CMS Views Medicare Solvency through Rose-Colored Glasses

The 2014 Trustees Report was released on Monday, July 28th. The Center for Medicare and Medicaid Services (CMS) press release paints a rosy picture, but fails to discuss the bad news that is hidden in plain sight. According to the cheerleaders at CMS, the health of the Medicare Hospital Insurance Trust Fund has improved since last year. The Trust Fund purportedly will remain solvent until 2030 — four years longer than projected in the 2013 Trustees’ Report. The press release partially credits the 2010 landmark law, the Patient Protection and Affordable Care Act (ACA) with controlling the growth of Medicare spending. The Trustees Report is supposed to project future Medicare spending based on current law. But, that also means the official projection includes provisions meant to slow spending growth that the Trustees know are unlikely to occur. In years past, the Trustees tended to ignore these uncomfortable facts. Around 2010 the Office of the Actuary at CMS took the unprecedented step of producing an Alternative Scenario report explaining that the assumptions in the Trustees Report were unrealistic, and the projection were most assuredly wrong. That raised eyebrows in the policy world. This year, the alternative scenarios (i.e. conditions that are more likely to occur) crept up from the appendix (at the back) and landed uncomfortable on page 2, with the authors explaining:

In last year’s report…the projections were based on current law; that is, they assumed that laws on the books would be implemented and adhered to with respect to scheduled taxes, premium revenues, and payments to providers and health plans…

Current law requires CMS to implement a reduction in Medicare payment rates for physician services of almost 21 percent in April 2015. However, it is a virtual certainty that lawmakers will override this reduction as they have every year beginning with 2003.

If you look at what the Trustees actually believe will happen, the Medicare Trust Fund’s financial future doesn’t look so rosy!  An excerpt from the report explains why:

An excerpt from the report explains why:

…as the substantial differences among the Trustees’ projected baseline, current-law, and illustrative alternative projections demonstrate, Medicare’s actual future costs are highly uncertain for reasons apart from the inherent difficulty in projecting health care cost growth over time. Because the physician payment reduction required by current law has been overridden for 12 consecutive years, the Trustees decided for the 2014 report to emphasize projections that reflect the current practice of modest payment increases in the physician fee schedule. These projections do not represent either a policy recommendation or a prediction of legislative outcomes. Nevertheless, the Board recommends that readers interpret the projected baseline estimates in the report as the result of the outcomes that would be experienced if the productivity adjustments and IPAB measures in the Affordable Care Act could be sustained in the long range under the Trustees’ economic and demographic assumptions.

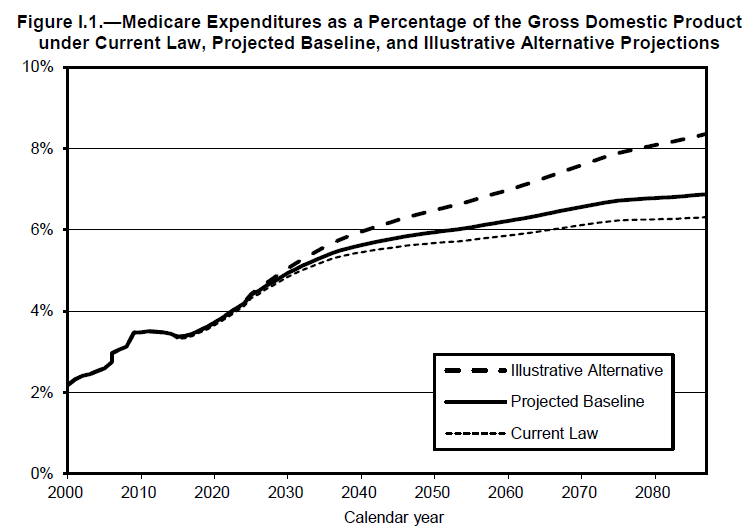

Today Medicare consumes about 3.5% of GDP. If the sustainable growth rate provisions actually occur (i.e. physician and hospital payment reductions), Medicare will grow to consume only 5.6% of GPD in 2040, and 6.3% of GPD in 2088. If other cost-saving measures also fail to materialize, the proportion of the economy spent on Medicare will rise to 8.4% in 2088. So, if you assume the Medicare physician fee cuts will not take place; if you assume the Independent Payment Advisory Board will not be allowed to gut Medicare reimbursements; if you assume the productivity improvements that are supposed to slow Medicare spending but have failed to work, the percentage of GDP consumed by Medicare in the coming years is one-third higher than the projection under current law. This is discussed in greater detail in the Trustees Report, the Alternative Scenario report. However, the link was

not working when this was written. Most striking thing about the Medicare Trustees Report, even the best-case scenario looks pretty bad! For additional information on what the Trustees Report says on disability see the NCPA Retirement Blog.

“However, it is a virtual certainty that lawmakers will override this reduction as they have every year beginning with 2003.”

So the only reason they paint this rosy picture is because they have been overriding the reduction in Medicare payment rates for over 10 years? Go figure.

This Trustees’ report confirms that 10,000 baby boomers do not begin receiving Medicare benefits every day.

The trust fund is merely an accounting mechanism, for the real dollars were lent to the Treasury to pay for general expenses.

The Treasuries issued as collateral for the loans appear as intragovernmental debt.

To redeem intragovernmental debt, the Treasury will have to borrow the cash, increasing the deficit.

What kind of reserve fund is liquidated via borrowing?

Certainly not an insurer’s reserve fund.

Don Levit

Don, you are correct.

There are so few people who understand that the emperor has no clothes.

I’ve posted to that effect below.

They should use Google Glass, instead of rose-colored glasses!

We already know that the Board’s projections are off because there is no way the Medicare doctor reimbursements are NOT going to decrease…they already are, and an increasing number of doctors are going to drop out of Medicare.

Maybe “an increasing number of doctors will drop out of Medicare,” but it won’t make any difference because so many more are going to accept Medicare patients. Last year alone (2013) there were close 30,000 new physician Medicare providers, more than double the rate of increase as new Medicare beneficiaries for the same year. We already have a glut of physicians and the that glut is only going to get larger. Over 100,000 kids in medical school today. And there are over 120,000 physicians in training (residency and fellowship programs).

Very interesting.

There were 16,000 students in Medical School according to Assoc of American Med Colleges. Not all will graduate. We make it difficult to import ECFMGs. A third of doctors are over 50 and a quarter are over 60. With baby boomers using more medical system and Obamacare making over utilization easy, there is and will be a doctor shortage. It may take 10-20 years to begin developing system for more doctors in US. There’s only one thing to do – marry a doctor.

Big Truck Joe Wikipedia has a list of all the US medical schools (allopathic and Osteopathic). There are 171. If you Google “current number of students” for each school then you will come up with 100,568 students. In addition to the medical students there are over 120,000 doctors in training (residency and fellowship programs). Remember that the Assoc of American Med Colleges benefit from the notion that we have too few doctors. If you believe there are only 16,000 medical students then you also must believe that the average number of students in each school is less than 100.

Kaiser puts the number of yearly US Med school graduates at approx 17,000 MD students graduating each year – not 30,000 as suggested frOm Wikipedia; plus another approx 4000 DO students graduating per year so u are still looking at 20,000 MD and DO graduates per year. not all of whom practice medicine – some goto research, some business so they aren’t all clinical. Anecdotal evidence suggests any older generation doctors are retiring so the new ones may not minted fast enough to replace the retires. Plus – how many doctors no longer participate with Medicare and Mediciad? Doesn’t matter if there are tons of doctors if none of them will accept u as a patient. I think there is and will be doctor shortages especially as Obamacare insurance allows more people, legal or not, to begin to utilize healthcare service they never had in the past.

Those who anticipate physician shortage do not just look at the number of med students and residents. There is also the question of how many physicians are retiring, and the increased demand for services as the population ages.

There are currently over 100,000 medical school students matriculating through US medical schools according to the 171 medical schools (look it up yourself and do the math). Older doctors are not retiring as expected because many of them were hurt financially by the recent recession. A recent study by CMS (August 2013) showed that doctors were more likely to accept patients with Medicare insurance than they would accept patients with private insurance. Last year the number of doctors accepting Medicare patients increased by close to 30,000 – a rate of increase that was more than twice the rate of increase in new Medicare beneficiaries. Second tier providers (Nurse practitioners and Physician assistants) are now beind allowed to practice at the top of their skill sets so that many of the routine office visits that use to be handled by physicians are now being handled by these other providers. By the way, Missouri just passed a law which will allow recently graduated medical students who have no residency or fellowship training to practice in under-served areas under the guidance of fully licensed physicians. In many of our most populated areas there is already an oversupply of doctors. This is going to be a huge problem within the next few years especially while we still have a fee-for-service payment system. This type of payment system encourages doctors to do “more” even when “more” is not needed.

Thank you. That is a very well informed comment. The evidence you are citing supports Devon Herrick’s assertion: That Congress is unlikely to follow through with cuts to Medicare’s physician fee schedule.

The report you cite also points to a significant difference in access for patients in traditional Medicare versus Medicare Advantage (i.e. the latter have better access).

Also, physicians delaying retirement simply because they needed to earn incomes for a few more years than they had expected is not grounds for confidence!

What follows is my Monday Morning Fax for 8/4/14. This is a one-page newsletter that I send to our 1500 physician members every Monday for the past 15 years:

In their latest report the Medicare Trustees state that the Affordable Care Act and rising payroll tax revenues will extend the “solvency” of the Medicare Part A Trust Fund to 2030.

The myth is not that the Medicare trust fund will run out of money in 2030 or any other year; the myth is that the Medicare or Social Security trust funds ever contained any money or real assets at all. Politicians parrot this myth and use it as an excuse for not fixing the government’s greatest fiscal problems; some politicians may actually believe it.

In order for something to be an asset it must have intrinsic value i.e., be real property, or be someone else’s liability. If I write you a check, then you have an asset and I have a liability. If I write myself a check, then I have both the asset and the liability, it’s a wash, no matter how big the check is.

The Social Security and Medicare trust funds are composed only of checks written by the US Treasury, one part of the federal government, to the trust funds, another part of the ffederal government. Those checks are called “Treasury Bonds” but are not listed on the government books as “debt held by the public” and they cannot be sold in the open market to raise money to pay benefits like real Treasury Bonds could. It’s a wash; just read the following from the Citizen’s Guide on page iv; that’s exactly what it says to explain why the trust funds don’t show up as an asset of the Government:

“The Government also reports about $4.8 trillion of intragovernmental debt outstanding, which arises when one part of the Government borrows from another. For example, Government funds (e.g., Social Security and Medicare trust funds) are typically required to invest excess annual receipts in federal debt securities issued by the Treasury Department, thus creating liabilities of the Treasury and assets of the trust funds. These respective amounts are included in Department of the Treasury and investing agency financial statements, but offset each other in the preparation of the Governmentwide consolidated financial statements”

So, either the Treasury report is wrong and there are real trust funds with real assets as the politicians say or the Treasury report is telling the truth and the trust funds are an accounting fiction. What the Treasury report really means is that ALL future payments for Medicare and Social Security will actually come from future federal taxes or borrowing, and not from any assets of the so-called “trust funds”.

There is a general expectation, promoted by politicians, that somehow payroll taxes are like a pension “paid in” when working and “paid out” later. Having “trust funds” supports this false expectation. The American people would be much better off, and the politicians worse off, if the finances of the federal government were open and clear. Until this particular illusion dies, we cannot have realistic discussions about the current financial condition of the federal government.

Thank you. Are you still faxing it?

Yes, a few hundred still go by fax, the majority are e-mail now. But I still make sure that it fits on a single 8.5 x 11 sheet in 11-point arial type. It takes a lot more time to make it so short but our members are busy.

I think it was Mark Twain who once wrote, “I would have written a shorter letter but I didn’t have the time.”

Bruce:

You are absolutely correct.

The proof of the lack of assets is how the trust fund is redeemed to pay benefits: Treasuries are sold for cash which comes from either borrowing or increased taxes, both of which increase the deficit.

If redemption increases the debt or deficit, that is not redemption. It is slavery!

I have many links accumulated over the years such as you graciously provided. I have discovered through long blog postings with Bruce Webb at the Angry Bear blog, that if one is committed to his illusion, it makes no difference how many governmental links you provide to spread the truth.

Even the Social Security Administration itself admits to the fallacy of a trust fund.

Still, Bruce Webb could merely call me names, which meant I was winning the discussion.

I do not care about winners and losers.

I care about truth and lies.

Don Levit

How do “increased taxes” “increase the deficit?”

They increase the deficit if there are no extra taxes to spend

All taxes go to the Treasury’s general fund

Since the taxes have all been spent we have a budget deficit

The other option is to borrow money thru issuing additional Treasuries which is issuing more debt

I do not know for sure if the Additionsl debt increases the current deficit but it is an increased obligation for future taxpayers of which our generation is responsible for putting into existence

Don Levit