69” data doesn’t mean much. Except for woman between 70-75, all these statistics look insignificantly different

I [re]joined the workforce as a paralegal in 1987 after divorce. I am now almost 67. I have substantial savings, well above the averages that I see from time to time in news stories. I would love to be a full-time retiree.

However, given today’s ZIRP, my savings earn nothing. So if I retire now I’ll not have enough unearned income to supplement my SS to “support the lifestyle to which I have become accustomed” (a/k/a expected to have in retirement.) Nor, in the economy that I now expect to continue for another 4 years, would I ever find another job if my income indeed proved insufficient for me to do as I want. I live relatively frugally, but still have been able to afford to live as I choose. I don’t want to lose that comfort level.

I am filling a desk chair that a younger [college grad?] might take, thereby delaying the normal turnover of workers.

Taxes on SS and/or reduction of benefits has nothing, nada, to do with my decision to continue to work. Interest rates do.

Go NCPA Go!

I certainly support the policy adjustment that resulted from NCPA’s “tax ideas” though I feel I must echo Gabriel’s sentiment. Besides the poor economy necessitating work into later years, isn’t it also possible that the modern science which has increased longevity makes Americans healthier and more capable of working past 65?

.

It could also be just a cultural shift. Americans, more so than in most countries, derive a significant portion of their identity from where they work and what they do. Perhaps many baby boomers have the American work ethic so instilled in their psyche that they feel personally obligated to continue employment. Of course, if 33 cents of every dollar was taken as was prevalent before the tax rate change, maybe this wouldn’t be the case!

.

I also see that the age category 75+ has decreased for both male and female. Is the theory that more individuals are working up to that age and can now afford retirement? Or are we getting sicker and less capable of work?